Trump's Relentless Policymaking

Credit card rate caps, investigating the Fed, & more

Optimism that the White House’s pace of economic policymaking would slow in 2026 has proved misplaced. Extraordinarily misplaced. Maybe the most misplaced that optimism has ever been.

During the first 12 days of 2026, the White House:

Captured Venezuelan president Nicolás Maduro, leading to several oil-related policy announcements, including that revenues from the sale of Venezuelan oil would be stored in offshore accounts rather than with the U.S. Treasury.

Announced a ban on institutional investors purchasing additional single-family homes.

Banned defense contractor dividends and stock buybacks and capped defense contractor executive pay.

Ordered the government to purchase $200 billion in mortgage-backed securities.

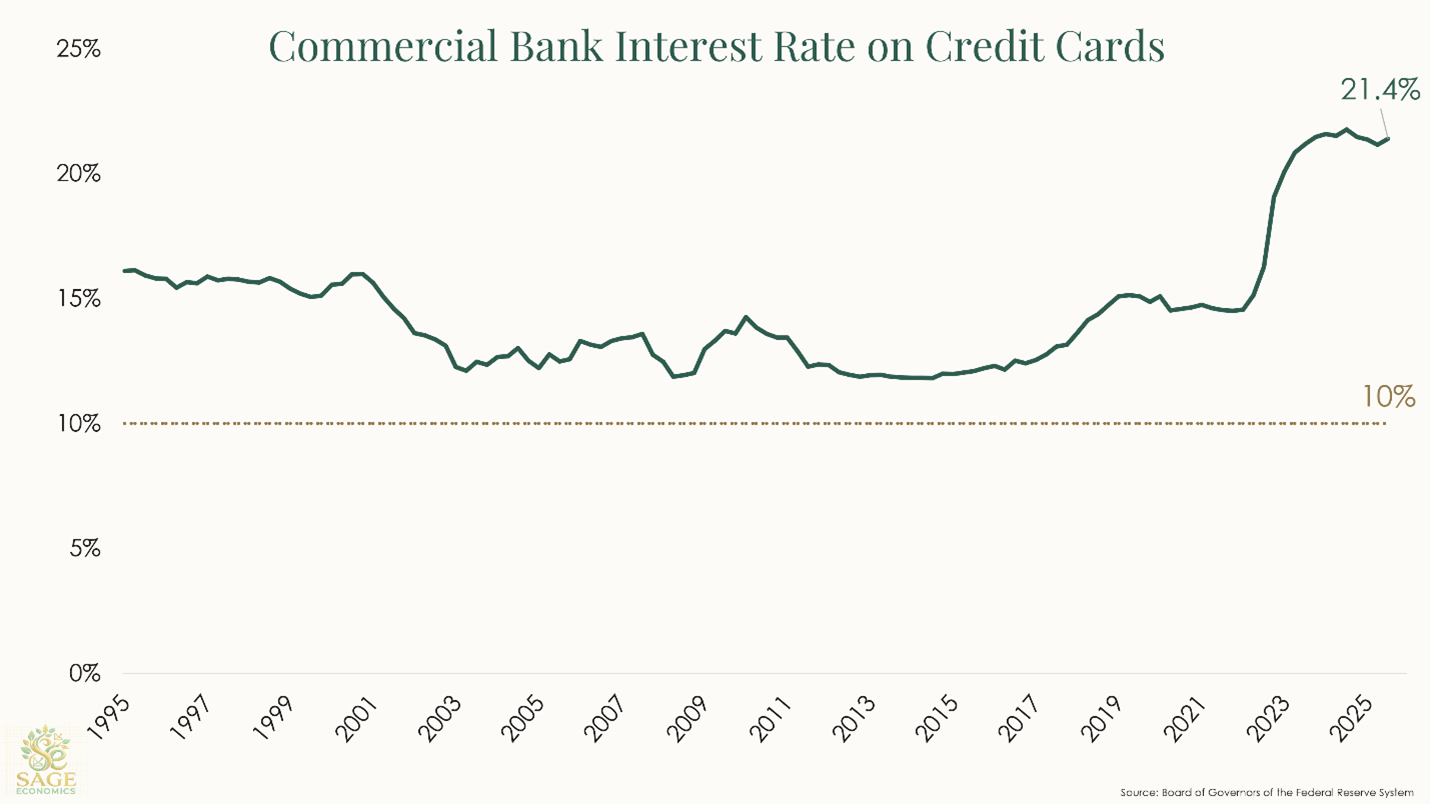

Announced a 1-year ban on credit card companies charging interest rates higher than 10%, effective January 20th.

Floated a $600 billion increase to the military budget in 2027, bringing it from $900 billion to $1.5 trillion.

Reportedly had the DOJ launch a criminal investigation into Fed chair Jerome Powell for lying during his testimony about renovations to the Fed offices.

Most of these spurred an “Ah! We should write about this for the newsletter” moment, only for another crazier, more economically impactful announcement to drop before we could type a single word.

So instead of a deep a deep dive on any of these topics, here are a few sporadic thoughts:

A bad idea on credit cards

Credit card interest rates have never dipped below 10% (at least since the data series started in 1995).

If they’re capped at 10%, banks will revoke credit and/or begin charging large annual fees that many Americans can’t afford. Think of it like this: if we capped mortgage rates at 1%, the result would be that nobody gets a mortgage.

So a 10% credit card rate cap would cause a drop in consumer spending. That would hurt restaurants, retailers, airlines, etc., which would in turn hamstring an already weak labor market.

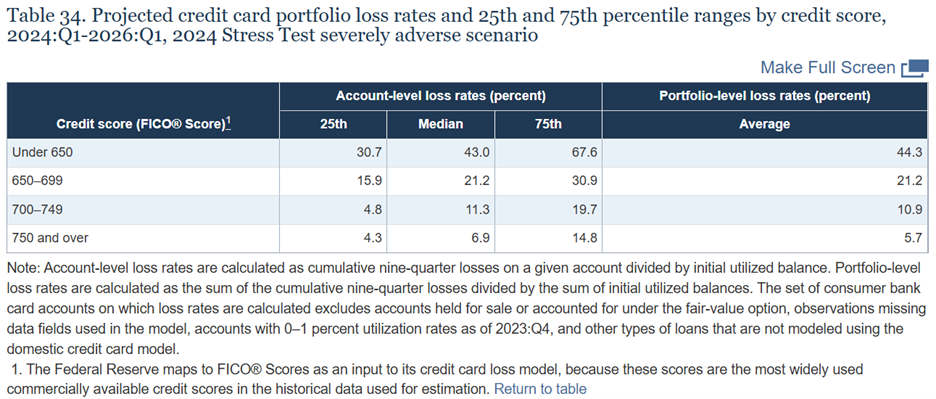

Consider the Fed’s most recent stress test, which is like a war game to make sure banks can survive a downturn. Under a severely adverse scenario (very bad downturn), 44% of outstanding balances held by accounts with credit scores under 650 would be uncollectible. 44%!

Even for borrowers with credit scores between 700-749, the banks lose 11%.

Who wins here? Payday lenders. Who loses? Just about everybody else.