Unemployment Hits 4-Year High

September's delayed jobs report a mixed bag

This post is sponsored by KODIAK – Proven Workforce Solutions. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I trust and 2) addressing critical issues like skilled labor shortages in construction. KODIAK, which recently merged with Pivot, checks both those boxes. Their mission is to help construction companies find experienced talent, including engineers and project managers for Direct Hire, as well as skilled craft professionals like welders and electricians for contingent staffing. With over three decades of experience, I encourage contractors struggling to find workers to consider KODIAK.

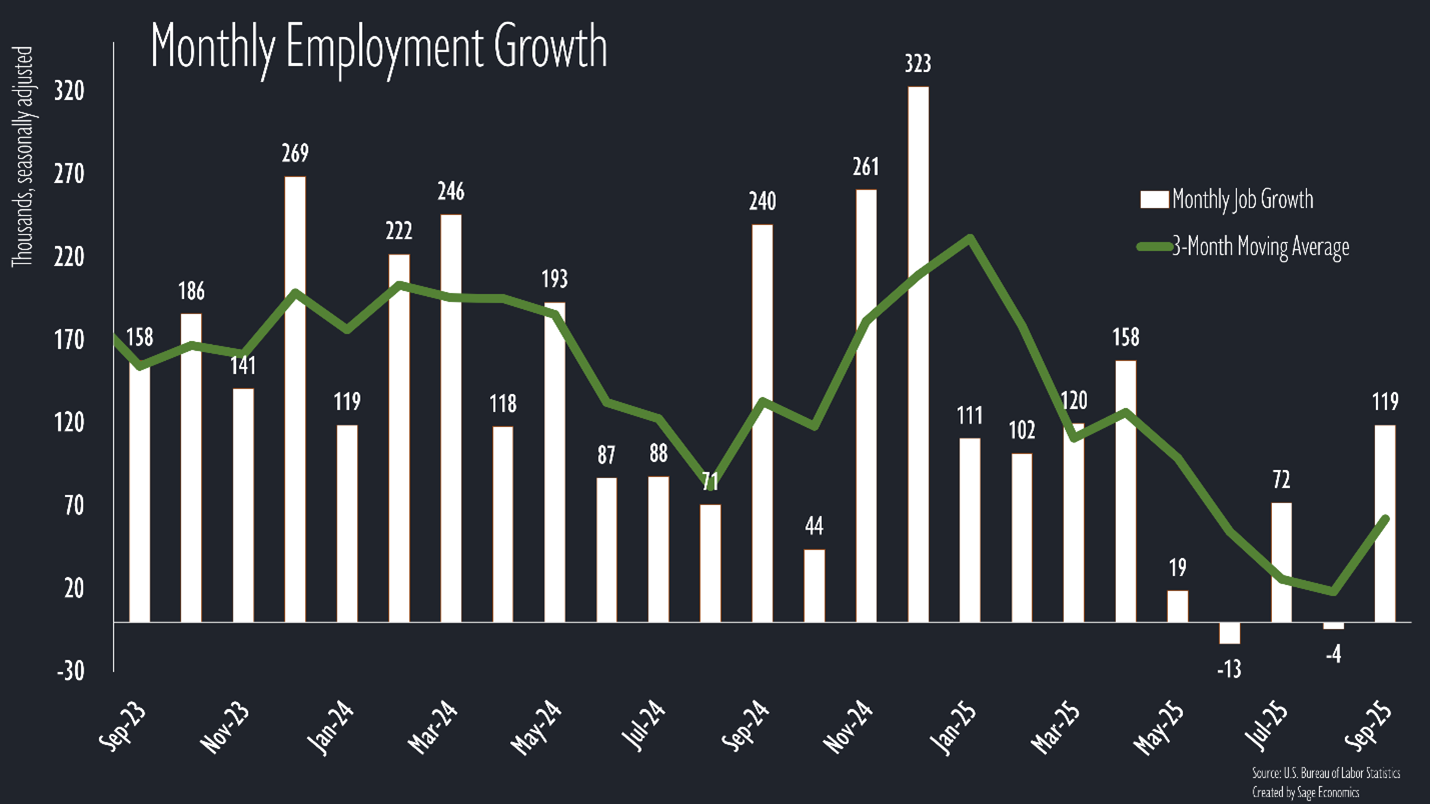

U.S. employers added 119,000 jobs in September, according to today’s very delayed release (would have been on October 3rd if not for the government shutdown). That’s the fastest job growth since April, but that’s not saying all that much. We’ve averaged fewer than 40,000 jobs per month over that span.

That said, we’ll definitely take 119,000, especially given recent trends.

More concerning: the unemployment rate rose to 4.4% in September from 4.3% in August. That’s the highest rate since October 2021 and higher than any non-pandemic-affected month since 2017.

