Tariffs, Inflation, & More

Week in Review: Nov. 25-27

Week in Review

This week, we should all give thanks for an economy that simply refuses to slow down. If anything, it’s overheating and getting hotter by the day.

Monday

TSA Checkpoint Travel Numbers

Travel volumes rebounded over the past few days, according to TSA data, edging back ahead of 2023 levels. This confirms that the dip last week was entirely due to the timing of Thanksgiving. Imagine how much more we would travel if we had better airlines, airports, and less traffic congestion. Nonetheless, America is on the move.

Gas Prices & Diesel Prices

Gas prices were unchanged at $3.17/gallon this week (technically they fell by $0.002/gallon). That’s the lowest price during the last week of November since 2020, and that’s before accounting for inflation. Give thanks, and maybe go for a joy ride—with gas this cheap, it would be a shame not to. Just stay off the Baltimore Beltway if you know what’s good for you. I’ve reserved that.

Diesel prices increased to $3.54/gallon. On one hand, that’s the highest price since the end of October. On the other, it’s $0.61/gallon cheaper than at the same time last year. Both B.J. (played by Greg Evigan) and the Bear (played by a chimpanzee of course) would approve.

Tuesday

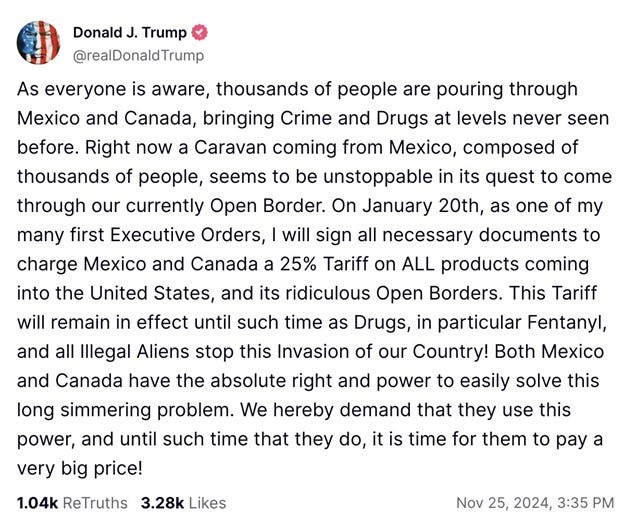

New Trump Tariff Threat

President elect Trump dropped a new tariff proposal—25% on all Mexican and Canadian imports, to be implemented on January 20th.

A few thoughts on this:

1. This would violate the USMCA, a trade agreement negotiated and signed by none other than President Trump in 2018.

2. Trump made a similar threat against Mexico during his first term. Those tariffs were never enacted.

3. I’m reasonably confident these tariffs won’t be implemented (negotiating posture).

4. Not so confident that, were I running an import-reliant business, I wouldn’t prepare for them.

5. Research indicates that just the threat of tariffs—whether or not they ever come into effect—reduces business investment and hiring due to uncertainty.

6. Among other effects, this would cause significantly higher gas prices in the Great Lakes states, and that’s a big reason why I think it won’t happen (think Blue Wall).

7. Related: Trump has said he wants to revive the Keystone Pipeline project (yes, please!), but the Keystone Pipeline would transport oil from Alberta to Nebraska.

8. Fentanyl is a huge problem, though one that’s rapidly improving. That said, I don’t think drug smugglers are particularly sensitive to import taxes. I don’t remember tariffs ever being mentioned on Miami Vice.

9. Again, I’m pretty sure these won’t happen, but it’s worth paying attention to.

Blue State Governors Back Bad Permitting Policy

Democrats, to my pleasant surprise, vocally supported policies during this presidential election that would make it easier to build. One of those vocal supporters was Maryland Governor Wes Moore, who spoke on a “YIMBYs (Yes In My Back Yard) for Harris” call during the campaign.

