Tiny Car Week in Review

Tourist DNA, job openings, & more

This week brought us economic policy news on fuel efficiency standards, chip exports to China, and tourist visa requirements plus updated data on job openings, small business optimism, and a lot more.

Monday

Trump Admin Proposes Rollback of Corporate Average Fuel Economy (CAFE) Standards

Look, I’ve been hard on this administration’s economic policies, but this? Weakening fuel efficiency standards?

This is great; CAFE standards don’t necessarily improve fuel economy, and they might actually make it worse.

The fuel efficiency targets introduced in 2011 scale with vehicle size, giving larger vehicles easier targets. So by making a car slightly bigger (stretching its wheelbase, widening its track width), manufacturers get easier MPG targets.

For instance: a Mini Cooper (32 MPG combined) scores worse than an F-150 (20 MPG combined).

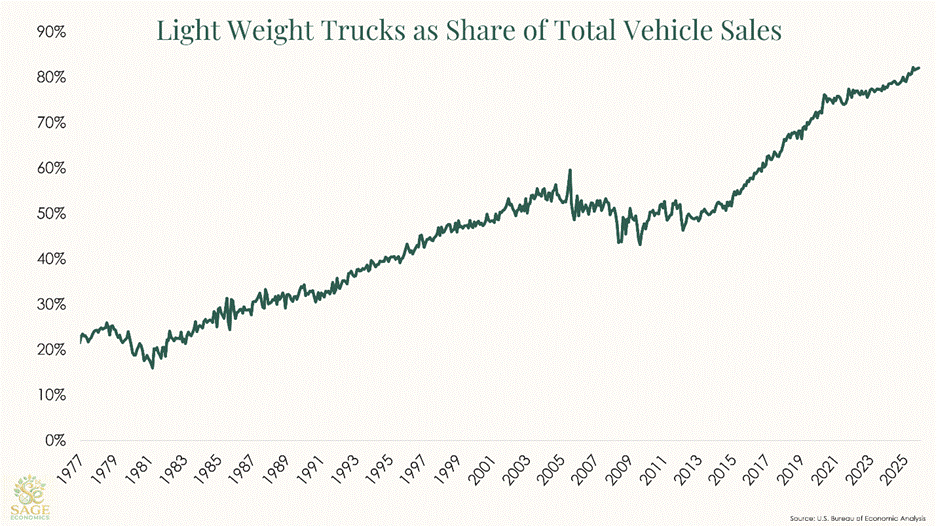

This has, obviously, incentivized the production of larger vehicles. In 2011, the lightweight truck category accounted for less than half of all vehicle sales. That’s now over 80%.

Yes, vehicle bloat (also known as Autobesity) is a long-term trend—Americans love big cars—but the acceleration starting in 2011 is obvious, and it’s not just the share of vehicle sales: both cars and light trucks have grown larger.

This change probably won’t improve environmental outcomes. Declawing a poorly designed law that creates bad incentives is different than designing an efficient law with good incentives.

What this will hopefully do is increase the number of sedans, wagons, and other small vehicles (like Kei trucks!) available for sale in the U.S.

Trump Admin Allows NVIDIA Chip Sales to China

The White House is going to let Nvidia sell advanced AI chips to China, with the U.S. government taking 25% of the revenues from those sales.

For Nvidia, this is obviously great. For our national lead in AI development, this is less great.

There are still some details to be established here, including how many H200 chips— which are powerful but not our most advanced—we’ll sell to China and how those sales will be approved by the government.

I don’t know enough about this to have much of an opinion. China hawks and political opponents are calling the decision a grave national security threat, but that’s to be expected. The consensus view seems to be that this will cut into our AI lead without fully erasing it.

More broadly, this reinforces the recent notion that the admin is not as tough on China as many expected.

TSA Checkpoint Travel Numbers

Air travel remains slightly below year-ago levels, according to TSA data. This was up on a year-ago basis for most of the year. I’m not going to read too much into this just yet, but I will if it turns out to be a slow holiday travel season.

Oil Stuff

Gas prices fell to an average of $3.07/gallon. That’s the cheapest since May 2021—anyone need stocking stuffer ideas?—and is at least partially the result of historically strong domestic oil production.

Diesel prices also fell and, at $3.67/gallon, are in much better shape than a few weeks ago.

Tuesday

Job Openings & Labor Turnover Survey (JOLTS)

The Great Stay continued in October, according to this BLS data release. Employees quit at the lowest rate on record (excluding March to June of 2020), and businesses hired new employees at the slowest pace since 2010 (not a great time for the economy, if you’ll recall).

The layoff rate inched up to a 12-month high but is still pretty low by recent standards, roughly in line with 2019 levels.

Job openings held steady at about 7.6 million. That’s high compared to the past two years but, as a share of all jobs, is about the same as before the pandemic.

Big picture? It’s a weird labor market. No hiring. No quitting. Not much firing. In a word, I’d describe it as fragile. An increase in layoffs would cause significant damage, but nothing is irreparably broken just yet.

NFIB Small Business Optimism Index

This measure of small business optimism rose slightly in November, but so did small business uncertainty, with small business owners particularly unsure about making capital expenditures over the next 3-6 months.