Wednesday Links

CRE, HSAs, The Sphere, & more

1. Do you think America is declining in a way that evokes the fall of the Roman Empire? If so, you’re engaging in a longstanding national tradition; Americans have been comparing the nation’s eminent collapse to ancient Rome for over a century, as you can see in this thread of newspaper clippings that dates back to 1895

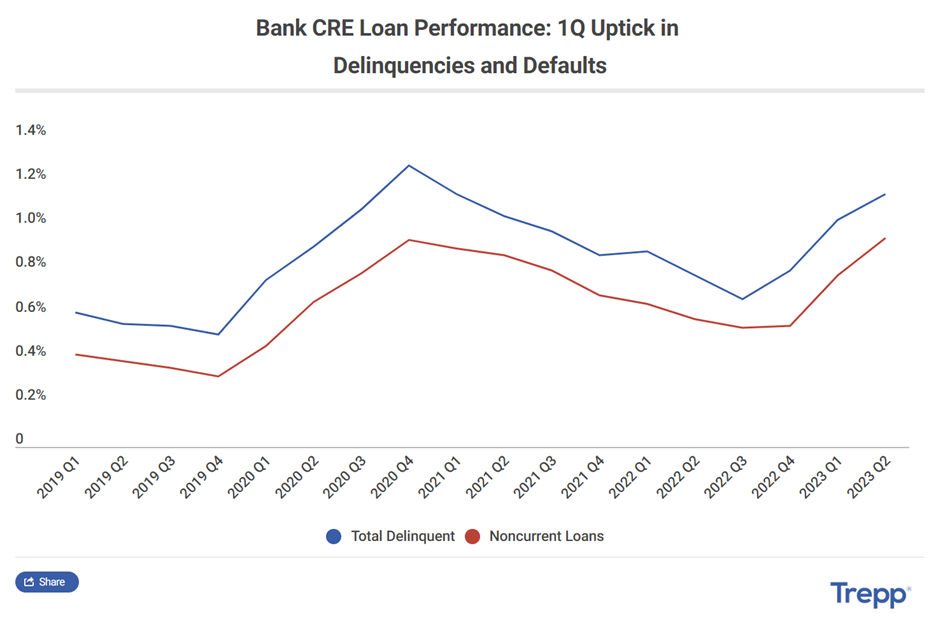

2. The delinquency rate for bank-held commercial real estate loans jumped to 1.15% in the second quarter, up from 1.03% in the first quarter according to data from Trepp.

Work from home has pushed the office sector vacancy rate higher, reducing valuations. If too many owners default on these loans, it could cause serious problems for banks—you may have heard this referred to as the looming CRE debt maturity wall (“looming,” like it’s an axe murderer in a horror movie).

Sure, this could eventually cause some problems, but the way Trepp presents this data makes it seem a lot scarier than it is at the moment. The Fed’s data on CRE delinquency rates going back to the early 1990s should quell some fears.

3. But hey, who knows? According to this Bloomberg survey of investors, 65% of respondents think that the U.S. office market won’t rebound without a severe crash.

