Recession, Retail Sales, & Resi. Construction

Week in Review: July 17-21

Look, I know you don’t want a recession. Recessions are not good for your investments, your business, your neighbors, your communities, human happiness, etc. But because I’ve been predicting that a recession would begin this year since last year, I need one. So stop being so selfish and please, please, please work with me to help our economy collapse, at least a little. My professional reputation depends on it.

Statistically, this week was all about retail sales, new residential construction, and a few other housing market indicators, but we also got new data on the gender wage gap, industrial production, and more.

Monday

Gas Prices

Gas prices increased for the second straight week but are still about $0.01 lower than one month ago and $0.92 lower than one year ago. Diesel prices are also lower, especially in New England and the Midwest, and around the Rocky Mountains, which is great for diminishing transportation costs.

TSA Checkpoint Travel Numbers

The number of people passing through TSA security during the week ending July 19th was up about 0.1% compared to the same week in 2019. I can testify that Denver’s airport, which is not anywhere close to Denver, was slammed on Thursday morning.

Tuesday

Retail & Food Services Sales

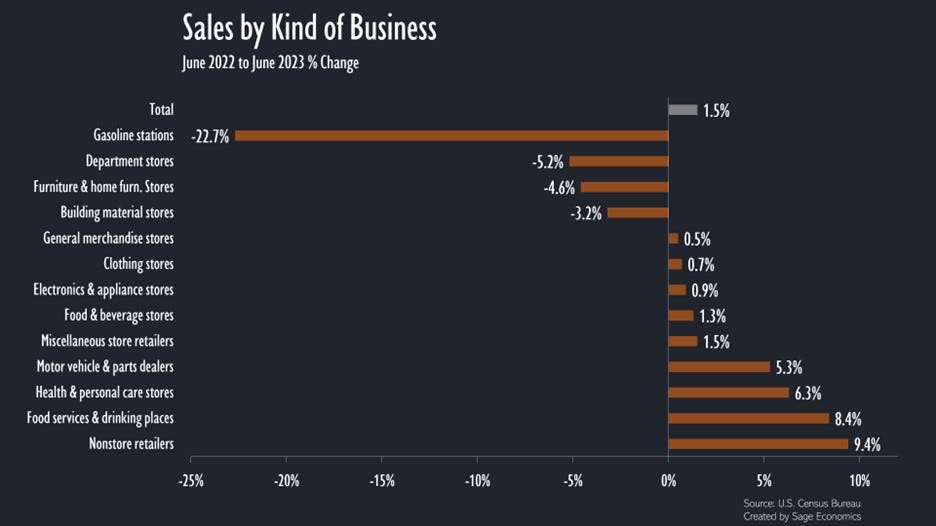

Spending at stores and restaurants increased slightly in June, up 0.2% for the month and 1.5% for the year. These numbers aren’t adjusted for inflation, so in real terms spending was flat in June and down over the past year.

Excluding sales at gas stations—those are down nearly 23% over the past year due to lower gas prices—retail spending has outpaced inflation over the past year, though just barely.

There’s a pretty big spread between categories. Spending is up big at restaurants (+8.4%), car dealerships and parts stores (+5.3%), and online stores (+9.4%) but down big at department stores (-5.2%) and furniture stores (-4.6%).

Big picture: retail sales increased a bit slower than expected, and that’s a good thing. The economy will ideally slow down gradually in the coming months without contracting, and that’s more or less what happened with retail sales in June.

Industrial Production

Industrial production declined by 0.5% in June and, after increasing in every month from December to April, has now fallen in two consecutive months. Since reaching a cyclical peak in September 2022, industrial production has fallen about 1.2%.

The decline over the past two months was driven by pretty chunky declines in spending on consumer goods. That checks out with our understanding of current economic dynamics; demand for goods is falling while demand for services is rising.

This is important because industrial production is one of the six indicators that the NBER uses to diagnose a recession. So far, this is the first of the six to turn over.

NAHB/ Wells Fargo Housing Market Index

Single-family homebuilder confidence increased through the first half of July and is now at its highest level since June 2022, though it remains below pre-pandemic levels. Confidence about the current market increased slightly while confidence about the next six months inched lower. The inventory of existing homes on the market is so small that homebuilders (and the new home market) are faring better than you’d expect with mortgage rates hovering near 7%.

Earnings & Wages of Salary Workers

Wages for full-time salary workers increased in the second quarter and are 5.7% higher than during the second quarter of 2022. That means wages are rising at a faster pace than inflation, at least over the past year.

Real wages (i.e., inflation adjusted) are up 0.8% since the start of the pandemic, but men’s wages are down 1.3% while women’s are up 0.9% As a result, the women’s-to-men’s earnings ratio increased to 84.5%, the highest on record.

A tight labor market has been great for women and other demographic groups that typically experience worse labor market outcomes, but at least some of the decline in the gender wage gap is due to the rush of retirements that occurred during the pandemic. As higher-paid men at the end of their career retire, that drags down the average wages across the gender.