Rate Cut Week in Review

Retail sales, bond yields, & more

This week brought us the first Fed rate cut of 2025. Before you celebrate, maybe check the discussion on treasury yields (under Friday); it might be a while before we actually see lower borrowing costs.

As far as data releases go, this week brought us updates on retail spending, homebuilding and homebuilder confidence, import prices, fraudulent unemployment claims in Texas, and more.

Monday

Oil Stuff (Baker Hughes Rig Count, Gas & Diesel Prices)

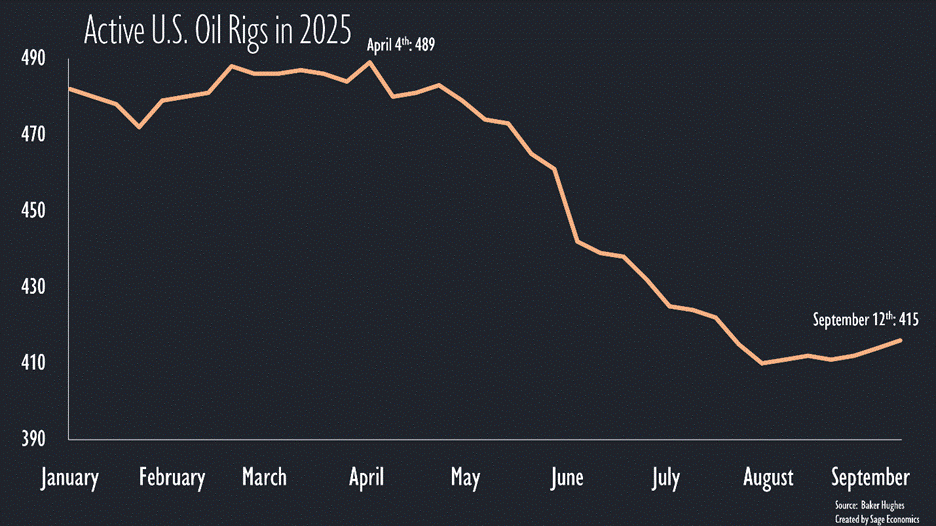

Still not much to see here. Both gas prices and diesel prices fell slightly this week, while the number of active U.S. oil rigs rose again and are rallying, albeit slowly, from the early August low.

TSA Checkpoint Travel Numbers

The number of people flying continues to trend about 1.5% above year-ago levels, according to TSA data. That’s a perfectly acceptable rate of growth—no issues here.

Tuesday

Retail Sales

Retail spending rose quickly in August, and the increase was pretty widespread across retail categories. Spending is now up 5.0% year over year, but that doesn’t account for inflation. Even in real terms, however, this is a decent-enough pace of growth.

NAHB/Wells Fargo Housing Market Index

This measure of homebuilder confidence was unchanged in September and remains really, really low. We’ll see if lower interest rates (if they actually translate into lower borrowing costs, more on that below) help over the next few months. For now, homebuilders remain glum.

Industrial Production

Industrial production (how much our manufacturing, mining, and utilities sectors produce) edged 0.1% higher in August and is up 0.9% over the past year. This is far from spectacular but, given that IP is one of the six indicators used to diagnose a recession, we’ll definitely take unspectacular growth.

Import Price Index

Import prices rose 0.3% in August, the largest jump since January, and are now unchanged on a year-over-year basis (had been down Y-o-Y the past few months). If we exclude fuel, however, import prices are up 0.9% over the past year. [Note that this index does not include customs duties, just pre-tax prices.]

This modest growth (slower than inflation) suggests that foreign companies are, at least thus far, swallowing only a small share of the tax increase.