But on Tuesday, Governor Moore said he has “grave concerns” about “the lack of community involvement in the planning process” for a proposed 70 mile transmission project that runs through Maryland. To be clear, part of the reason blue states are hemorrhaging population—and set to lose several electoral votes as a result—is because it takes years of studies and community engagement to even get a project approved.

I’ll give Governor Moore a break here—I think this project goes forward, and this may be his way of trying to soothe communities, some of whom may legitimately be harmed by this still very necessary project and are infuriated by the prospect of eminent domain.

I can’t be as charitable with Massachusetts’ governor Maura Healey, who signed a clean energy transition bill that, according to her, cuts “through the red tape holding back clean energy infrastructure.” That sounds great, but the bill actually just creates way more red tape. It’s like red tape industrial policy.

The bill (good summary here) includes new requirements for developers “to do community outreach and hold public meetings before they begin collecting permits,” has even stricter environmental impact study requirements, and—most impactfully of all—creates an “Intervenor Trust Fund” to literally provide money to environmental groups who want to sue the developers trying to build clean energy projects.

There’s a reason Texas is lapping the rest of the nation in clean energy development, and it’s not because state politicians are particularly amenable to clean energy. See for instance the television drama Dallas, which ran for 14 seasons starting in 1978 and featured oil man Larry Hagman playing the role of J.R. Ewing. Very little mention of renewables on that show.

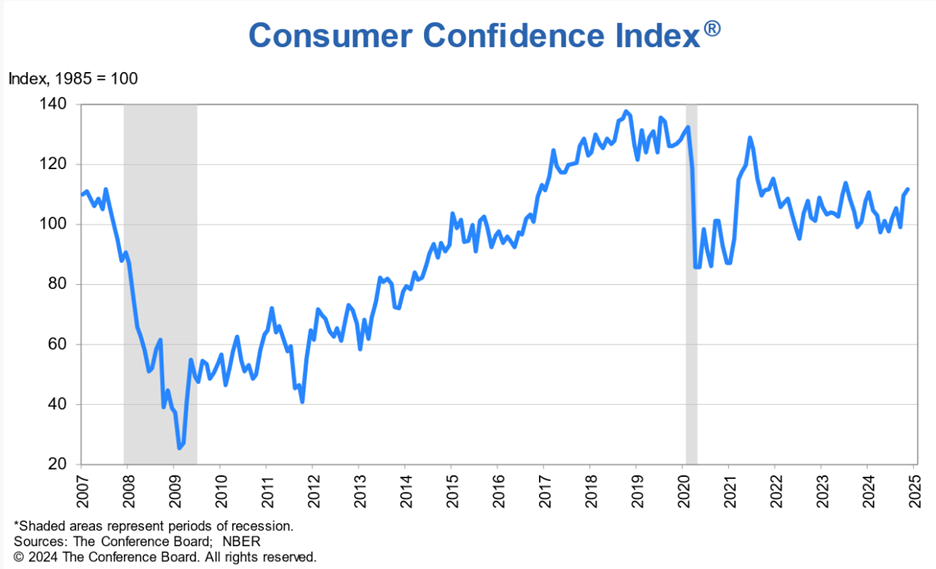

The Conference Board Consumer Confidence Index

The measure of consumer sentiment improved in November. As we mentioned last week, that probably has a lot to do with the elections being over. Of note, people are feeling VERY good about the stock market; 56% of respondents think stock prices will increase over the next year, the highest share since Conference Board started conducting this survey in 1987. That might be a good reason to start raising cash.

New Home Sales

Sales of new homes fell sharply in October, plunging to their lowest level since November 2022. Chalk this one up to the hurricanes—sales plummeted 28% percent in the south as North Carolina and Florida recovered from Helene and Milton. Not to suggest this would have been a glowing release without the storms—it’s just not a great time to buy a house.

S&P/ Case Shiller Home Price Indices

Home prices fell slightly in September but are still up 3.9% since September 2023, according to this measure. Even with prices moderating, homes are still really expensive right now, especially considering borrowing costs. Home sellers should be thankful, in part because there are so few of them. Homebuyers, less so.

