The ILA Strike, Job Openings, & More

Week in Review: Sep. 30 to Oct. 4

This week had it all. The start of a dockworker strike, another Orioles’ disappointment (what is it with Kansas City?), a resolution to the dockworker strike, a jobs report (see Zack’s longer post on that here), new construction spending data, and more.

I have to say, that jobs report was epic. This economy has retained a shocking level of forward momentum, and I am amazed. What that means, however, is that interest rates are not poised to decline as quickly as has been anticipated later this year and next. Bond yields surged today in response.

Monday

TSA Checkpoint Travel Numbers

Travel volumes have slowed, according to TSA data, and are virtually back down to 2023 levels. After a historically strong summer for air travel, consumers have clearly pulled back. My guess is that it has a lot to do with buy now, pay later. Many Americans financed their summer vacations with credit cards. Can’t do that forever.

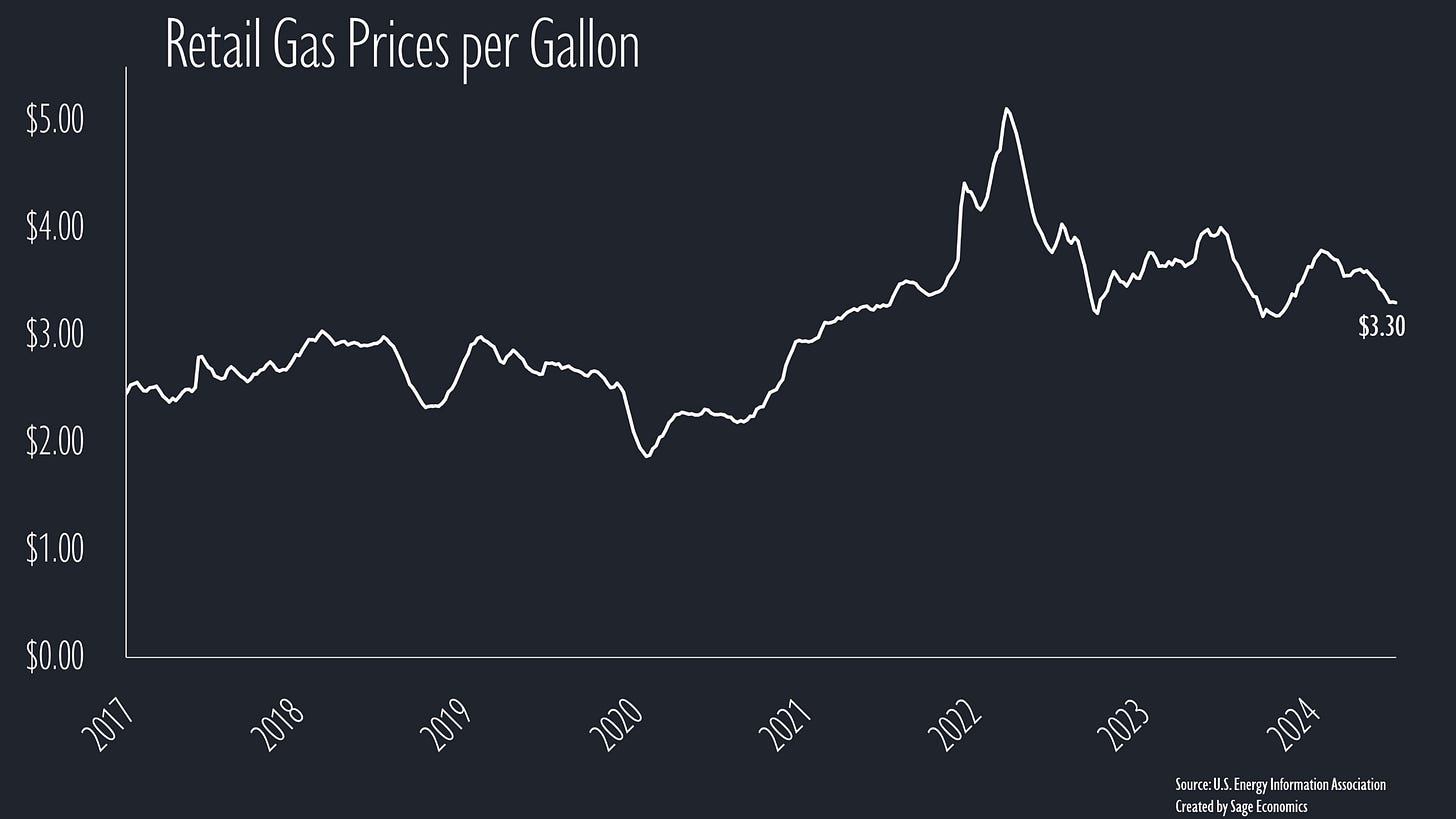

Gas Prices & Diesel Prices

Gas prices inched down to $3.30/gallon and have been remarkably flat in recent weeks. Diesel prices stayed at $3.54/gallon, still just above a three-year low. Of course, with madness and mayhem spreading in the Middle East/Eastern Mediterranean, next week stands to be different.

Tuesday

ISM Manufacturing PMI

This measure indicates that the U.S. manufacturing sector contracted again in September and at the same pace as in August. The good news is that manufacturing prices fell for the first time in 2024. Not much we didn’t know here. Manufacturing activity is slowing, and so is inflation (in general).

Job Opening and Labor Turnover Survey (JOLTS)

The number of open jobs increased to 8.04 million in August. That’s the most since May but about 1.3 million fewer than in August 2023. Put another way, 5.6% of all jobs were unfilled at this time last year, and now just 4.8% of jobs are unfilled. That’s pretty close to the pre-pandemic rate. This is another thing that amazes me. Everyone complains about their workers, and yet they respond by hiring even more.

That said, hiring, firing, and quitting are all occurring at a slower rate than in the years leading up to the pandemic. The Great Stay continues, with labor market churn as low as it’s been in a long time. In part because the hiring rate has been falling, Friday’s blockbuster jobs report (see below) was even more surprising.

Construction Spending

Residential construction spending fell 0.3% in August and is just barely higher than one year ago. Spending on new multifamily construction is down pretty sharply (-7.5%) since August 2023.

Nonresidential spending inched higher for the month, but that was mostly due to infrastructure projects. Private nonresidential spending fell 0.1% in August and is up just 3.6% over the past year (reasonably close to inflation so effectively flat in real terms).

Manufacturing construction continues to rip right along, with more than $1 in every $9 spent on construction going toward manufacturing facilities in August.