Overreactions, Train Lockouts, & More

Week in Review: Aug. 19-23

This should have been a slow week for economic news and data, but everyone overreacted to the BLS jobs revision on Wednesday, fueling a swarm of conspiracy theories, and then two Canadian railways locked out their workers on Thursday, threatening supply chains and the attendant U.S. inflation outlook. By the way, I’ve declared Baltimore Orioles’ starting pitchers an endangered species. Please don’t harm the few who remain.

Monday

TSA Checkpoint Travel Numbers

Travel volumes are holding up better than they did at this point in 2023, according to TSA data, but are clearly trending lower, as is normal at this time of year. In short, travel remains hot-hot-hot. At some point, we can’t simply say this is because of pent-up demand from the pandemic being released into the economy. I’m sure that still matters, but people love to travel, and when they have the money to do it, they do.

Tuesday

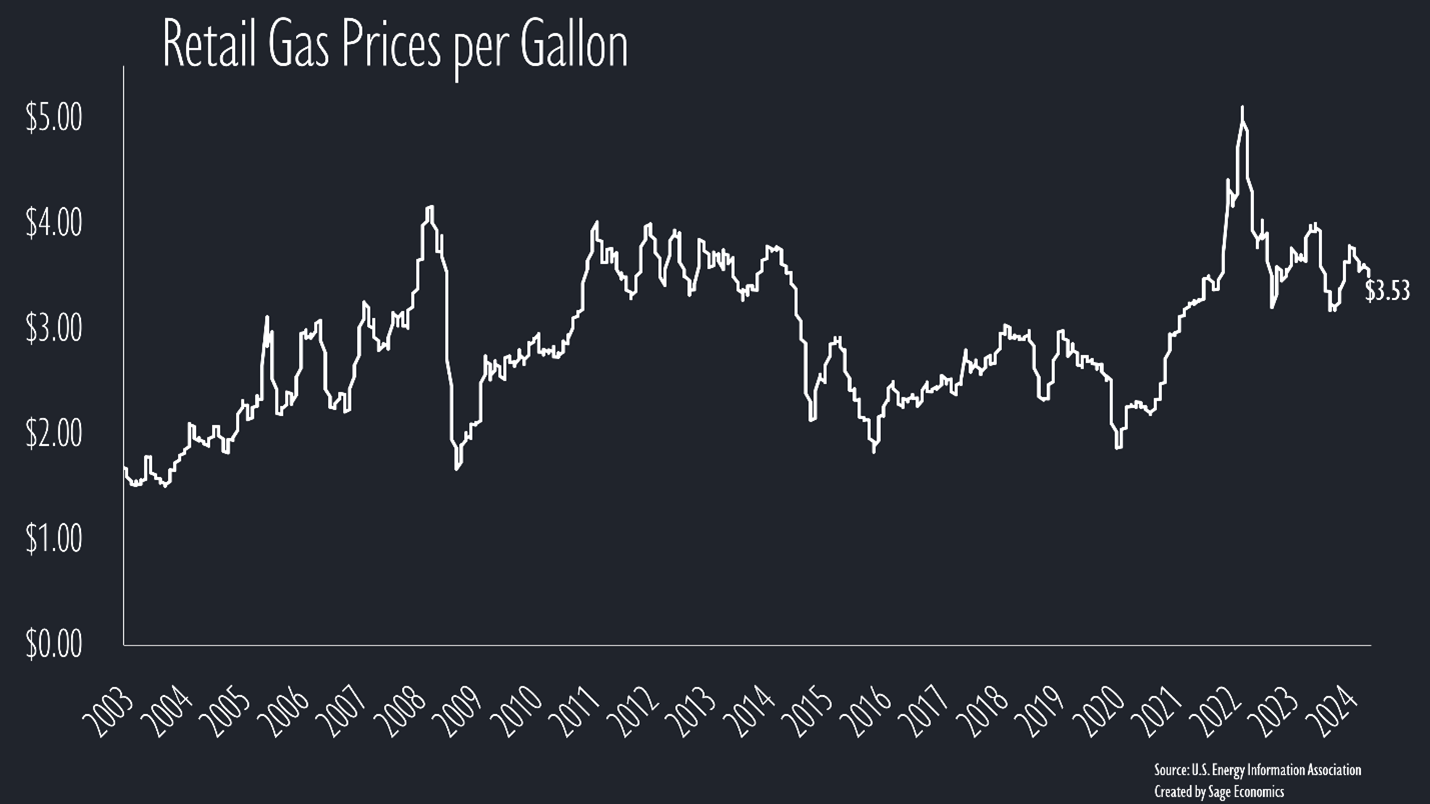

Gas Prices & Diesel Prices

Gas prices fell to an average of $3.50/gallon and should keep trending lower over the next few weeks. Diesel prices fell again and are below $3.70/gallon for the first time since January 2022. This is obviously good news for consumers and shippers alike.

Wednesday

Mortgage Applications

Mortgage applications fell last week. Purchase applications are down 8% from the same week last year, while refinance applications are up 90% over that span.

