The Bad Data Will Continue Until Morale Improves

Week in Review: Feb. 24-28

Don’t look now, but this economy is beginning to falter a bit. Economic data came in weaker than anticipated for a third consecutive week and financial markets are choppy. Even as expectations for higher inflation become more pervasive, the yield on the 10-year Treasury fell, indicating that more investors are heading for safe havens. Macroeconomically, we now have (arguably) constraining monetary and fiscal policymaking (thanks, Elon), which sets the stage for meaningful economic slowing during the quarters ahead.

Or it could just be the bad weather in January.

Monday

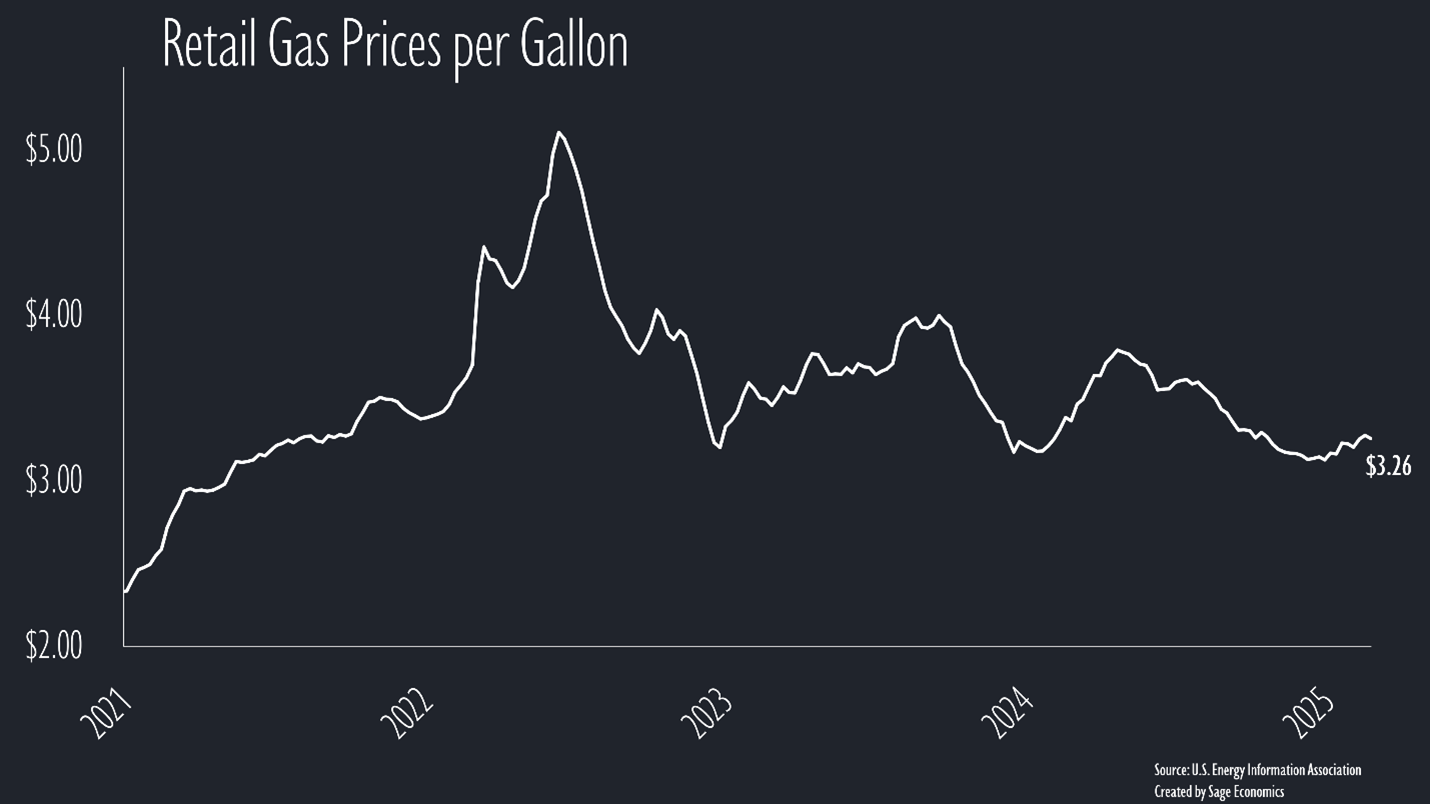

Gas Prices & Diesel Prices

Gas prices inched down to $3.26/gallon this week but will start moving higher as soon as gas stations switch over to summer-blend gasoline. Diesel prices rose to $3.70/gallon. That’s the highest price since August but still way lower than one year ago.

TSA Checkpoint Travel Numbers

Air travel slowed dramatically over the past few days, according to TSA data, and is 3.0% below 2024 levels over the past week. It’s possible government layoffs have reduced travel volumes. I know conferences are being cancelled. For instance, I was supposed to speak on behalf of the Department of Energy in mid-April, but that conference has been cancelled as the Department “considers its fiscal priorities”. It’s also possible a few recent high profile plane crashes/incidents have spooked would-be flyers.

