Yeah, yeah, I know, inflation is at a 40-year high. It’s the talk of the town. But how many people are paying attention to the fact that unemployment is near a fifty-year low? A recent poll found that a majority of Americans thought that our nation had lost jobs over the past year, but we’ve actually gained about 6.5 million.

I’m not trivializing the impacts of inflation. It’s hammering household balance sheets, particularly for lower-income workers and households on fixed incomes. But there are also more than 11 million available, unfilled jobs in America, wages are rising rapidly, and consumers are still spending. My point is, things aren’t entirely as bad as they seem.

Anyway. Tomorrow is Good Friday, so this week in review is a day earlier than normal. Now, on to the week that was.

Monday

The Rocket and the Feather

Oil prices have declined pretty significantly off their March highs, but gasoline prices, which rose just as rapidly as oil prices, have yet to come back to earth. Why? The rocket and the feather, which was explained really well by this Washington Post article.

The rocket and the feather (which is formally called asymmetric price transmission) is, in this instance, the notion that when oil prices rise, gasoline prices take off like a rocket. When oil prices come back down, gasoline prices fall slowly, much like a feather.

The idea here is that when prices are high (and rising), consumers are choosy and might drive past a few gas stations before picking the one with the lowest price. This forces gas stations to compete, and so they have less pricing power and sell their gasoline with lower profit margins on the way up.

When prices are falling, however, consumers see prices that are lower than they expect, and that makes them less choosy. Gas stations don’t have to compete as much, as they can keep their prices higher, earning larger profit margins.

I won’t dive too far into the details. The WaPo article linked to up above is a great overview, and this paper gives you a deeper dive if you’re really curious.

Tuesday

Consumer Price Index (CPI)

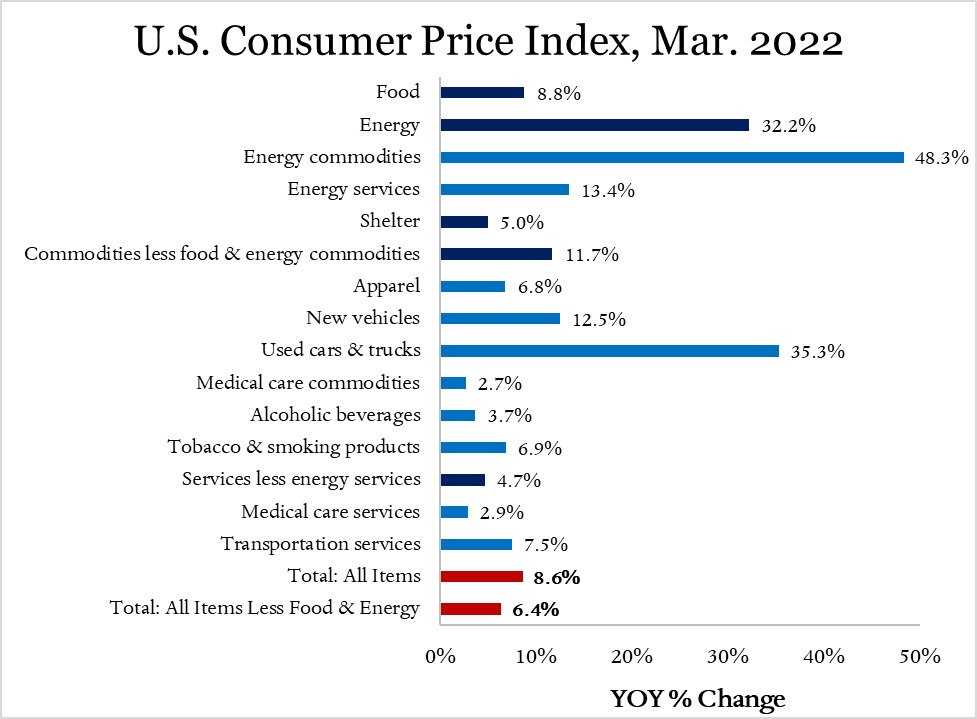

CPI data came out on Wednesday, and it was roughly as bad as expected. CPI-U, the Bureau of Labor Statistics’ primary measure of inflation, increased 1.2% in March and is up 8.5% since March 2021. Core CPI, which is like CPI-U but excludes food an energy prices, increased 0.3% for the month (less than the 0.5% consensus forecast) and is up 6.4% year over year.

You’re probably wondering why anyone would exclude food and energy prices, which account for about 21% of the CPI’s basket of goods (i.e., normal expenditures for the average person), and the reason is that food and energy prices are more volatile than other categories and also highly susceptible to influence from non-economic factors like Russian madmen (looking at the graph below, you can see that energy prices are particularly volatile). For the average consumer that has more than a fifth of their spending tied up in those two categories, I doubt the volatility argument makes much of a difference, so while Core CPI may be useful for assessing trends, CPI-U is a better measure of how inflation is impacting Americans.

But I digress. The 8.5% increase in CPI-U is the fastest rate of inflation since 1981. Predictably, a lot of the inflation was driven by skyrocketing energy prices, which were up 11% for the month, but we knew that was coming. Russia invading Ukraine drove fuel prices higher, and gasoline prices (as reported by CPI) rose 18.3% from February to March. This is not the main reason to detest Vladimir Putin, but it’s likely in the top 50.

The surprising (and arguably concerning) aspect of the CPI data is the 0.6% monthly increase in prices for services (this excludes energy-related services), which are now up 4.6% year over year. We’ve talked quite a bit in this newsletter about the surge in demand for goods and how that has overwhelmed supply chains and pushed inflation higher. The fact that service sector is seeing such hefty price increases suggests that inflation is spreading across the economy, with wage inflation serving as a major and sticky factor. Fuel prices impact services, too. Transportation service prices were up 2% for the month, and suddenly I’m paying a fuel surcharge on my Lyft rides.

Wednesday

Keep reading with a 7-day free trial

Subscribe to Sage Economics to keep reading this post and get 7 days of free access to the full post archives.