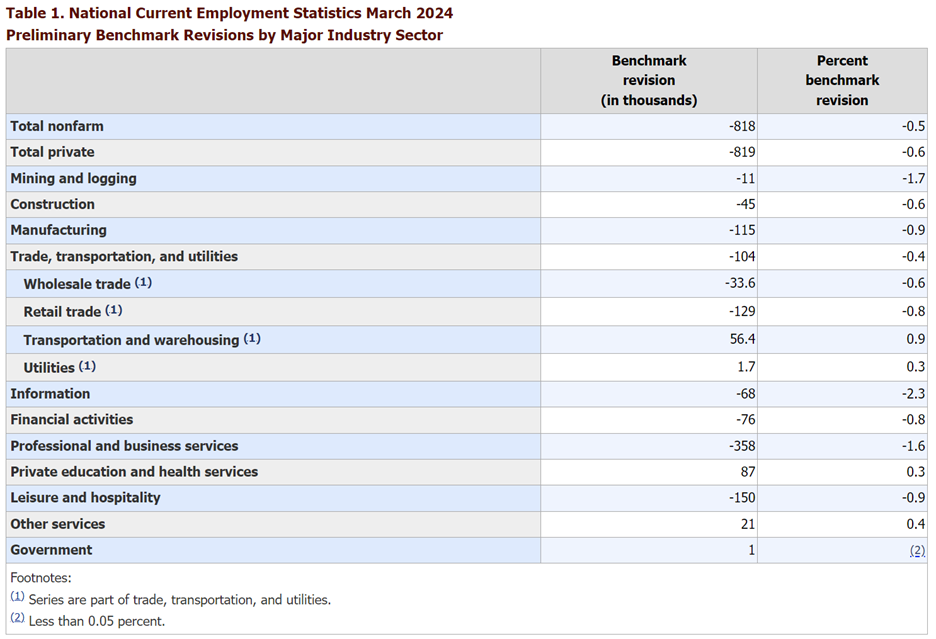

Payroll Employment Benchmark Revision

The BLS revised employment growth between April 2023 and March 2024 by -818,000 jobs. Put another way, over that one year period we averaged 174,000 jobs per month (pretty solid) instead of 242,000 jobs per month (really strong).

First: Why do they do this? (if you don’t care, skip the next two paragraphs)

The BLS estimates monthly job growth by surveying about 650,000 businesses. That helps them figure out something like a per business change in jobs, but they also need to know the number of businesses that start up or shut down. This is tricky. They do the best they can, but sometimes—especially during economic recoveries or downturns—they’re off by a decent amount.

Once a year they use another one of their surveys (the QCEW, which uses data from state unemployment insurance programs) to revise the rate at which businesses opened and closed in the model they use for monthly job growth. The release this week was the preliminary revision—we won’t know the final revision until the January 2025 jobs report is released.

Second: What does (and doesn’t) this mean?

This means that job growth was slower than we thought during 2023 and early 2024, especially in the following industries: information (think tech and media), leisure and hospitality, professional and business services, and manufacturing.