Tuesday

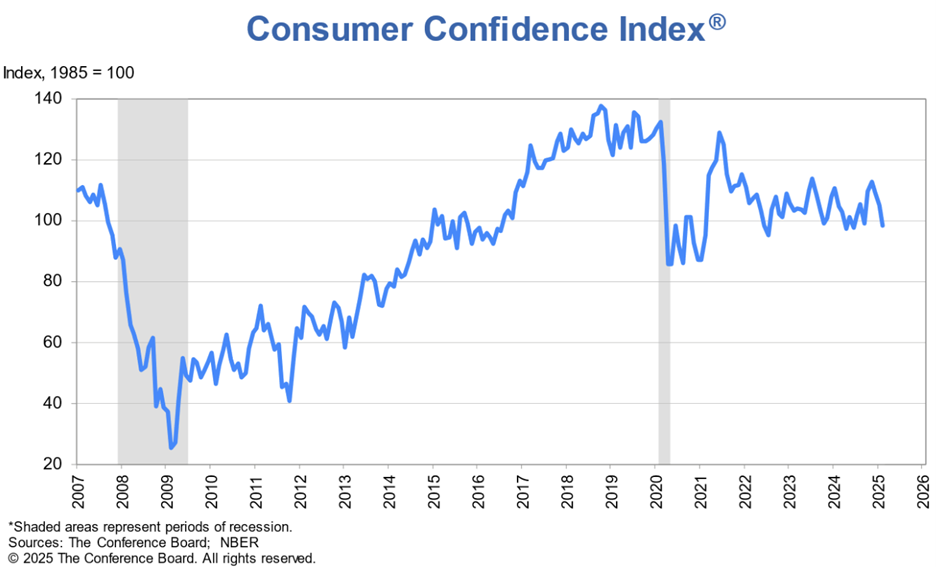

Conference Board Consumer Confidence Index

Consumer confidence plunged in February, posting the largest monthly decline in more than three years. Economic sentiment was great following the election but has since fallen off due to drastically increased uncertainty and stubborn inflation. Eggs and tariffs remain the talk of the town.

That said, we generally don’t put too much weight on sentiment readings—soft data like this matter way less than hard data—but the abrupt change in vibes is undeniable.

S&P CoreLogic Case-Shiller Home Price Indices

National home prices fell slightly in December but finished 2024 up 3.9%. That’s a smaller increase than in previous years, but housing affordability for would-be buyers is still atrocious with mortgage rates up near 7%.

Wednesday

Dockworkers Ratify New Contract

Remember the dock workers strike from a few months ago? The International Longshoreman’s Association finally ratified a new contract that includes a 62% pay increase over six years—raising base wages from $39/hour to $63/hour—and guarantees against automation. Notably, both the ILA and the shippers have credited President Trump for helping to get the deal done. Does this signal a change in unions’ party affiliation?

