No Economy for Young Adults

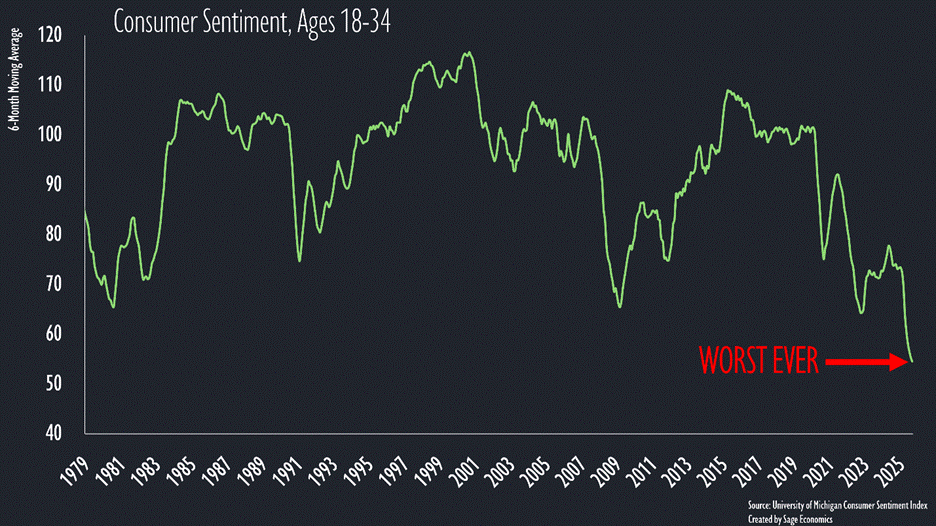

Is the economy uniquely bad for young adults? They certainly think so. Consumer sentiment for people between 18 and 34 years old is at the lowest level ever recorded.

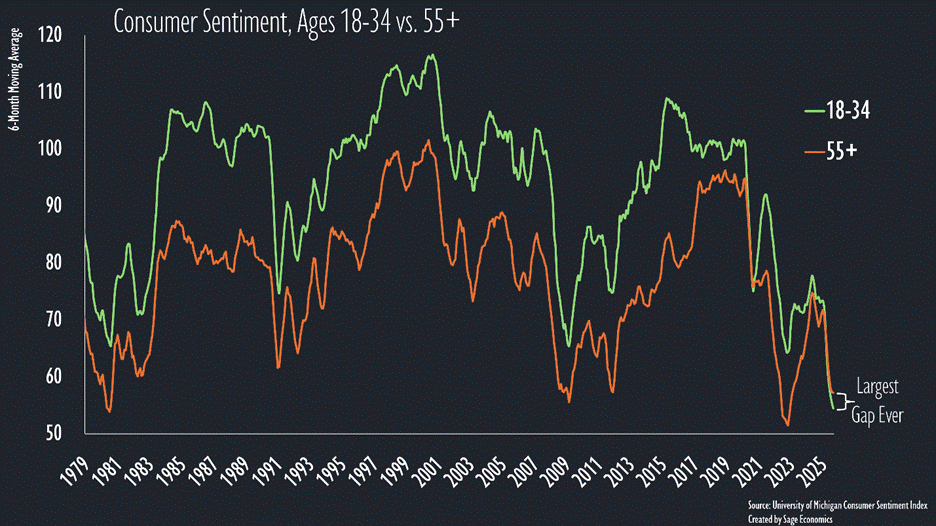

Historically, that youngest consumer segment (18-34) has been far more optimistic than the oldest (55+). Not so in 2025. As of September, the gap between 55+ sentiment and 18-34 sentiment is the largest on record.

Consider that 55+ sentiment has only been above 18-34 sentiment in 20 of the 573 months for which we have data, and 10 of those have occurred since November 2024.

