Premature Week in Review

Services, manufacturing, & more

There were unusually few data releases this week and we have busy travel days tomorrow, so Week in Review is going out today (also making this free to all subscribers). Despite the light week, we still got the start of higher tariffs and updates on the services and manufacturing sides of the economy, bank lending standards, a few housing stats, and more.

Monday

ISM Manufacturing PMI

The manufacturing side of the economy contracted for the fifth straight month in July, according to this survey of industry managers. Industry employment shrank at a faster pace than in June, and prices are still rising rapidly.

The comments have a lot to say about tariffs, including this quote from an apparel manufacturer:

These tariff wars are beginning to wear us out. It’s been very difficult to forecast what we will pay in duties and calculate any cost savings we’ve had this year. Also, tariffs have disrupted our customs import bond. There is zero clarity about the future, and it’s been a difficult few months trying to figure out where everything is going to land and the impact on our business. So far, tremendous and unexpected costs have been incurred.”

Regarding costs, “tremendous and unexpected” are not ideal adjectives.

Senior Loan Officer Opinion Survey (The SLOOS!)

Lending standards remained mostly unchanged (i.e., extremely tight) throughout the second quarter of 2025, according to this survey of bank officers. Demand for loans was mostly unchanged too, although there was a slight weakening in the demand for nonresidential construction loans.

TSA Checkpoint Travel Numbers

There was lots of panic and hand wringing when travel volumes fell way below 2024 levels in early spring. Many pointed to reduced international tourism, blaming the decline on foreign policy and bad feelings. I didn’t quite buy that and speculated that the year-over-year decline was caused by the timing of Easter, which was three weeks later in 2025 than 2024.

The Easter explanation is looking good. Travel picked up again this week and is now more than 3% above year-ago levels, according to TSA data. Whatever else is going on with the economy, people are still flying.

Oil Stuff (Baker Hughes Rig Count, EIA Oil Production, Gas & Diesel Prices)

No big changes here. The number of active U.S. oil rigs fell for the 17th straight week, down another 5 rigs. Gas rig counts increased again. This dynamic—more gas rigs, fewer oil rigs—will stick around for a while.

U.S. oil production inched up again but remains below the all-time high set in December. Given falling rig counts, however, not bad.

Gas prices inched higher but are still about $0.30/gallon lower than during the same week last year. Diesel prices were flat for the second straight week and are just slightly higher than year-ago levels.

Tuesday

ISM Services PMI

The services side of the economy grew in July but at a slower pace than expected, according to this survey of industry managers. Despite the modest growth, the details of this release aren’t great. Prices are increasing. Employment levels are shrinking. Respondents’ comments put a lot of blame on tariffs.

Wednesday

Mortgage Applications

Mortgage applications crept higher this week. While they’re up from the same week last year, they’re still extraordinarily low by historical standards.