This revision doesn’t affect the unemployment rate, the labor force participation rate, or the employment to population ratio, all of which are determined through yet another survey. The revision is also backward looking, so it doesn’t affect our understanding of the second quarter of 2024 onward.

The Fed (and everyone else) knew these revisions were coming and knew they were going to be negative, with estimates in the range of -300,000 to -1 million.

Third: Is this a grand conspiracy?

No. If the BLS was cooking their numbers, why would they issue a revision? And if they were cooking the books at the urging of the White House, why would they issue a huge negative revision a few months before the election?

Consider these revisions a sign that the BLS is doing their very best to provide the most accurate possible information about the economy.

Fourth: There is a silver lining.

There were about 0.5% fewer jobs than we thought as of March 2024, but our current estimates of output remain unchanged. That means that productivity—output per hour worked—has increased at a faster rate than we thought.

FOMC Minutes

The Fed released the minutes from the July meeting where they chose to keep interest rates unchanged. Not much of note here, and we’re going to have a rate cut at the September meeting. Only thing left to be determined is whether it’s a 0.25 or 0.50 percentage point cut. I think it may very well come down to the employment report that will be released on September 6th. If unemployment ticks up again, expect a half-point rate cut.

Thursday

Canadian Rail Strike

Canada’s two biggest railroads locked out about 9,000 workers after they couldn’t reach a labor agreement with the Teamsters. Consequently, 2,500 fewer rail cars will bring goods from Canada to the U.S. each day, putting upward pressure on prices for lumber, a variety of food, cars, and a bunch of other products.

Existing Home Sales

Sales of existing homes (i.e., not new) increased in July. That ends a streak of four straight monthly declines, but the increase was only 1.3%, and existing home sales are still down 2.5% year over year. These won’t rebound in any meaningful way until mortgage rates come down. I expect the housing market will simply explode with a rush of sales either late next year or in 2026. I’ve already declared 2026 The Year of the Realtor, as both buyers and sellers come rushing back into the market as mortgage rates begin to at least better approach pandemic lows.

Jobless Claims

Initial jobless claims ticked up to 232,000. That’s higher than in Spring but still pretty moderate by historical standards. These are down 21,000 from the same week last year—layoffs just aren’t a problem for the economy right now. Continued claims for unemployment insurance inched higher, continuing a modest upward trend.

Jobless claims are higher than in the earlier parts of 2024, but so far there’s nothing to be concerned about in this data series. Call it a soft landing if you’d like.

Mortgage Rates

Mortgage rates inched lower this week, and the average 30-year fixed is now at 6.46%, the lowest level since May 2023.

U.S. Crude Oil Production

U.S. oil production bounced back to 13.4 million barrels per day last week, marching the all-time high set during the first week of August.

Friday

New Home Sales

More new homes were sold in July than in any month since May 2023. To put this into context, there were more new homes sold in July than in any month between July 2007 and June 2020. It will be interesting to see how the split between new home sales existing home sales changes as rates fall in the coming months.

Links of the Week

Home Insurance is a Really Big Problem (Kyla’s Newsletter)

How to Build a 50,000 Ton Forging Press (Construction Physics)

Annie Jacobsen on what would happen if North Korea launched a nuclear weapon at the US (80,000 Hours)

Final Thoughts

After this week, my outlook for the economy is: Improving

As I write this, the stock market is reaching for its 10th positive day in 11. Capital continues to course through the veins of the U.S. economy. Corporate profitability remains strong. And that growth scare we suffered a couple of weeks ago is increasingly in the rearview mirror.

Mind you, I’m not ready to give up my recession forecast just yet. Monetary policy operates with long and variable lags and all that. But the fact of the matter is that the economy’s strength continues to surprise me despite an overextended consumer, a flailing U.S. manufacturing sector, and sagging downtown office markets. I still think that there is an elevated probability of a mild recession early next year, but if I don’t see further economic weakening after Labor Day, I might have to join the soft landing crowd. Enjoy your weekend, drive safely, and watch out for those Orioles’ starting pitchers.

Looking Ahead

Next week brings us an important reading on inflation, GDP data, and more.