Week in Review: Feb. 5-9

The vibes are improving

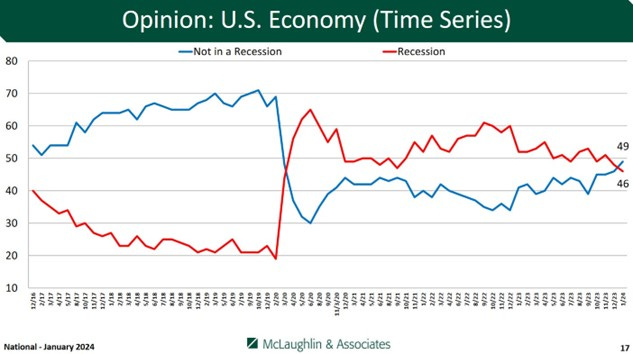

For the first time in four years, more Americans say the country isn’t in recession, according to this poll from McLaughlin. Nothing in the data released this week—a measure of wage growth, CEO confidence, Congressional Budget Office projections, and more—should alter their minds.

Monday

Senior Loan Officer Opinion Survey

Credit conditions (i.e., banks’ standards for approving applications for loans) were mostly unchanged during the fourth quarter. For commercial and industrial loans, about 80-85% of banks kept standards the same, and about 10-15% tightened them.

For construction and land development loans, 57% kept standards unchanged, 42% tightened, and 1% “eased somewhat.” About 55% of banks say demand for construction loans weakened during the fourth quarter, while just 9% say demand strengthened.

ISM Services PMI

The U.S. services sector expanded for a 13th consecutive month in January, according to this survey of industry leaders. That’s the good news. The bad news is that services prices increased at a faster rate than they did in December.

Of note, one respondent from the construction industry said: “Transportation impacts of the Suez Canal, due to unrest in the Red Sea and the issues at the Panama Canal are impacting both costs and schedules for the transport of global goods.”

Gas Prices

Gas prices increased for the third straight week. At $3.25/gallon, gas is still about $0.30 cheaper per gallon than it was one year ago. Expect prices to continue to rise over the next couple of months as we approach the summer travel season and as oil prices likely head higher due in part to geopolitics.

Diesel Prices

Diesel prices increased to $3.90/gallon. That’s the highest price since December but about $0.64 cheaper than one year ago.

TSA Checkpoint Travel Numbers

No sign of a slowdown in air travel yet; the number of passengers screened by TSA remains about 5-6% higher on a year-over-year basis.

Tuesday

Metro Area Employment & Unemployment

In December unemployment rates increased in 230 metro areas, fell in 128, and were flat in 31. The lowest unemployment rate was in Burlington, Vermont at 1.6%. The highest was in El Centro, California at 18.3%.

Of the 51 largest MSAs (>1 million people), Baltimore had the lowest unemployment rate at 2.0% and Las Vegas the highest at 5.3%.

Congressional Budget Office Economic Outlook

The nonpartisan CBO estimates that immigration unexpectedly surged starting in 2022 and, as a result, it “now expects that the civilian population age 16 or older in 2033 will be larger by 7.4 million people.” Because of that faster than expected immigration (and therefore population growth), the CBO projects:

Consumer spending will be 2% larger than initially expected from 2027-33 (an increase equivalent to 1.4.% of GDP)

Residential investment will be 10% larger than expected (0.4% of GDP)

The labor force will have 5.2 million more people than previously projected by 2033.

If you want to read more on this, see Box 2-1 on page 50 of the report.

These are just projections, but if they are correct that the population is growing faster than expected, that would explain a lot of the faster-than-expected growth over the past few years. It will be interesting to see if the next population estimates from the Census Bureau support this.