New Home Sales

New home sales (i.e., newly built) fell sharply in January. I think it’s fair to blame weather, which was pretty bad. The fact that sales increased in the West but fell in the other regions supports this notion. Sales are virtually flat over the past year, and even with inventory levels rising I doubt we’ll see a meaningful increase until mortgage rates come down.

Mortgage Applications

Mortgage applications fell slightly last week.

Thursday

Pending Home Sales

Pending home sales, which show us what actual home sales might look like in a month or two, fell sharply in January and are now at their lowest level ever recorded. Blame bad weather, high mortgage rates, and extraordinarily elevated economic uncertainty.

Durable Goods Orders

Orders of durable goods (things that last 3+ years) increased at a healthy pace in January, but that was entirely due to the large and volatile transportation equipment category. Think Boeing. Excluding transportation, both shipments and orders of durable goods were unchanged for the month.

As long as durable goods orders are creeping higher on a year-over-year basis (and they are), there’s not much to worry about here.

Mortgage Rates

Mortgage rates fell for a fifth straight week, but with the average 30-year fixed at 6.76%, are still very high by Millennial and Gen Z standards.

Jobless Claims

Initial jobless claims increased to 242,000 this week, 32,000 higher than during the same week last year. This doesn’t include federal workers (that’s a separate data series that lags by one week), and this weekly increase could just be statistical noise. We should, however, see claims surge over the next couple weeks as federal spending cuts take their toll on nonprofits and others dependent on federal outlays.

Continued claims for unemployment insurance edged down and have been flat over the past few months.

U.S. Crude Oil Production

U.S. oil production was flat and remains just below the all-time high set in early December. I still expect this year to see a new all-time production record as the Trump Administration, including Treasury Secretary Scott Bessent, strive to expand oil production in America.