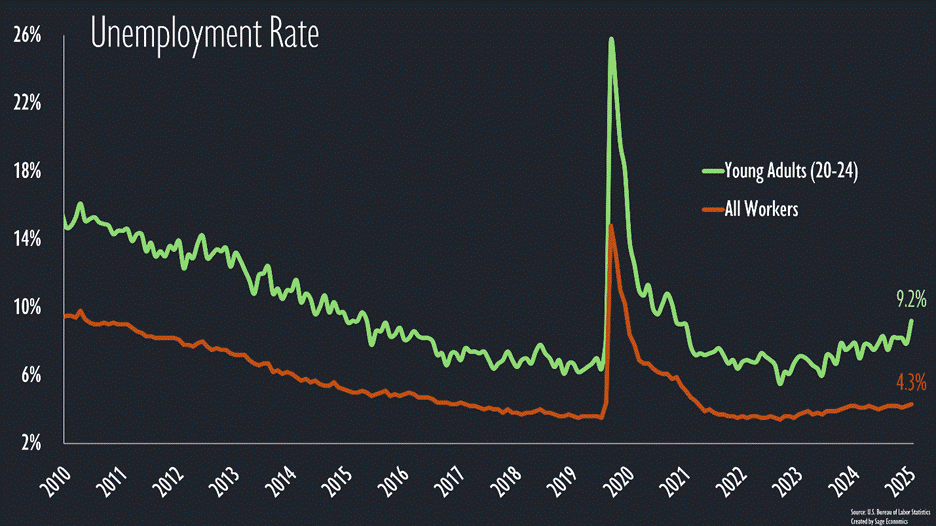

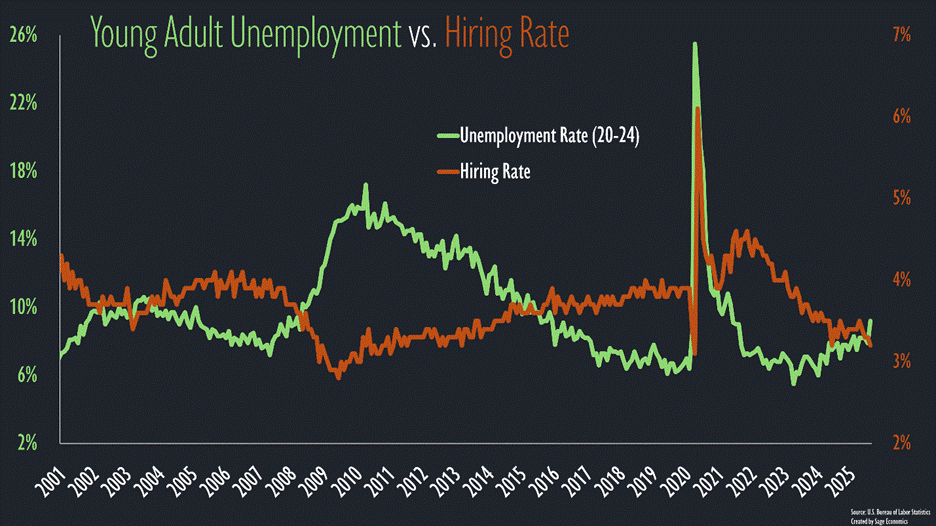

High and rising joblessness for young adults explains a lot of this dismal outlook. The unemployment rate for 20–24-year olds has surged recently, while the unemployment rate for all workers has hardly budged.

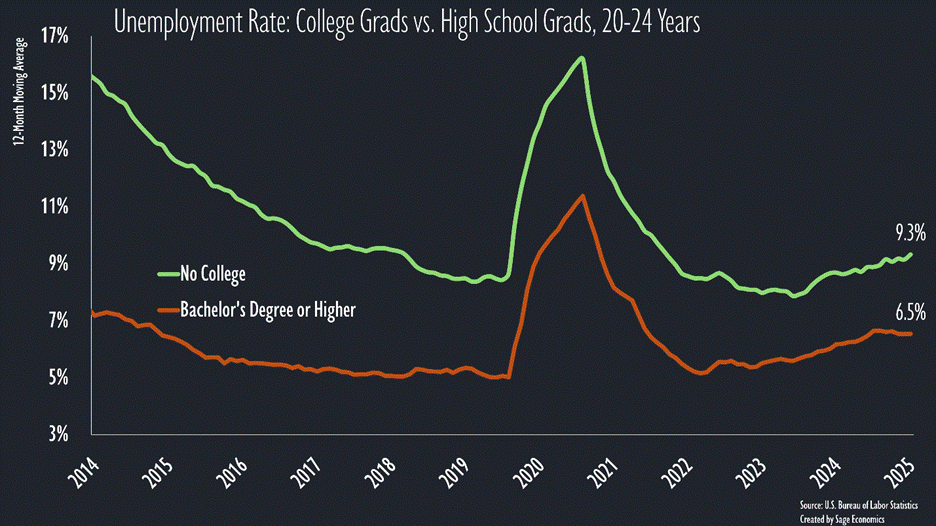

Many blame AI. I don’t.

