The Economy as Keanu Reaves

Week in Review: Feb. 27-Mar. 3

The economy is like Keanu Reeves. It’s dodging bullets (Matrix-style) in the form of interest rate increases. It’s firing back John Wick-style in the form of reports of outsized job growth, retail spending, low unemployment, and a paucity of initial claims for unemployment. So read about the week that was. We received interesting information regarding construction spending, the manufacturing sector, and more.

Monday

Durable Goods Orders

New orders for durable goods plunged in January, down 4.5%. This isn’t as big of a swing as it seems because durable goods orders surged 5.1% in December, so orders are still above November’s levels.

Pending Home Sales

Pending home sales, which are supposed to be indications that completed home sales will increase in the near future, surged in January, up 8.1% from December. They are now at their highest level since August 2022. Morpheus would be proud. I did not see this coming, though mortgage rates had been dipping for a time and some people jumped on those lower rates. Since then, rates have crept higher, which means that the rebound in pending home sales is likely to prove short-lived. Mortgage applications have been diving recently.

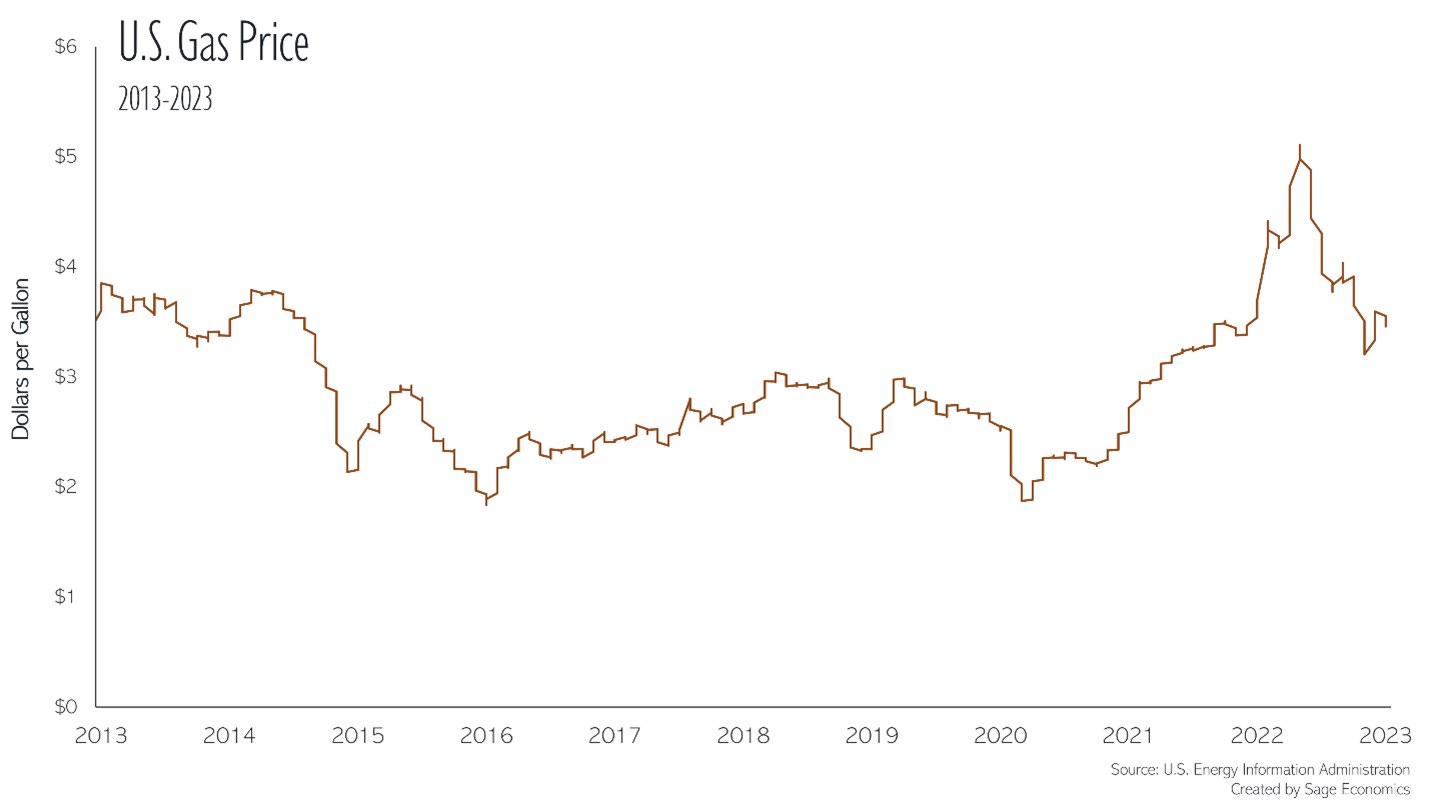

Gas Prices

Gas prices fell to $3.457/gallon. This is the third straight weekly decline. Gas prices are now down $1.65 (32.3%) from the peak in early June, which not coincidentally is when headline inflation peaked…

TSA Checkpoint Travel Numbers

Travel numbers for the week ending 2/28/2023 edged back above 2019 levels and remain well above 2020-22 levels.

Tuesday

Conference Board Consumer Confidence Index

Consumer confidence fell for the second straight month in February. People feel a little better about current conditions, but worse about the short-term outlook. The expectations index fell below 80, “the level which often signals recession within the next year.” I’m down with that forecast.

Home Price Readings

The FHFA Housing Price Index showed home prices fell 0.1% in December, but are up 6.6% year over year. The S&P Corelogic Case-Shiller Index showed prices down 0.8% for the month and up 5.8% year over year. Big picture, home prices are now gradually edging lower and there is more of that to come. Prices in many metros got out of hand and are simply not tenable in the current interest rate environment.