May Jobs Report: The Definition of Insanity

Employers add 339,000 jobs for the month

This post is sponsored by Pivot Workforce. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I know and trust and 2) tackling an important problem like the construction industry's skilled labor shortages. Pivot checks both those boxes. Their goal is to help construction companies get the high-quality talent they need, and they have over three decades of experience staffing difficult-to-fill positions for some of the most recognized names in the construction industry. I urge any contractors struggling to find workers to give Pivot a look.

There’s a misattributed Einstein quote that goes something like: “the definition of insanity is doing the same thing over and over and expecting different results.” That’s always bothered me. Doing the same thing over and over expecting different results is the definition of practice, not insanity.

Today’s jobs report has me reconsidering, because the consensus forecast for payroll job growth missed low for an astounding 14th consecutive month. U.S. employers added 339,000 jobs in May, about 150,000 more than expected, and the March and April estimates were revised up by a collective 93,000 jobs. Forecasters are either insane or getting really good at underestimating the strength of the economy, and maybe both.

The unemployment rate increased from a 50-year low of 3.4% to a still low 3.7% in May, and average hourly earnings increased 0.3% and are up 4.3% year over year. That’s still faster-than-ideal increase in wages from an inflation perspective, but modestly higher unemployment and slowing wage growth is exactly what the Fed wants to see, especially when you consider that the labor force expanded for the month.

Conflicting Data

There are two surveys that go into the jobs report. The establishment survey, which gives us the change in payroll employment, and the household survey, which gives us the unemployment rate (and some other labor market measures). Here’s the problem: according to the household survey, employment declined by 310,000, which is a very different finding than the 339,000 increase shown by the establishment survey.

Digging into the details, it looks like most of the gap between the estimates is largely due to technical definitions: the household survey includes unincorporated self-employed workers (contractors, gig workers, etc.), and the establishment survey doesn’t. If you use the establishment survey definitions on the household data, you get a monthly gain of 394,000 jobs, even larger than the 339,000 in the establishment data.

So that means that there was a huge decline in unincorporated self-employed workers in May. A lot of them got more traditional jobs and are now on payrolls, and a decent number of them became incorporated self-employed workers, meaning they started a business.

The decline in self-employed workers that occurred in May might have something to do with the writers’ strike (this is purely conjecture). To the extent contractors work on sets, they may have lost their work due to the strike.