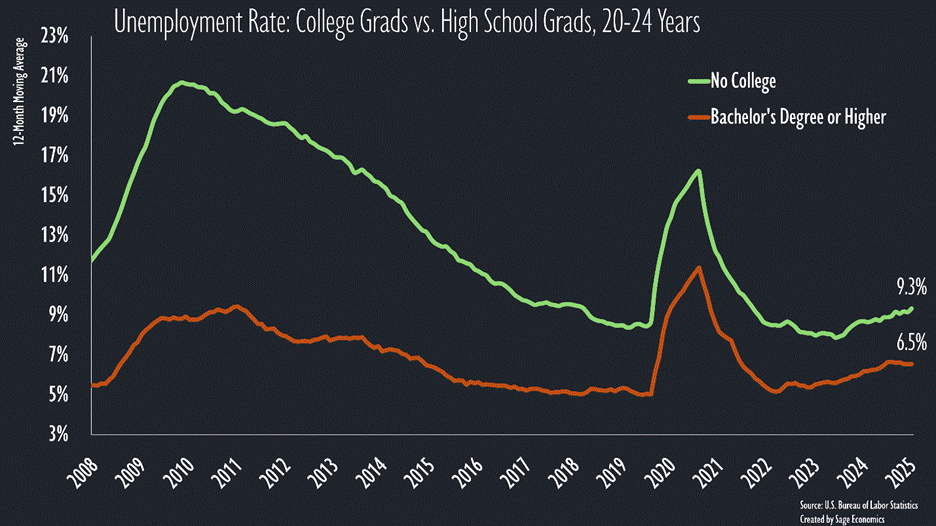

If AI were to blame, it would largely harm those with college degrees. Instead, the rate for young workers with a college degree has started to edge lower over the past several months while the rate for those without a college degree has continued to rise.

This stems from an urge to blame cyclical trends on newsy subjects like AI (or work from home, or quiet quitting, or guys playing video games, or whatever).

The cyclical—and boring—explanation is that employers, spooked by tariffs and economic uncertainty, are not hiring, and that’s particularly rough on new labor market entrants.

Historically, young adult joblessness rises when the hiring rate (hires divided by all jobs in a given month) declines.

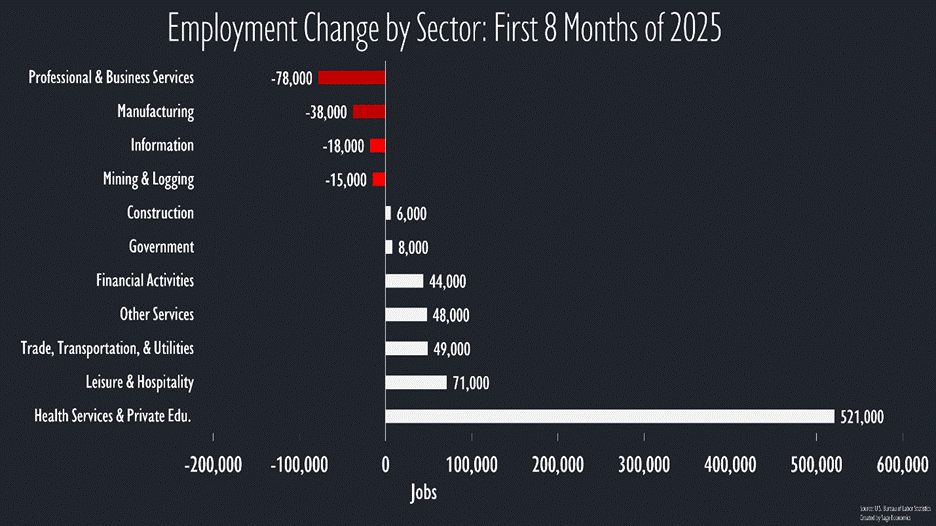

Hiring has been particularly weak in industries that tend to hire more workers without a college degree. [Note: the decline in professional and business services employment has been at staffing firms and other blue-collar services; the white-collar part of the segment has grown in 2025.]

So it’s hard for young adults to get a job. That’s reason enough for them to feel down about the economy, but it’s not their only reason.