Friday

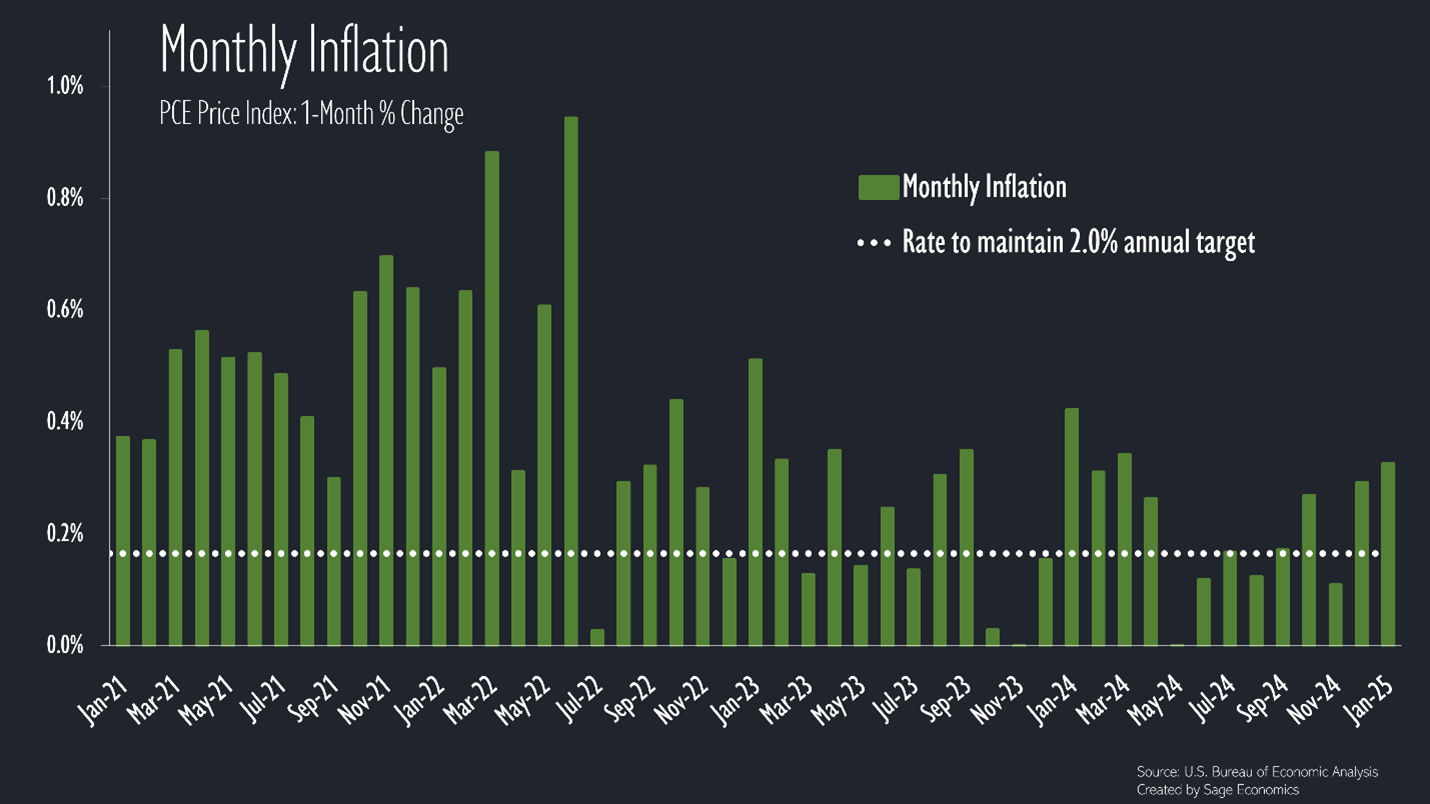

PCE Price Index

The Fed’s favorite measure of inflation increased pretty forcefully in January, rising at the fastest pace since March. The green bars need to stay below the white dotted line (on average) for inflation to return to a 2.0% annual rate. As you can see below, inflation has accelerated since October, and that’s before many of the tariffs under consideration go into effect (if they in fact do).

This is what was expected and doesn’t change our understanding of the inflation situation. Prices are rising at a slower pace than they were in 2023 and early 2024, but we appear to be stuck at a roughly 2.5% or 2.6% annual rate. Not great, not terrible, and not going to get us lower interest rates any time soon. Higher interest rates for longer – you’ve heard that before.