This indicator has measures for 20 metro areas, for those interested.

Wednesday

PCE Price Index (Inflation)

The Federal Reserve’s preferred measure of inflation increased 0.2% in October and is up just 2.3% over the past year. That’s not too far above the 2% target rate. That’s great.

Less great: core prices, which exclude food and energy because of volatility, are now up 2.8% over the past year. Again, this economy is overheated, and more inflationary pressures appear to be coming our way.

We knew inflation picked back up in October from other readings like the Consumer Price Index. Even so, this is a disappointing release and suggests the Fed may cut rates at a slower pace than previously expected.

Income, Spending, & Saving

Personal income increased sharply in October, rising by the largest amount since March. Spending also increased for the month, though at a slightly slower rate than income. When incomes rise faster than spending, savings increase, and that’s exactly what happened—the savings rate increased to (a still pretty low) 4.4% for the month.

Pending Home Sales

Pending home sales, which foreshadow what actual home sales will look like in a month or two, increased in October and are now at their highest level since March. That’s particularly encouraging given that I assume the hurricanes affected selling activity in North Carolina and Florida.

Durable Goods Orders

New orders for durable goods (anything that typically lasts at least three years) inched higher in October. That ends a streak of two consecutive monthly declines but is also a smaller increase than expected. It’s been a tough few years for the goods-producing side of the U.S. economy which has been in its own recession for the better part of the past two years based on a variety of indicators.

Mortgage Applications

Mortgage applications increased last week, with purchase applications up 12% but refinance applications down 3%. That checks out—who’s refinancing with average 30-year fixed rates around 7%? Probably only those with variable rate mortgages who had to refinance.

Jobless Claims

Initial jobless claims inched lower and remain very low. Continued claims for unemployment insurance ticked higher again but remain at a reasonable level as a share of total employment.

No warning signs from this indicator but, as we’ve been saying, once there are warning signs, it’ll be too late to do anything about it.

Mortgage Rates

Mortgage rates fell slightly this week, with the average 30-year fixed dipping to 6.81%. That’s still too high to support any meaningful homebuying activity.

Links of the Week

America’s Productivity Boom (Apricitas Economics)

America doesn’t really have a working class (Noahpinion)

Regulating Sausages (Marginal Revolution)

Final Thoughts

After this week, my outlook for the economy is: Both improving and deteriorating

Yeah, yeah, yeah, I know that is the typical economist shenanigan. On the one hand this, on the other hand that. But before you judge me, let me explain. The economy seems ripe for further economic growth. I’m buying into the notion of a soft landing, except it may not be so soft given consumer appetites to continue spending and corporate balance sheet strength.

With $7 trillion of cash and cash equivalents sitting on the sidelines, there is a lot of investing in risk assets yet to transpire and an abundance of pent-up demand for dealmaking, whether in the form of M&A activity or initial public offerings. There is also pent-up demand to both buy and sell homes. Once we get sufficiently low mortgage rates, realtors will be spending a ton of time at settlement tables.

So what’s deteriorating? The inflation and interest rate outlooks. We’ll see what President-elect Trump has in store for us, but if tariffs, tax cuts, and immigration reform are on the way as proposed, already accelerating inflationary pressures will be further catalyzed. That will translate into higher interest rates for longer, serving to stifle the release of some of that pent-up demand. From my perspective, all the new President needs to do is hold tight, let interest rates fall, and watch as the economy enters another rapid growth cycle. But he may be tempted to do many of the things he suggests, which might delay the arrival of America’s next economic surge.

Looking Ahead

Next week is packed with data releases including construction spending and the all-important November jobs report.

How great would it be to elect a President who has the capacity and common sense to analyze a problem and come up with the best solution, regardless of what side of the political aisle you fall on? Anirban, any interest in 2028? Pick Zach as your running mate and you've got my vote!