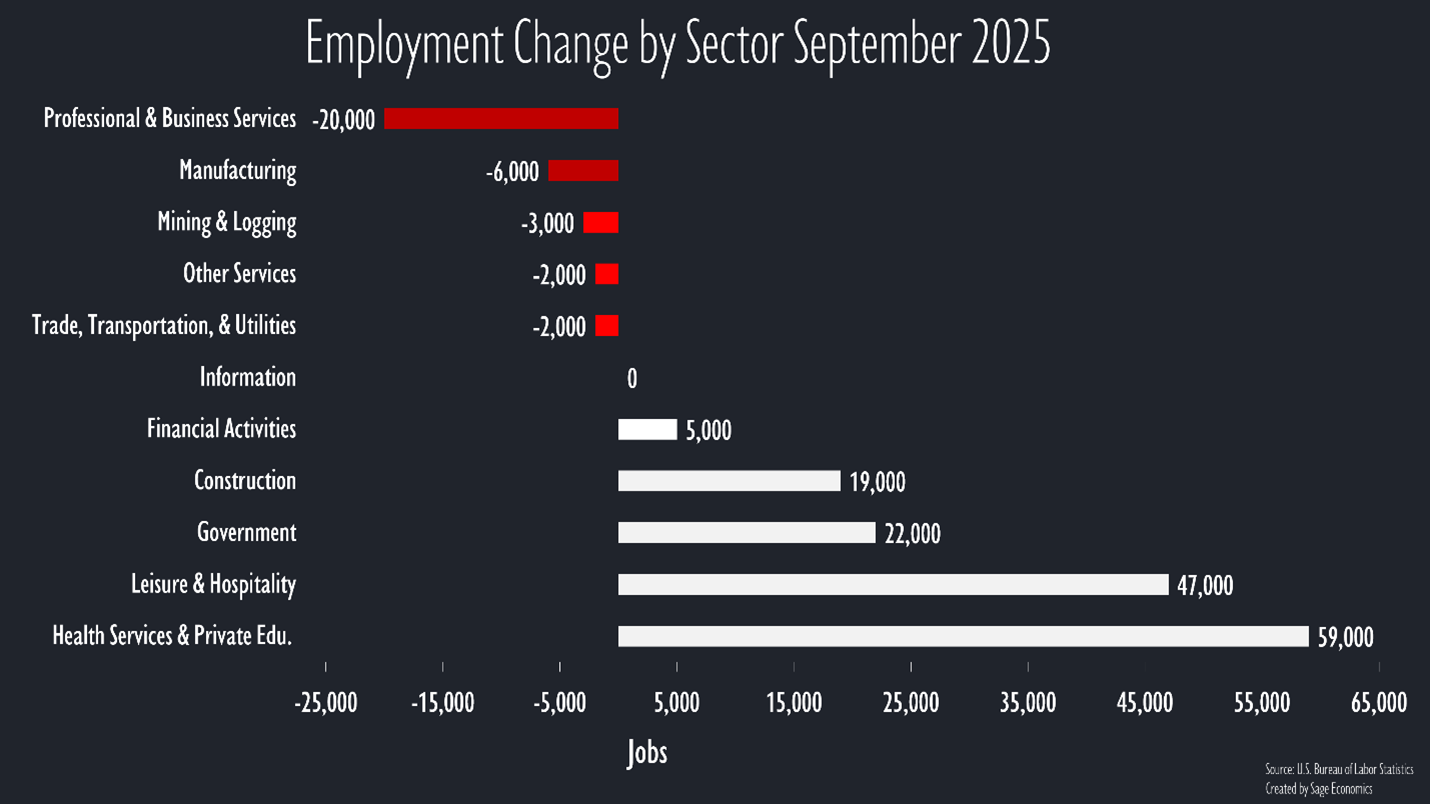

The composition of job growth is also a little worrying. The large decline in professional and business services employment was due to a 19,100 job decline in temporary help services (think staffing firms), although growth was weak in most of the industry’s white-collar segments too.

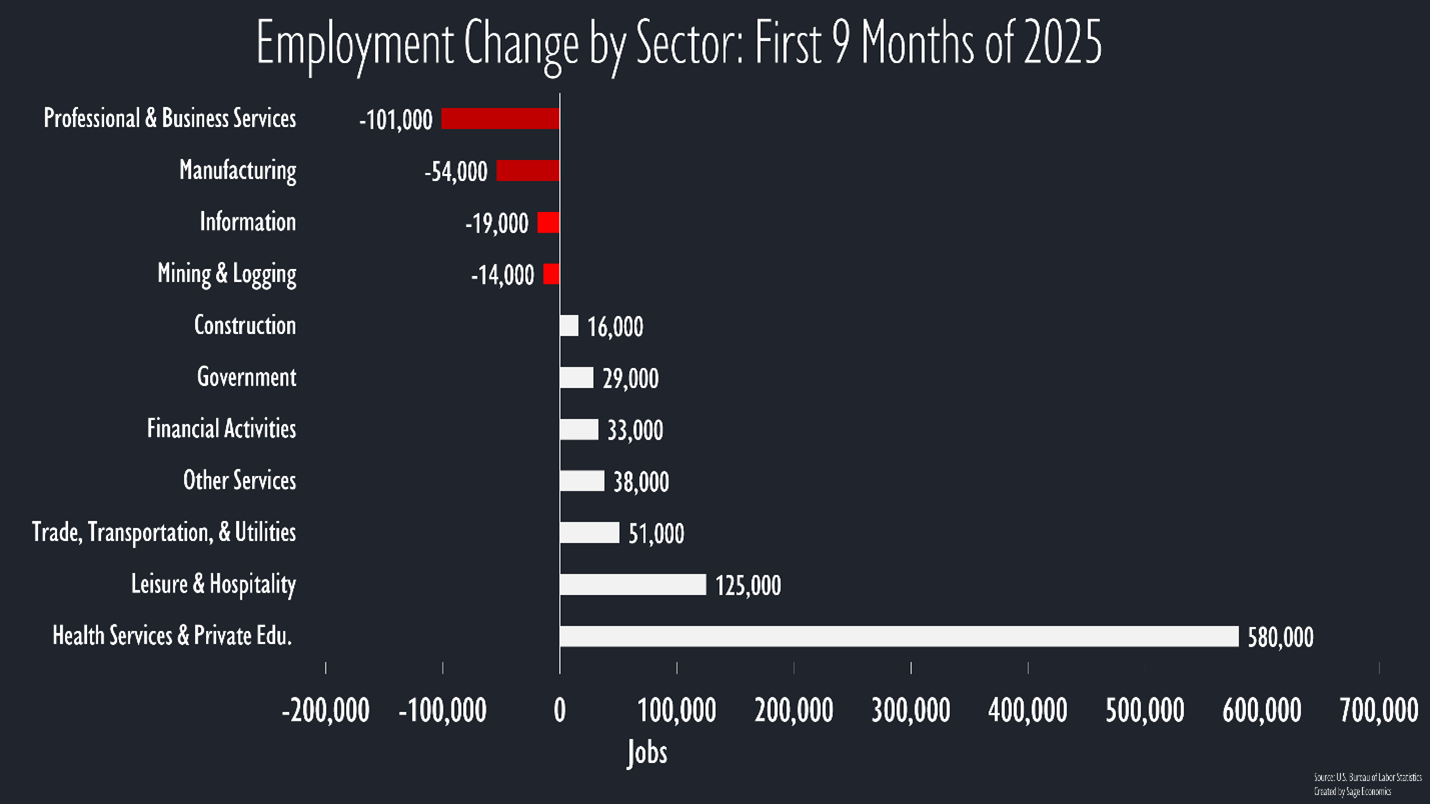

Manufacturing lost jobs for the fifth straight month in September, and employment in the category is down by 58,000 since the Liberation Day tariff announcements in April. Whatever the intent of our current trade policy, it’s hammering domestic manufacturing.

As has been the case, job gains were concentrated in just two segments. Healthcare, which is a noncyclical segment (its performance does not necessarily track with the rest of the economy), has accounted for the vast majority of 2025’s employment growth.

Leisure and hospitality (think arts, entertainment, restaurants, and hotels) has also added jobs at a healthy enough pace, with restaurants accounting for most of the industry’s employment growth in September.

Ending on a positive: the labor force details in this release were pretty solid. The labor force grew, labor force participation inched higher, and prime age (25-54) labor force participation was unchanged at a pretty elevated rate. So that’s all good.

The Upshot

The economy added jobs at a healthy pace in September, though most of those were restaurant or healthcare jobs, and the unemployment rate continues to trend higher, albeit slowly.

But that’s September, before the longest government shutdown in history. We won’t get an October jobs report (more on that below), and we’ll have to wait until mid-December for November jobs data.

Big picture: nothing in this report is panic-worthy, but on-net it makes me feel just a little worse about the economy.

On Future Data Releases

The BLS isn’t going to publish an October employment report, and to be clear, there’s no conspiracy here. The BLS couldn’t send out surveys during October because of the government shutdown, and even if they could go back and somehow do it retroactively, the data would be stale by the time they finished.

So we’ll get November employment data about 10 days later than normal on Tuesday, December 16th. Starting in January, I assume we’ll be back to normal.

What’s Next

Anirban will cover a week packed with economic data in Week in Review, our every-Friday post that covers everything you need to know about the economy in a breezy, five-minute read. That’s just for paying subscribers. If that’s not you and you want it to be, just click the button below:

Love this!! Would love your thoughts on some of my stuff — follow me back, I could DM you?