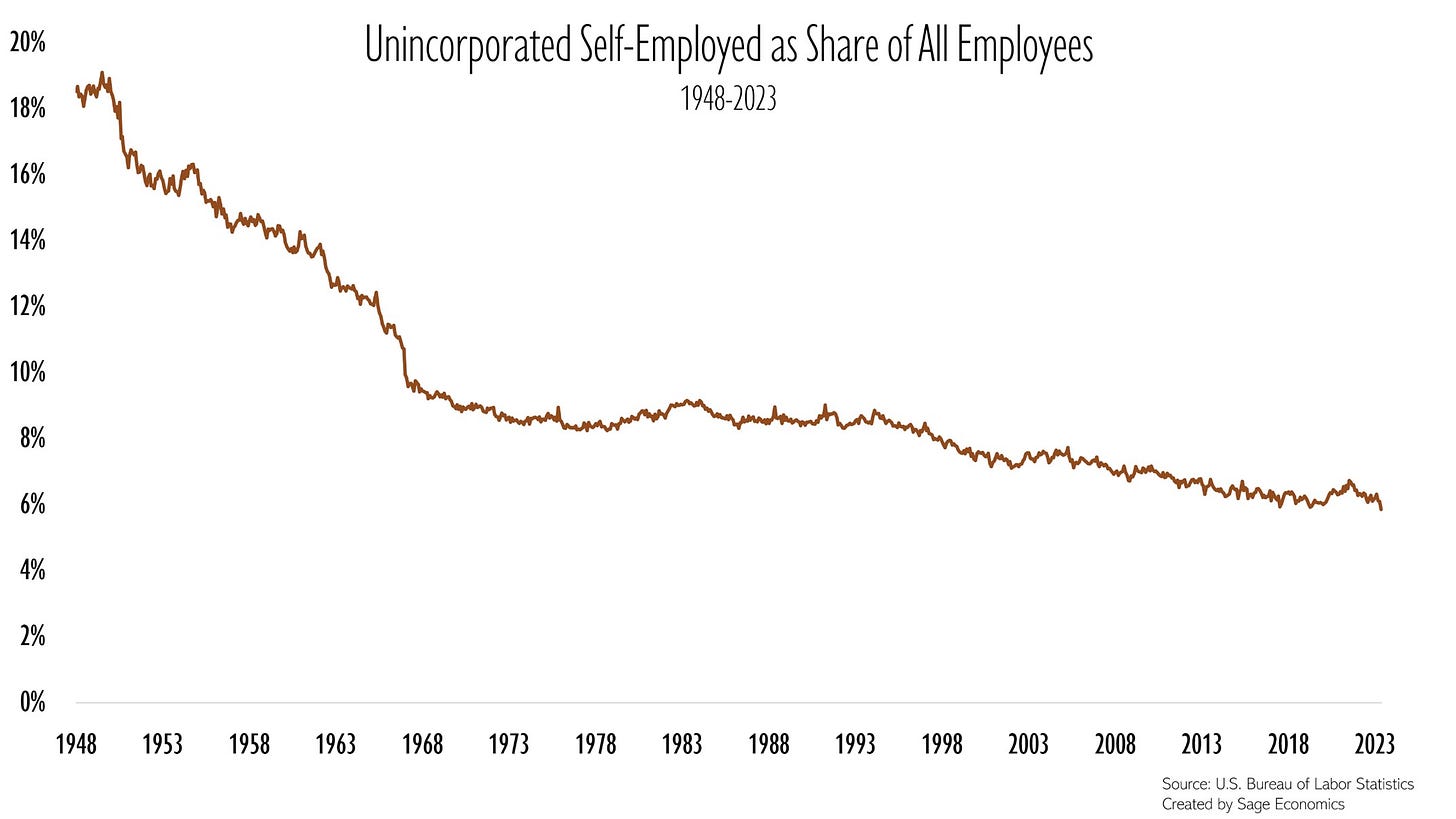

Finally, I think there’s a notion that the number of self-employed gig workers has exploded in recent years, and that probably ties back to this idea that “the economy sucks, just not for me.” In reality, the number of self-employed workers is currently lower than it was before the pandemic and is significantly lower than it was from the late 1980s to the start of the GFC in 2007.

In fact, unincorporated self-employment as a share of all employees has declined steadily since the start of the data series in 1948 and, at 5.9%, is currently at the lowest level on record. There’s probably a lot at play here (and I’m writing this on the fly in response to today’s jobs report…), but I’m guessing this trend has something to do with the IRS declaring employer-based health insurance exempt from taxation in 1943.

Job Growth by Industry

Job gains were pretty broad-based in May, though two segments lost jobs for the month. Manufacturing saw a small setback, which makes sense given other recent indicators from that sector. Information, which includes tech, media, and motion picture-related work, lost 9,000 jobs. That also checks out.

The biggest gains were in education and health services, and most specifically in healthcare. That segment doesn’t include public schools, which are part of the government category but also added jobs at a really fast pace in May. Leisure and hospitality, the slowest recovering sector from pandemic-job losses, continues to add jobs but at a less rapid pace than in recent months.

As always, you can read Anirban’s in-depth thoughts regarding the construction industry’s labor market at Associated Builders and Contractors.

Final Thoughts

With a huge caveat that economic data is pretty confusing at the moment with lot of mixed signals, there’s a lot to like about this jobs report. Employers are still hiring at a fast pace, but we’re starting to see a tiny bit of slack in the labor market. That should reduce wage pressures, helping in the fight against inflation.

Big picture, we’ve added jobs at an above-average rate for 29 consecutive months, the unemployment rate is still near historical lows but rising, and wage growth is slowing. You should feel good about this heading into the weekend.

What’s Next

We’ll have Anirban’s Week in Review post out for paying subscribers later today. If that’s not you and you want it to be, just click the button below.

Going to be using this counterstatement next time I hear anyone say that quote! Another excellent summary of the current contradictory feelings of data vs sentiment that everyone seems to be talking about.

Have you looked at the PT vs. FT vs. multiple job gains? How many foreign born vs native born have acquired these jobs? The data BLS shares smells funny...