Housing affordability has collapsed over the past three years. The annual ownership cost of a median priced home was less than 35% of median household income from 2008 to 2022.

That changed when interest rates started rising in 2022, and it changed rapidly. Homeownership costs have been above 40% of median income since 2023 and above 45% for over a year.

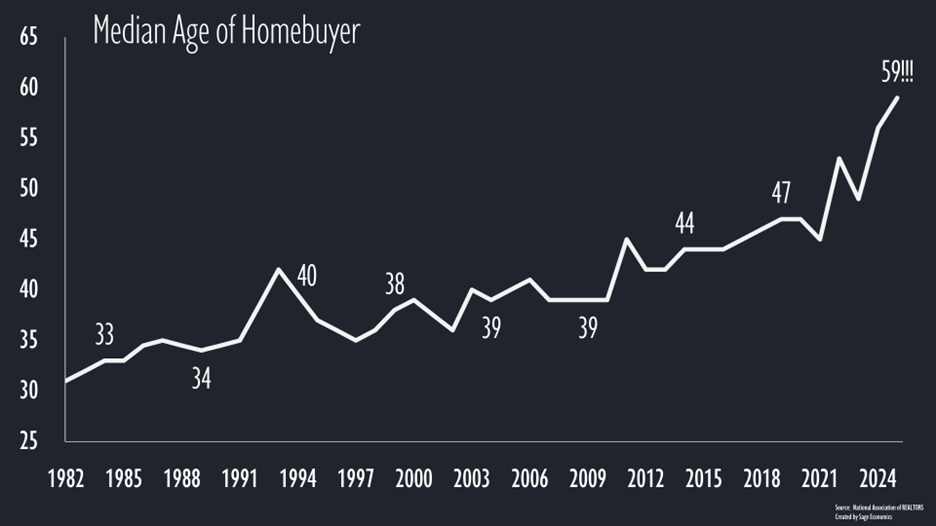

But that’s a recent trend, and homeownership has been drifting farther out of reach for young adults—and I’m using a very liberal definition of “young”—for a long time. The median homebuyer age has risen steadily and, as of 2025, stands at a truly absurd 59 years. Just one in five home purchases in 2025 was made by a first-time buyer, the lowest share on record.

The inaccessibility of the housing market—largely a supply issue—is also due to the debt many young adults start their careers with. As of 2003, student loan debt totaled just $241 billion, or about 3.3% of all outstanding household debt. Student debt has increased about 580% since that time.

About $154 billion of that student loan debt is 90+ days past due as of the third quarter of 2025. This can make getting a mortgage more difficult and eat away at the cash that can be used for a monthly housing payment.

Despite all that, the kids will be all right

Current conditions are tough, but—housing aside—that has a lot to do with short-term dynamics. This isn’t the first spell of dismal young adult sentiment, nor is it the most justified.

Just ask anyone who entered the workforce from 2008 to 2012, when the 20-24 unemployment rate surged to nauseating heights (just look at this graph from earlier but with the X-axis extended).

Those Millennials won’t spare much sympathy for Gen Z, though they might them that “hey, things can get better.”

The hiring rate will pick up; it’s just a question of when, and homebuying conditions should be better, if not great, by the end of 2026. Gen Z is also outperforming in some regards, like accumulating wealth at a faster pace than previous generations (yes, even after adjusting for inflation).

To the extent AI changes the way we work, I expect the generation that used (or you know, abused) it to get through college will also excel at using it in their careers. Just ask a Millennial who’s ever helped a Boomer or Gen Xer edit a PDF.

Big picture? It’s a tough time to enter the workforce, and like every generation, this one faces some unique economic challenges. Even so, the doom and gloom about the situation is at least a little overblown.

What’s Next?

The Senate just passed a measure to reopen the government, and it looks like the House will vote on it this week. We’ll cover that, a bunch of private-sector data releases, and more in Week in Review, our every-Friday post that gives you everything you need to know about the economy in a breezy, five-minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.

You state: "homebuying conditions should be better, if not great, by the end of 2026"...can you explain why it should be better?

I really enjoyed this. As someone who as worked in corporate America for much of my adult life, I have found the current housing market and economy to be disenchanting. The American model has always been, go to school, work hard, save your money and economic prosperity will follow. That feels increasingly out of reach for myself and a lot of the people I grew up with. Happy to see a perspective that we’ve been down this road before and perhaps there are greener pastures ahead.