Reopened Week in Review

Tariff checks, 50-year mortgages, & more

This week was great for anyone who’s dreamed of using a $2,000 tariff-rebate stimulus check to place a down payment on a 50-year fixed rate mortgage. Best week ever!!

In even better (and more realistic) news, the government reopened. While we’re still waiting to hear when public data releases will resume, this week brought us a few updates including on small business optimism, some housing data, and more.

Monday

$2,000 Tariff Rebates

President Trump suggested $2,000 tariff rebate checks to American households. Don’t get your hopes up, because this just isn’t going to happen.

Were it to happen, however, it would be really expensive. If the cutoff is people earnings less than $100,000, as Treasury Secretary Bessent has suggested, we’re looking at $300 billion in stimulus (estimate from Erica York). That’s more than projected annual tariff revenues (even if the IEEPA tariffs aren’t overturned by the Supreme Court, and that overturn seems likely at this point).

This stimulus would add to the national debt and would also trigger inflation by adding to the volume of spendable funds.

50-Year Mortgages

President Trump also suggested he was going to make 50-year mortgages a thing. If this were to happen, and I again don’t think it will, it would make housing even less affordable. Why? Because it’s just another demand-side solution to a supply-side problem.

Homes are effectively sold via auction (you can bid on just about any property you’d like to add to your portfolio). If you give everyone attending an auction the ability to pay over a longer period, reducing the monthly payment, more people at the auction will be able to afford a higher price. That will increase the number of bids and drive the price higher.

Moreover, the extension to 50 years would add to default risk. During the early years, homeowners with such a mortgage would generate very little equity. During a housing market downturn, many owners would quickly find themselves upside down on their mortgage. In those instances, some may simply choose the throw the keys at a banker.

Notably, many at the White House are not happy about this proposal.

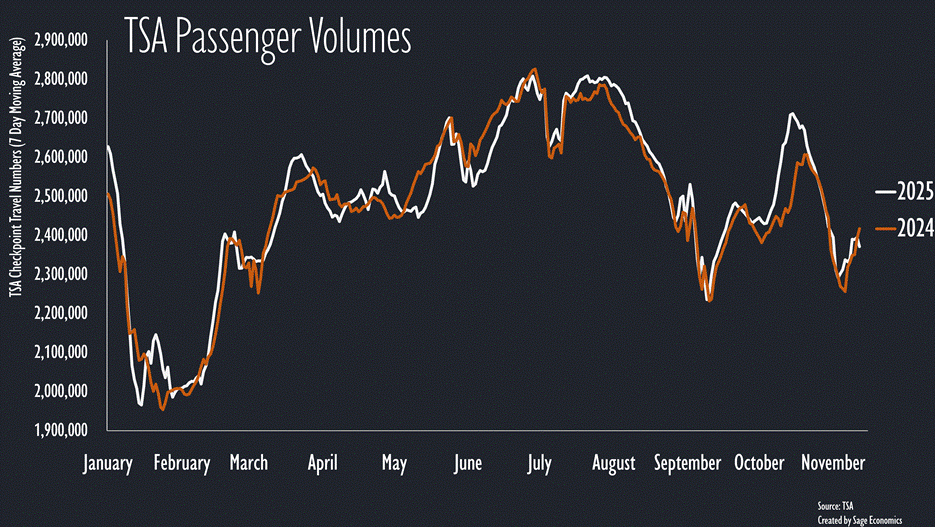

TSA Checkpoint Travel Numbers

Travel volumes slipped below year-ago levels over the past week, according to TSA data. We’ll see how much of that was due to the now-ended government shutdown once airlines begin flying their full complement of flights.

Gas and Diesel Prices

Gas prices increased to an average of $3.19/gallon this week. That’s the highest level over the past month but still low by recent standards.

Diesel prices rose sharply, however, and are at their highest levels since mid-2024. The rising price is due to lower-than-expected inventory levels for this time of year.

Tuesday

NFIB Small Business Optimism Index

This measure of small business confidence inched lower in October, falling to the lowest level since April. Owners’ biggest concern for the month was labor quality, with 32% reporting job openings they couldn’t fill. This might have something to do with altered immigration policy.

ADP Pulse Jobs Data

Private employers lost about 45,000 jobs over the four-week period ending October 25, according to this new ADP data series. It’s nice that they provided more real time estimates during this public-data-free period, but we have no idea how indicative this is of larger labor market trends. Even so, this is another check in the “weakening labor market” column.