Thursday

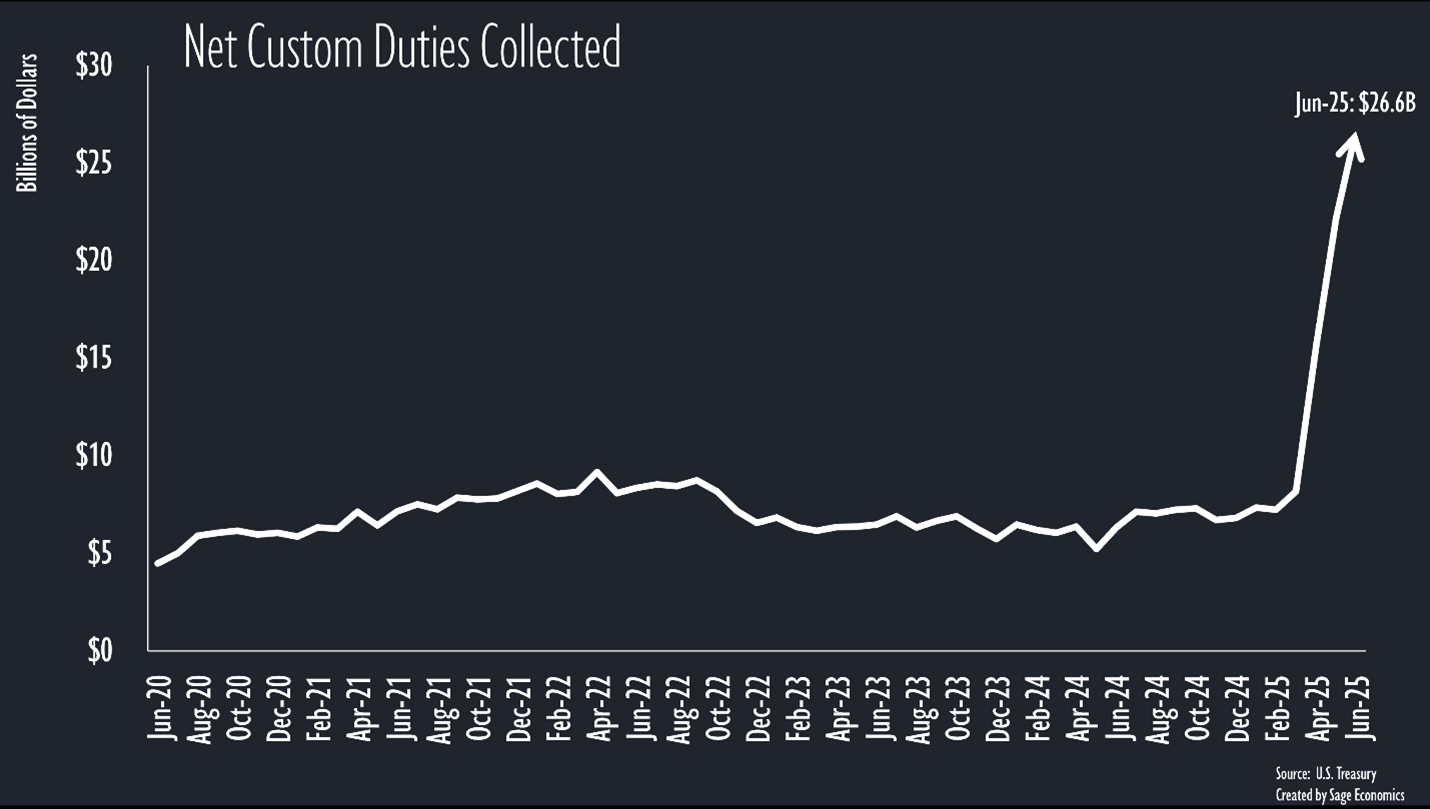

Higher Tariffs Kick In

Higher rates for a couple dozen countries kicked in today. We’re in the middle of one of the largest tax hikes of the past 100 years, and we’re really just getting started.

We’re working on a longer post on the state of the tariff situation, which we’ll hopefully have out in the next week or two.

Survey of Consumer Expectations

Consumer inflation expectations inched higher in July, with the year-ahead rate up to 3.1%. There was, however, some good news in this release. The expected year-ahead unemployment rate fell to the lowest level since January, and consumers feel better about the trajectory of their personal financial situations.

Waller Takes the Lead

Bloomberg reports that Christopher Waller, a current member of the Fed board of governors, is now the leading candidate to become the next chair of the Fed. He quickly became the odds on favorite in betting markets. This would be a really solid pick, in my opinion, and certainly my choice of the current candidates.

Jobless Claims

Initial jobless claims rose this week but remain pretty low. Which is to say, the Secretary of Labor doesn’t need to worry about her job.

This is the most encouraging data series at the moment, and I won’t be overly worried about the labor market unless initial claims start to rise.

Continuing claims for unemployment insurance also increased and continue to creep higher. Not great but, again, not too bad.

Mortgage Rates

Mortgage rates fell to the lowest level since early April, with the average 30-year fixed down to 6.63%. That’s still higher than one year ago and won’t support a much-needed rebound in homebuying.

Friday

University of Michigan Consumer Confidence Index

We’ll cover this in next week’s Review.

Links of the Week

Will data centers crash the economy? (Noahpinion)

Long-term Trends in Homes and Households (Erdman Housing Tracker)

Look at the most terrifying World Championship (Read Roge)

In praise of quitting (Useful Fictions)

Final Thoughts

After this week, my outlook for the economy is: A little better, but still way worse than a few weeks ago

Two weeks ago, it looked like the economy was in great shape. Then last week delivered some pretty grim data, strongly suggesting the noxious combination of rising inflation and worsening labor market conditions.

Big picture: tariffs are starting to weigh on the economy, and higher rates are just now going into effect. Stagflation appears to be a real possibility. That doesn’t necessarily mean recession, but it’s far from ideal.

Looking Ahead

Things pick back up next week with quite a few releases, the most important being July consumer price index data.