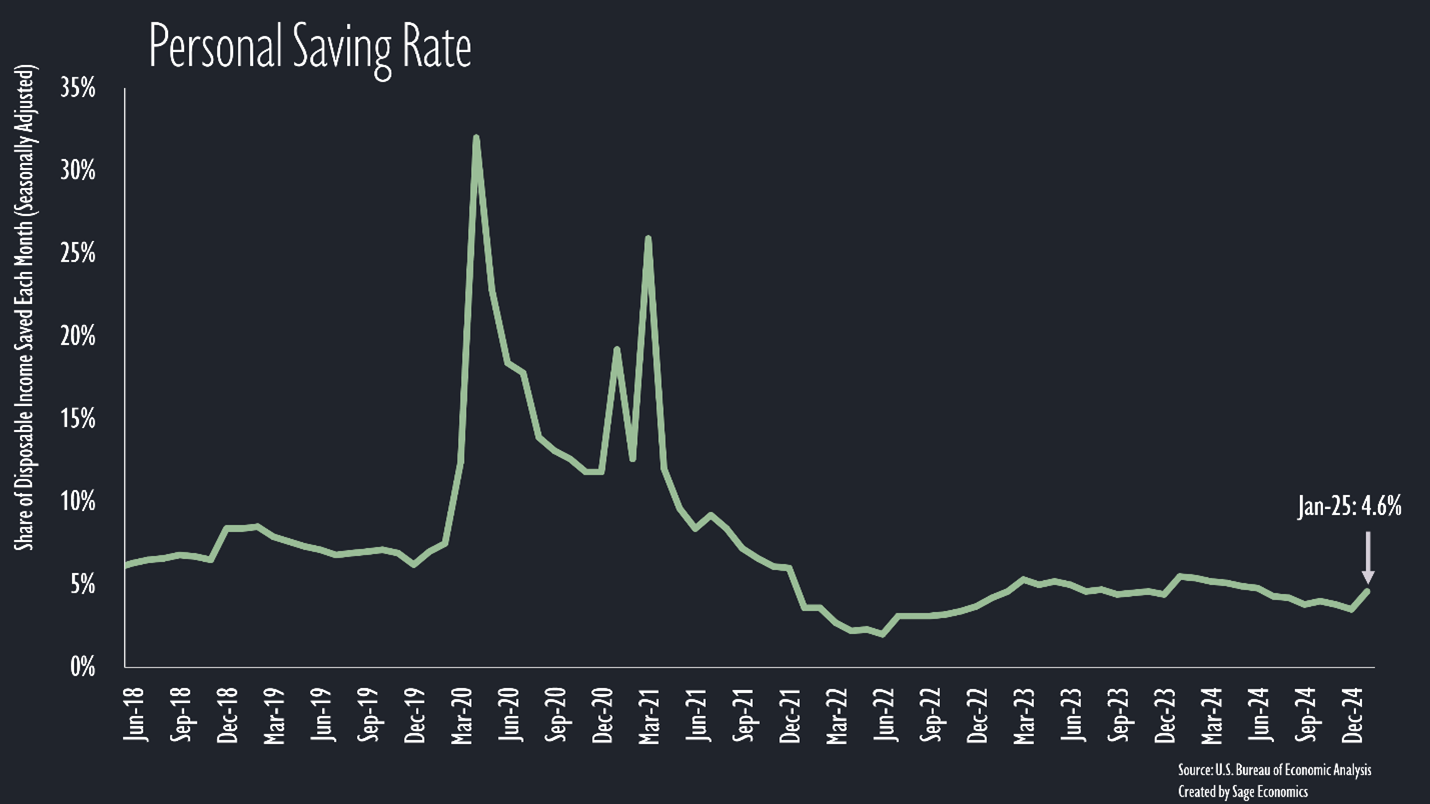

Income, Spending, & Saving

Income increased a hefty 0.9% in January, but wages and salaries increased just 0.4% (still a very healthy jump), with a lot of the increase due to investment income and social security payments.

Despite the increase in income, personal spending plunged in January, posting the largest monthly decline in almost four years. Notably, most of the decline was attributable to a massive 3.0% drop in spending on durable goods, which suggests weather might have had something to do with this. Of course, higher interest rates would also tend to frustrate consumer spending on durable goods like appliances.

The savings rate jumped to 4.6% in January (that’s what happens when income rises and spending falls), the highest level since the first half of 2024.

This could be a sign that consumers are pulling back, but I won’t believe it until we see another month or two of similar data. For now, I’m willing to blame bad weather for January’s weak spending data—nobody wants to go shopping in the snow and ice, especially if they’re from Texas.

Links of the Week

Certainty as a foundation for justice (Niskanen Center)

How to Fix High-Skilled Immigration to Maximize American Interests (Economic Innovation Group) and Native-Born Americans Are Not Losing Jobs to Foreigners (Cato Institute)

Man jailed since he was 17 charged with 5 more murders — 'like he was killing someone every month' (Chicago Sun Times)

Final Thoughts

After this week, my outlook for the economy is: Worse

At the heart of vibrant commerce is certainty. We don’t have that right now. Tariffs, deportations, tax code changes, etc. have many of us wondering where things are headed. That uncertainty combined with high and frozen interest rates is inducing a lot of wait-and-see behavior, and that’s not good for economic growth. The exception are those hyperscalers, who continue to finance the construction of data centers. I suspect that the economy’s energy production segment will be another major contributor to economic growth and construction starts this year.

Looking Ahead

Next week is packed with data including February jobs, construction spending, and more.