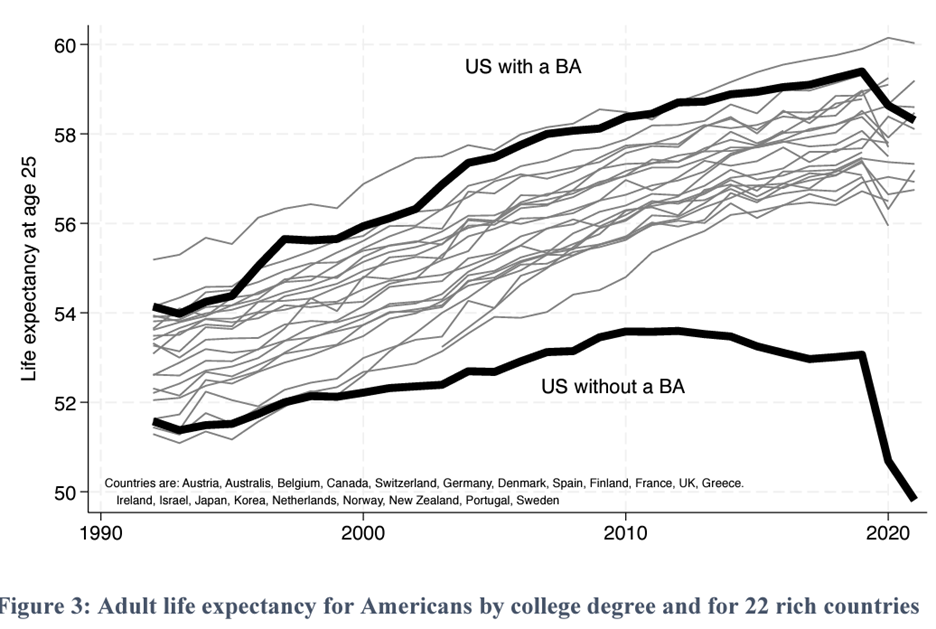

4. Economists Anne Case and Angus Deaton wrote about the widening mortality gap between Americans with and without a bachelor’s degree. They cite deaths of despair as the driver of this trend, but COVID also widened the gap because “People with BAs have Zoom. People without BAs don’t have Zoom; they have to go to work.”

5. The House Ways and Means Committee approved legislation to expand Health Savings Accounts. If you have an HSA that you max out, this is great! But if you dislike regressive policies or unfunded tax cuts that drive up the deficit, this is less great.

(If you fall into both camps, mutter how disgusted you are and then keep maxing out your HSA.)

According to the Committee for a Responsible Federal Budget, this legislation will cost the government $71b over the next ten years. The Ways and Means Committee justifies this as the cost of helping working families: “With 78 percent of health savings accounts owned by taxpayers making less than $100,000, HSAs are clearly a tool middle- and low-income families find useful.”

Sure, but a lot of those lower-income families don’t contribute to their HSA. Households making over $100,000 per year account for more than 75% of the value of HSA contributions, according to the Center on Budget and Policy Priorities.

6. “A Washington Post analysis of thousands of [public school book] challenges nationwide found that 60 percent of all challenges in the 2021-2022 school year came from 11 adults, each of whom objected to dozens — sometimes close to 100 — of books in their districts.”

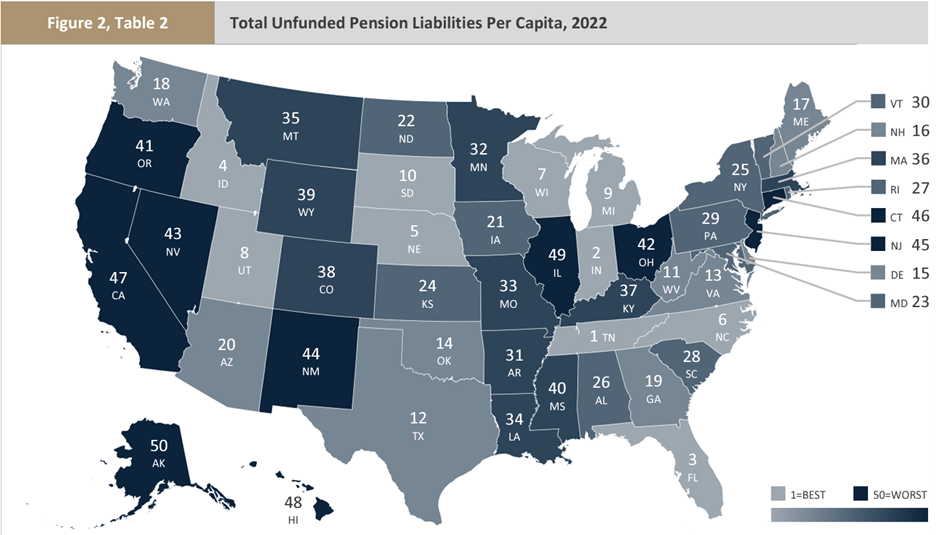

7. Dan Mitchell of the Cato Institute on state pension debt rankings (using data from this ALEC report).

8. The Sphere—a new music venue in Las Vegas and, in my opinion, the most incredible structure humanity has ever built—hosted its first concert last week. The only bad thing I can say about The Sphere is that my friends and family are sick of hearing me talk about it. If I’m elected president, my first order of business will be commissioning a Sphere in every city in America.

Insane footage from inside The Sphere

A video overview of The Sphere

A review of the first performance at The Sphere

Hour long video of U2 playing in The Sphere

9. Nick Bloom dives into the data on working from home: “The work-from-home conversation needs to shift from big-name CEO anecdotes and stories to data and research. When it comes to making decisions impacting millions of employees and firms, we deserve better. The data and research show well-managed work from home can raise and maintain productivity, while cutting costs and raising profits. “

10. National Environmental Policy ACT (NEPA) reviews are, ironically and catastrophically, hamstringing our transition to clean energy.

Up Next

As always, we’ll be sending out our Week in Review post on Friday. That’s only for paying subscribers. If that’s not you and you want it to be, just click the button below: