Loaded Week in Review

Inflation, tariffs, spending, & more

This week was loaded with economic data releases on inflation, retail spending, small business optimism, consumer sentiment, and housing, among other topics.

More importantly, the U.S. and China agreed on a 90-day reduction in tariffs. That represents the 55th announcement of new or revised tariffs since Inauguration Day, or more than 3 per week. Based on comments made this morning, we’re looking at several more tariff hikes in the next 2-3 weeks.

Monday

Modification to Tariffs on Chinese Imports

U.S. and Chinese officials met in Switzerland, and the result was a 90-day reduction in tariffs imposed by each country. So the U.S. is now imposing baseline 30% tariffs on Chinese imports (plus more on certain products) while China is imposing a 10% blanket tariff on U.S. imports.

As it stands, tariffs between the U.S. and China are a lot lower than they were on May 11th, but a lot higher than they were on April 1st.

In response to this announcement:

Shipments from China surged this week as importers race to get orders in during this 90-day reprieve (that could cause a bullwhip effect to shipping rates).

Stocks rallied hard.

Bond yields also rose pretty sharply (not great for the interest rate outlook).

This is absolutely good news, but the can has only been kicked 90 days down the road, and it’s far from the only can.

Senior Loan Officer Opinion Survey (SLOOS!)

This survey shows the majority of banks didn’t change their lending standards in the first quarter, though a few tightened while virtually none loosened. Which is to say, lending standards remain very tight.

The most important factor for the banks that tightened their lending standards: “a less favorable or more uncertain economic outlook” and “increased concern about the effects of legislative changes.”

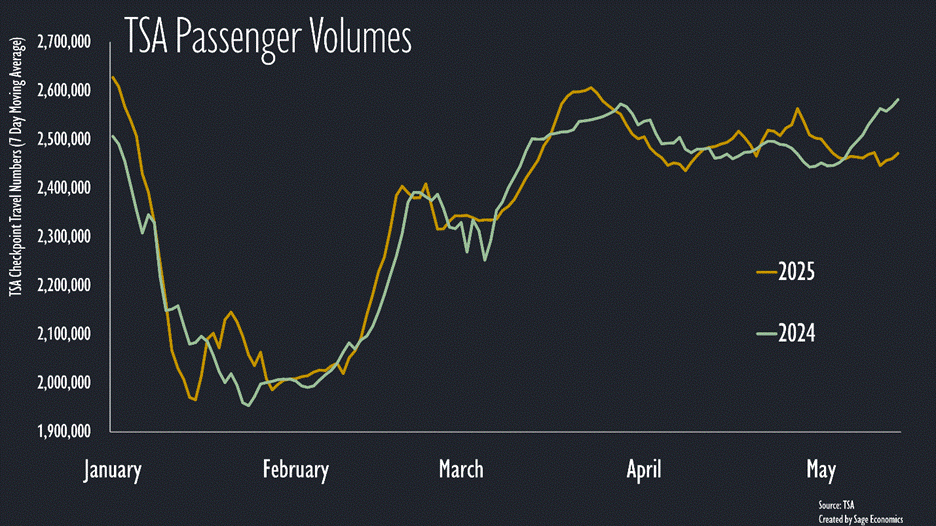

TSA Checkpoint Travel Numbers

It was another tough week for air travel, according to TSA data, and travel volumes are now more than 4% below 2024 levels. Not a particularly great sign, although given how spring break/graduation/summer travel timelines can fluctuate from year to year, I’ll give it another week or so before really worrying.

One reason for hope: a Bank of America survey found that 70% of respondents were planning to vacation this summer, higher than in 2024. So maybe this is the calm before the storm.

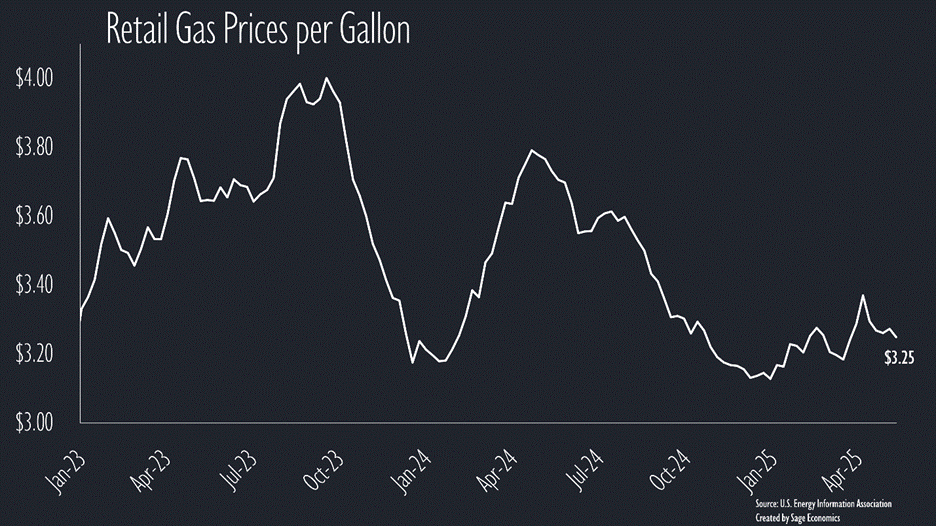

Gas Prices & Diesel Prices

Gas prices fell to $3.25/gallon this week, and we’ve yet to see a spring increase (prices usually rise as stations switch to summer blend). So the reason for low prices isn’t great, but hey, might as well enjoy them.

Diesel prices fell to $3.48/gallon, another 2025 low, due to weak demand for truck transportation. That might change in the coming weeks as we get a surge of imports with the 90-day reduction to some Chinese tariffs.