Pirates, Deflation, Housing, & More

Week in Review: Dec. 18-22

This was a good week for pirates, those who like falling prices, domestic oil production, consumer confidence, and whomever it is that produces out of office messages (banner week of sales for those folks).

This is our last Week in Review for the year and puts a tree topper on on over 60,000 words of recapping economic data releases in 2023. Thanks for reading!

Monday

Joint Operation to Stop Piracy in the Red Sea

The U.S. DOD announced a joint operation with several other nations to “address security challenges in the southern Red Sea and the Gulf of Aden, with the goal of ensuring freedom of navigation for all countries and bolstering regional security and prosperity.”

This is a nice way of saying that Houthi pirates (video of them hijacking a ship) have been targeting commercial ships in the Red Sea, and they need to stop. Seriously, cut it out. We’ve had enough supply chain issues lately and piracy just isn’t as fashionable as it was in the 17 century (and even then, I suspect it generated some resentment and strongly worded letters).

Global supply chains have been in great shape the past few months, and this represents a small, albeit growing, disruption; since November 19, 55 ships have changed course and gone around the Cape of Good Hope instead of passing through the Suez Canal, and BP recently paused all shipments through the Red Sea (according to Reuters).

Global shipping costs are up as a result, not only because of longer distances, but also because of surging insurance costs. That said, because of the growing multinational focus on piracy led by the Americans, my outlook for the pirates is not good (also not good for the Pittsburgh Pirates, a franchise that has been out of fashion since the late-1970s with limited exception).

NAHB Housing Market Index

This measure of homebuilder confidence improved slightly in December but is still extremely low. That’s largely due to a low reading for the traffic of prospective buyers component. While homebuilders feel slightly better about the next six months (though still not great), I’m not sure anyone is more excited for a new year than those who work in the home selling business. More time at the settlement table in store for 2024 and one suspects even more so in 2025.

Gas Prices

Consider buying a loved one a tub of gasoline for Christmas, because gas prices fell for a thirteenth straight week and, at $3.18/gallon, are at the lowest level since the middle of 2021. I use 93 octane exclusively by the way, just so you know.

Diesel Prices

If you’re looking to give a more upscale gift, you could go with diesel, which is now under $3.90/gallon. Thanks, no.

TSA Checkpoint Travel Numbers

The number of passengers screened by TSA slipped below 2019 levels this week. It looks like everyone decided to travel for Thanksgiving and stay home for Christmas.

Tuesday

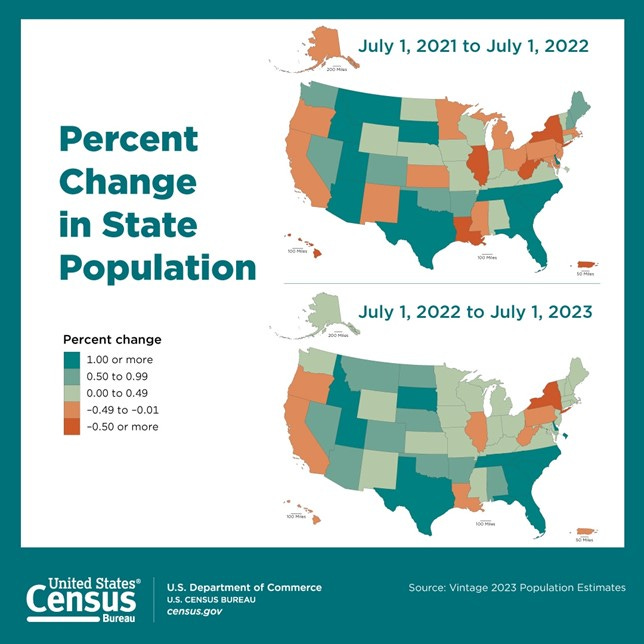

2023 Population Estimates

New year, same story with population changes: the sunbelt is growing like crazy, people are fleeing the northeast, and the rest of the country’s population is fairly stagnant.

Texas and Florida continue to lead the way in terms of absolute population growth, while South Carolina joined those two in the top three for percentage growth.

Since the start of the pandemic, Idaho has seen the fastest percentage growth in population, followed by the usual suspects and then Montana. The worst states for population growth were, unsurprisingly, New York and California, which collectively lost nearly 900,000 people since 2020.

We’ll have a longer post on this in the next couple of weeks with a full breakdown of the new data.

Fatal Workplace Injuries 2022

Nearly 300 more people died at work in 2022 than in 2021, and the fatal workplace injury rate inched up to 3.7 fatalities per 100,000 FTE workers (from 3.6 in 2021). The most dangerous occupational group was (by far) farming, fishing, and forestry, followed by transportation services.

New Residential Construction

New housing authorizations fell slightly in November but are up modestly over the past year. Single-family permitting increased slightly for the month and is up roughly 23% over the past year, while multifamily permitting has fallen off a cliff and is down more than 21% over the past year. As I’ve been saying at my presentations, project financing is more challenging and I don’t expect that to change massively next year even as the cost of capital dips. Many bankers do not have an appetite to add to balance sheet risk through further exposure to real estate, including multi-family and certain commercial segments.

