Shuttered Week in Review

A shutdown, tariffs, jobs, & more

You might have thought that with the federal government shutdown, there wouldn’t be much data to discuss. Ha! As it turns out, there were plenty of data releases despite the absence of construction spending, unemployment claims, and the all-important BLS jobs report. Here’s hoping for a quick reopening, more data to analyze, and the renaissance of the Ravens’ defense.

Monday

Pending Home Sales

Pending home sales, which typically tell us what actual home sales will look like a few months down the road, increased in August. While these are slightly higher than one year ago, they remain soft by historic standards.

Dallas Fed Manufacturing Survey

This survey-based measure of manufacturing activity in the Dallas Fed region fell sharply in September. The really interesting part of this is the comments, where we get some mixed signals on the effects of tariffs.

Here’s one such comment from an electronics parts manufacturer: “I may have to close the company. Orders have stopped coming in, and we do not know why.” Well, I don’t know either, but I have a theory it might have to do with . . . tariffs.

Here’s a comment I made in my own notebook: “The Ravens’ defense sucks, and I don’t know why.” Probably not tariffs, though.

Oil Stuff (Baker Hughes Rig Count, Gas & Diesel Prices)

Gas prices fell sharply this week and, at $3.25/gallon, are at their lowest level in over a month. The switch to winter blend gas formulas, which typically brings gas prices down, is mostly complete at this point. Diesel prices were essentially unchanged for the week. This is EIA data and, for the time being, it will keep being published while the government is closed.

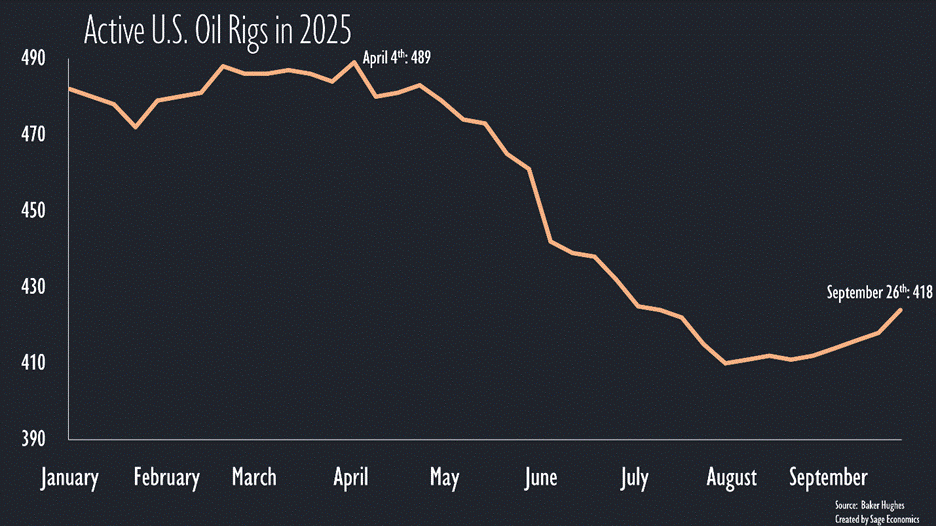

Meanwhile, the number of active U.S. oil rigs jumped sharply this week. While we’re still well-below pre-Liberation Day levels, the trend is encouraging for fans of fossil fuels.

TSA Checkpoint Travel Numbers

People keep flying at a slightly above-2024 level, according to TSA data, and that’s a good sign for the economy. Note that these data go through September 30, and we won’t get any updates until the federal government reopens.

Tuesday

New Lumber Tariffs

The White House announced additional tariffs of 10% on softwood lumber imports and 25% on upholstered wooden products and kitchen cabinets and vanities. This will further increase the cost of supplying a new housing unit in a nation already burdened with affordability challenges, including for young families.