Newsy Week in Review

A new Fed Chair, sad consumers, & more

This week brought a barrage of economic news.

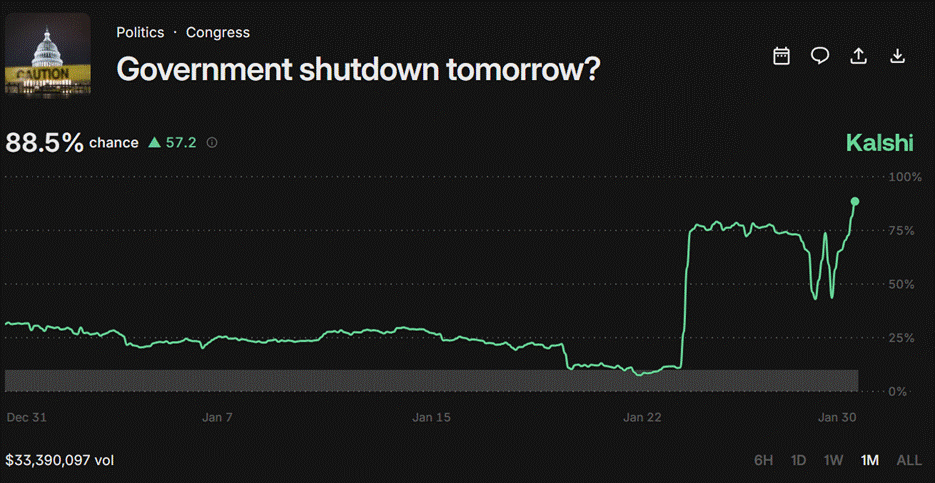

First and foremost, the killing of Alex Pretti by CBP agents in Minnesota and subsequent federal response have sent shockwaves through the U.S. political landscape, and some of those tremors will be felt in the economy. For instance, the odds of a government shutdown surged from 9% on January 23 to 77% on January 24. As of this writing (11:05 AM EST), the odds are up to 88% and rising.

Then there was winter storm Fern, which dumped snow and ice across much of the country and had big implications for oil markets, travel, and—given that schools here were closed from Monday to Thursday—my personal productivity.

Topping it all off, President Trump nominated Kevin Warsh to be the next Fed Chair today.

While this week was quieter on the data front, we still got updates on population growth, producer price inflation, consumer confidence, and more.

Monday

Durable Goods Orders

New orders for durable goods (things that typically last at least three years) increased at a healthy and faster-than-expected pace in November 2025 and—excluding expensive and volatile transportation orders—were up 2.4% year to date through the first 11 months of 2025.

Orders for computer and communication equipment are ripping, while orders for cars and car parts are hardly treading water.

Note that this release was delayed by the government shutdown. November feels like a long time ago, doesn’t it?

TSA Checkpoint Travel Numbers

Just 1.3 million people flew on Sunday, according to TSA data. That’s the fewest on any day since February 8, 2022, when the combination of winter storm Landon and the Omicron COVID-19 variant put a stop to most air travel.

This is interesting but not indicative of any broader economic trends. Winter weather sucks.

Oil Stuff

Gas prices increased for the second straight week but are still very low at $2.98 gallon.

Diesel prices shot up at a faster pace and are just $0.04 cheaper than one year ago.

Domestic oil production fell to the slowest pace since October, as of the week ending January 23rd, and will slow again for the following week due to the cold weather.

Tuesday

U.S. Population Growth

The U.S. population grew just 0.5% between July 2024 and July 2025. This was due to a “historic decline in net international migration,” which fell from 2.7 million the previous year to just 1.3 million.

I’m working on a longer post on population stuff. For now, here’s some scattered thoughts/highlights:

Natural population growth (domestic births minus deaths) continues to slow, coming in at just 519,000 for the past year. That’s down from 1.1 million in 2017. Simple projections show we’re heading for a demographic cataclysm.

“The Midwest was the only region where all states gained population from July 2024 to July 2025.” What an unexpected turnaround for Flyover Country!

Immigration is really hard to estimate. The Congressional Budget Office estimates net immigration slowed to 410,000 in 2025, while researchers at Brookings think it went negative for the year (Great thread from economist Jed Kolko on this).

The top five fastest growing states all voted for President Trump in each of the past three elections. The 2030 Census will not be kind to Democrats’ electoral college math.

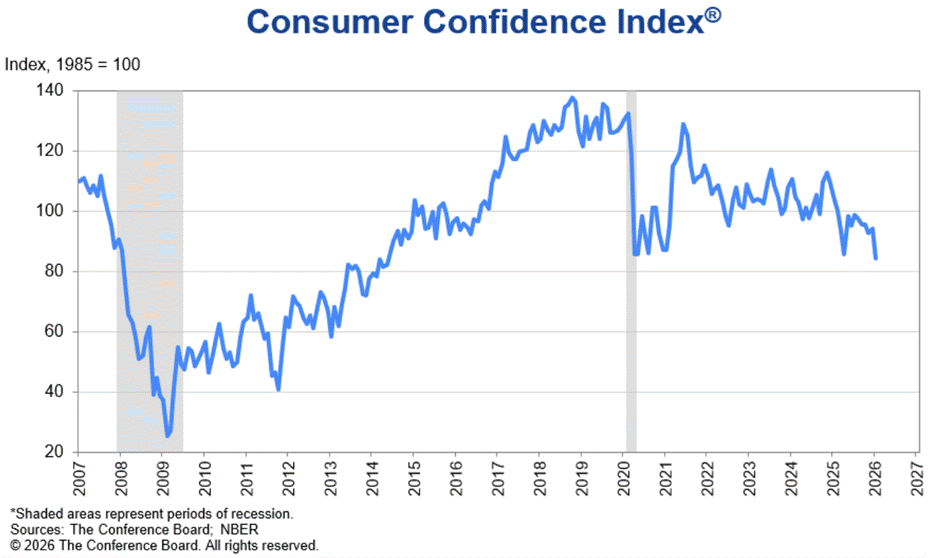

Conference Board Consumer Confidence Index

Consumer confidence fell off a cliff in January and is down to the lowest level since 2014. This is a little surprising; people are less confident than they were in April 2020 which, if you’ll recall, was a really terrifying time for the economy.

I’m not quite sure what to make of this. Consumers have been downbeat—at least compared to pre-pandemic levels—for a while now, but the recent decline is shocking and not reflected in most economic data.

My best guess is that consumers are overwhelmed by chaotic policymaking: mentions of “tariffs,” “trade,” and “war” all increased in the write-in responses for the month.

S&P Cotality Case-Shiller Home Price Index

Home prices increased slowly in November and were up just 1.4% year over year. Prices increased at the fastest pace in the Midwest and Northeastern U.S. and fell in many sunbelt cities.