Pyrotechnic Week in Review

Tariffs, travel, and more

Tariff dealmaking is out, tariff letter sending is in. Those letters aside, it was a shockingly quiet week for economic news and data releases with the exceptions of blistering stock and crypto markets.

Monday

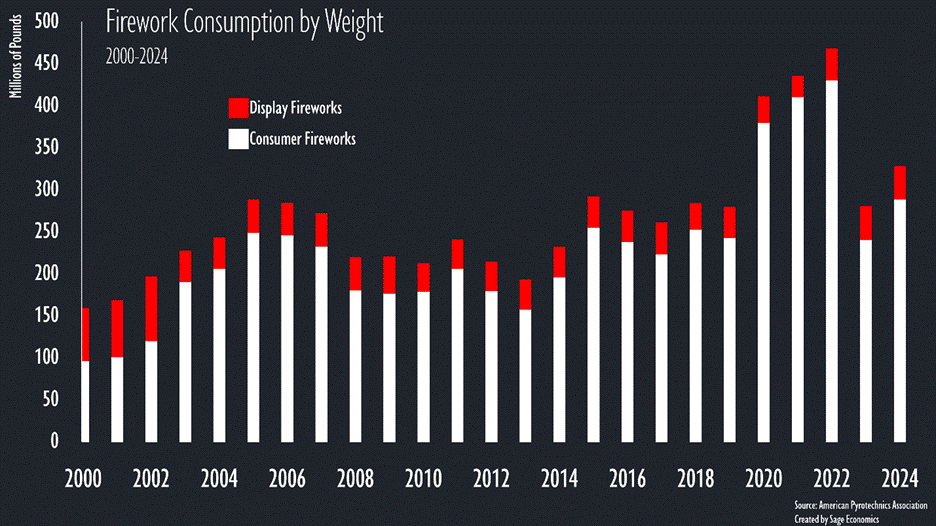

Firework Stats

U.S. firework consumption bounced back in 2024, according to the American Pyrotechnics Association. Will they continue the rebound in 2025 (check back a year from now)? I’m fairly confident we won’t return to 2022 levels anytime soon. This is true for two reasons. First, wildfires in California and others have engendered more restrictions on firework use. Second, tariffs on China, where we get much of our firework supply as a nation, is suppressing quantity demanded.

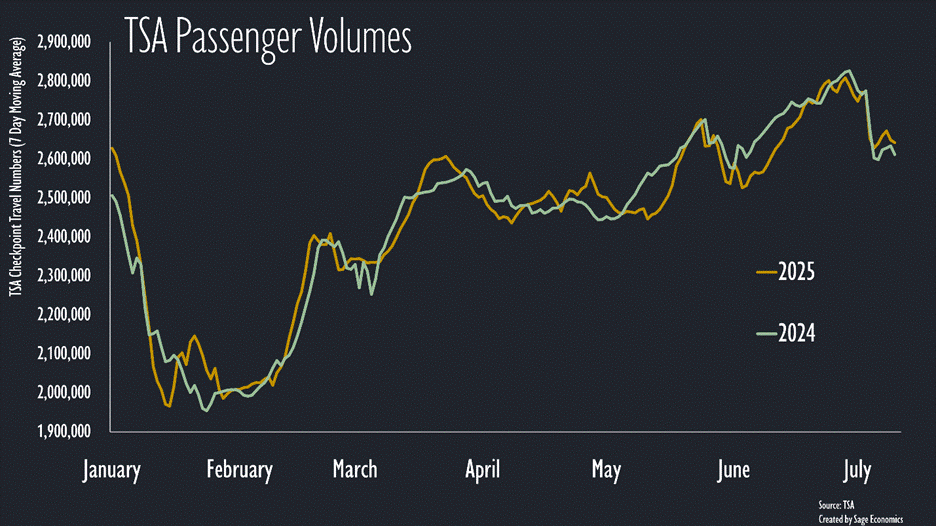

TSA Checkpoint Travel Numbers

Lots of people traveled by air during the July 4th holiday weekend, according to TSA data, and travel volumes have edged back ahead of 2024 levels. In another positive sign, Delta’s earnings beat expectations and they restored their full-year guidance. After a shaky couple months, it’s reassuring to see some positive signs from the travel industry, which is a largely discretionary spending category.

Baker Hughes Rig Count

The number of active U.S. oil rigs continues to slide, down another 7 rigs (-2%) during the week ending July 3rd. There are 54 fewer active oil rigs than one year ago, but 7 more active gas rigs.

Gas Prices & Diesel Prices

Gas prices fell during the first week of July and, at $3.25/gallon, are $0.35 cheaper than one year ago. Diesel prices inched higher for the week and are up a considerable $0.29/gallon over the past month. Is that merely in anticipation of Amazon’s Prime Days? Time will tell.