Time to panic about credit card debt?

Scary headlines and new data on household debt

The Fed released updated household debt data yesterday. It spawned a bunch of headlines like:

Credit card debt hits a ‘staggering’ $1.13 trillion. Here’s why so many Americans are under pressure

Credit card debt smashed another record high at the end of 2023

Millennials are struggling under mounting credit card debt, NY Fed finds

These headlines are both alarming and (at least technically) accurate. Credit card debt rose to an all time high of $1.13 trillion in the fourth quarter, and the share of credit card debt that’s now 90+ days overdue ticked up to 9.7%, the highest level since the second quarter of 2020.

Nearly 9% of credit card debt held by borrowers ages 30-39 transitioned into serious delinquency during the quarter. That’s the highest rate since 2010 and is a level typically only seen during recessions. (I’m not sure why millennials got singled out here. Younger borrowers always have the highest transition rates for credit card debt, and the trend is the same for all age groups.)

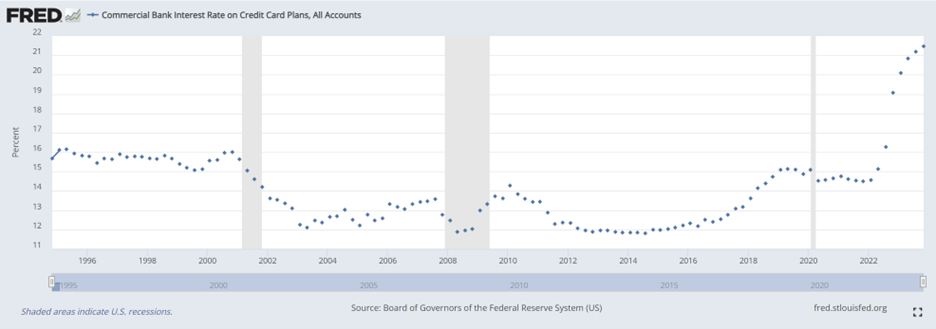

It’s fair to be concerned about this. The interest rate paid on credit cards hit 21.5% in November, the highest level on record (since 1995). That’s obscenely expensive borrowing.

But that’s just credit cards, and Americans are more up to date on their overall debt payments than at any point from the start of the data series in 2003 to the middle of 2022. Here’s the rate at which all debt flowed into serious delinquency by age. It’s not the slightest bit concerning, especially compared to the graph of credit card transition rates.

Part of the equation here is student loan debt. Due to the pause over the past few years, less than 1% of student loan debt is currently delinquent. That’s the lowest share ever and down from 10% in the middle of 2019. Millennials hold about 2.5x more student loan debt than credit card debt, and the lack of delinquent student loans has likely empowered them to run up a credit card balance.

Americans are also historically on time with their mortgage payments, with roughly 0.5% of total mortgage debt balance 90+ days late.

Big Picture

Credit card debt will cause problems if it keeps on its current trajectory for a couple more quarters, especially given the punishing level of credit card interest rates. For the time being, however, households have a good handle on their overall debt balances.

As a final note, we’ll get another data release on delinquency rates—looking at it from banks’ perspective instead of households’—later this month. Expect that to show more of the same: credit card delinquency rates at levels higher than anything since the Great Recession but lower than anything before 2011 and record low mortgage delinquency rates.

What’s Next

January was a busy month for Sage, and that means we have a glut of posts planned for February and March (like our first Q&A of 2024, which we finally got out yesterday). Upcoming posts include:

The third part of our series on 30-year construction spending trends (Part I and Part II here). This one is looking at state level trends. I’ve been working on it for a few months. The thing about states is, there’s a lot of them.

A few more predictions for 2024. We got our economic indicators forecast out but are working on additional predictions on a broader range of topics.

A piece on a couple of particularly horrible policy proposals I’ve seen over the past few weeks.

As always, a Week in Review post every Friday. Those are just for paying subscribers. If you want that to be you, just click the button below.