The number of single-family starts surged in December, rising 18% from November to the highest level since April 2022. Put simply, we started building a lot of new single-family homes in November—more than in any month from 2007 to 2019. If one is going to pay high rents, might as well pay high mortgage rates instead—must be the thinking among some meaningful fraction of Americans.

Wednesday

Conference Board Consumer Confidence Index

This measure of consumer confidence increased sharply in December and is now back at roughly 2017 levels (but still below 2018-19 levels). There’s been a lot of discourse this year about why sentiment is so bad, but maybe it was always just inflation. Look for sentiment to keep improving next year as inflation drifts back toward 2% -- unless of course I finally prove correct and recession arrives, driving unemployment higher in the process.

Existing Home Sales

Existing home sales inched 0.8% higher in November, but are still down year-over-year (and down in all four regions of the U.S.). But that was November, when mortgage rates were still in the mid-to-high 7% range. Expect existing home sales to move higher as rates fall in coming months.

U.S. Crude Oil Production

U.S. oil production increased to 13.3 million barrels a day during the week ending December 15, the highest weekly average ever. It’s been an extraordinarily good year for domestic oil production.

Fun fact: the U.S. is currently producing more oil than any other nation (and by a large margin).

Mortgage Applications

Mortgage applications declined this past week, ending a streak of six straight increases despite mortgage rates falling to their lowest level since June. That’s on a seasonally adjusted basis, so it should account for the holidays, but this still seems like more of a blip than anything else.

Thursday

Mortgage Rates

Average mortgage rates fell for an eighth straight week. At 6.67%, the average 30-year fixed rate is now at its lowest level since June.

Jobless Claims

Initial jobless claims remained extremely low at 205,000 this week, fewer than during the weeks leading up to pandemic. Continued claims for unemployment insurance were essentially flat and remain in line with pre-pandemic levels.

Friday

PCE Price Index (Inflation)

We often talk about the difference between disinflation (when prices rise at a slower rate) and deflation (when prices fall). We had the latter in November according to the PCE Price Index.

Not only did prices fall 0.1% for the month, but they’re up just 2.6% over the past year. That’s the slowest annual price increase since February 2021. Of course, this had a lot to do with plunging gas prices, but even if we exclude food and energy, prices increased just 0.1% in November and are up just 3.2% year over year. The Core PCE is the Federal Reserve’s preferred inflation measure, and so the news on inflation just gets better and better.

I still believe, however, that there may be some surprises next year, with inflation remaining stubbornly high in the context of still elevated wage pressures and now some emerging supply chain issues. But for now . . . inflation is slowing faster than anyone expected, and without a corresponding rise in unemployment. This is about as good as news gets to close out the year.

Personal Income, Saving, and Spending

Both total income and disposable income increased a strong 0.4% in November. Because prices fell for the month, inflation adjusted income increased by even more (though still just 0.4% once you round). Real expenditures increased 0.3%, which is also a strong—but not too strong—pace of growth.

The personal saving rate, which is the share of disposable income saved each month, increased to 4.1%. That’s still low by historical standards but the highest rate since August.

University of Michigan Survey of Consumers

This measure of consumer confidence also surged higher in December. Things are looking up!

New Home Sales

The number of new homes sold fell sharply in November (-12.2%), but mortgage rates were still way above 7% in November. Expect new home sales to increase in the coming months, especially with inventory levels inching up to the highest level since December 2022.

Links of the Week

Crime is way down this year (Jabberwocking)

Declining Mortgage Rates Lure Sellers Off Sidelines, Paving the Way For 2024 Buyers (Redfin)

The 2023 Headline of the Year Nominees (Paul Fairie on Twitter, very funny)

Final Thoughts

After this week, my outlook for the economy is: Improving

The economy performed far better than I expected in 2023. There were three elements that really surprised me: 1) that employers continued to hire so aggressively given how expensive workers have become and how much they complain about their own workers, 2) that consumers were willing to keep spending so aggressively, including by taking on so much additional debt in the context of elevated borrowing costs, and 3) that inflation fell so rapidly given a tight labor market and wicked geopolitics, including in commodity rich parts of the world.

How did the economy navigate through all of these issues? Stimulus. U.S. federal government deficit spending really helped to bulk up activity, including on defense and in the form of support to state and local governments. None of this seems especially sustainable to me, but the fact of the matter is that we enter 2024 with far more momentum and optimism than I anticipated when 2023 was just getting started . . .

Looking Ahead

We’re taking next week off but will be back the first week of 2024 to review new data on jobs, construction spending, and more. Happy New Year, and thanks for reading!

Regarding the rise in single family starts - people continue to have life changes that necessitate changing where they live in spite of the cost of doing so. The used home market has limiited inventory because not many people are moving and high interest rates. The new home market can be attractive because the larger builders are offering their own financing, much of the time at a rate better than the rest of the market.

There is no deflation (clickbait?) .... price growth is slowing, in part to the laspyeres design of cpi and changes to quality and innovation overweights

Real productivity and growth are not happening macro , it’s sectoral , you can see it in weak software sales and the shedding of sales forces anticipating the impact AI will have in automation of b2b sales ( which I think may backfire because people like to trade with people and not with algorithms ... like playing solitaire )

Macro finance sector is selling us a bill of goods to keep interest rates from rising in a political year (sad that we can’t divorce good decisions from political king making )

Great compendium of metrics overall... nice stack !