This is the first Week in Review post, and I’m making it available to all subscribers. Next Friday (and every Friday after that), it will only be available to paid subscribers. You can read more about what’s included in a paid membership here.

Monday

Construction Spending

The value of construction put in place (i.e., construction spending) increased 0.4% on a monthly basis in November 2021 and 9.3% on a year-ago basis. The residential segment, which currently accounts for a bit less than half of total spending, increased 0.9% for the month and is up 16.1% year-over-year. Nonresidential spending (read more of my thoughts at ABC) was flat for the month and is up a far more modest 3.4% since November 2020.

This is an unsurprising release that does little to change our understanding of current dynamics. The residential sector continues to outperform nonresidential. The cost of delivering construction services is rising rapidly in both segments thanks to labor shortages and higher materials prices. Year-over-year trends remain firmly in place and nothing in the monthly data suggests the birth of a new trend.

Tuesday

ISM Manufacturing Index

The ISM Manufacturing Purchasing Managers Index (PMI) came in at 58.7 for December 2021 (it’s a diffusion index whereby any reading above 50 indicates expectations of growth and any reading below 50 indicates expectations of contraction), down from 61.1 in November. Orders continue to be strong and consumers collectively have lots of money to spend.

The indices for new orders, production, supplier deliveries, and inventories decreased from November’s reading but remained above 50, while the employment index and backlog of orders index increased in December but also remain above 50 (i.e., manufacturers are hiring and seeing their backlog expand at a faster rate). The one PMI component that remains below 50 is the customers’ inventories index, which improved from 25.1 in November to 31.7 in December, but indicates that inventories are still too low.

In short, the economy continues to be characterized by elevated demand and constrained supply, and that’s good for domestic manufacturing growth prospects.

JOLTS (Job Openings and Labor Turnover Survey)

According to the Bureau of Labor Statistics’ JOLTS survey, the number of available, unfilled jobs totaled 10.6 million in November, which is the lowest level since June 2021 but higher than at any point before June. The job opening rate (the % of total U.S. jobs that are unfilled) was 6.6% in November – still very high.

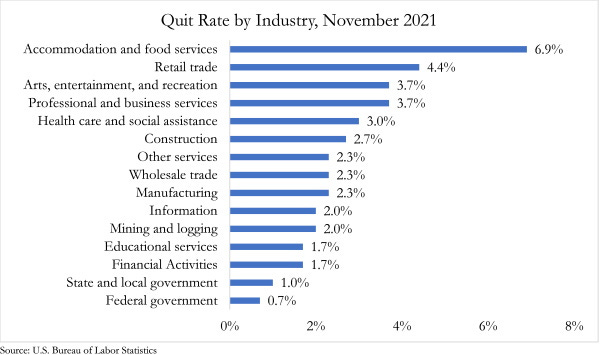

The quits rate (the share of U.S. workers who quit their job in November) was 3.0%, up from 2.8% in October and tying the all-time high set in September. The Great Resignation continues. Employers will be chasing scarce talent with higher wages and/or offers of greater flexibility all year.

Not all industries are equally affected by the Great Resignation; 6.9% of all workers in the accommodation and food service industry quit in November. For context, just 1.7% of financial activities employees and 0.7% of federal employees quit in November. What does this mean? All restaurants are now BYOP (bring your own patience).

Global Supply Chain Pressure Index

You’ve probably never heard of this indicator, and that’s because it’s a brand new index created by the New York Fed. I haven’t had a chance to review it in depth, but I’m optimistic that it will be a useful indicator, especially in the light of how important the alleviation of global supply chain pressures is to economic growth prospects. The Global Supply Chain Pressure Index is at an all-time high (the series extends from September 1997 to November 2021).

Wednesday

FOMC Minutes

The FOMC December meeting continued the trend of rising hawkishness. The nation’s leading monetary policymakers indicate that they anticipate reductions in asset purchases each month, “resulting in an end to net asset purchases in mid-March, a few months sooner than participants had anticipated at the November FOMC meeting.” The FOMC is rightly worried about strained supply chains and expressed that “it may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated. Some participants also noted that it could be appropriate to begin to reduce the size of the Federal Reserve’s balance sheet relatively soon after beginning to raise the federal funds rate.”

Financial markets, particularly the once high-flying NASDAQ, have not responded well to these pronouncements. Interest rates are headed higher in 2022, so get ready for that.

ADP Employment

According to the ADP Employment Report, U.S. nonfarm payroll employment increased by a bit more than 800,000 in December. Pre-pandemic, this was mostly seen as a useful tool for predicting the BLS nonfarm payroll report. But now this may be a better indicator of labor market activity than the gold-standard BLS report (see below). I, for one, will be paying more attention to the ADP report going forward.

Thursday

Factory Orders

New orders for manufactured goods increased 1.6% in November, moderately more than the 1.3% predicted by economists. Demand for goods is still higher than Cheech and Chong. Not much to see here.

Mortgage Rates

Mortgage rate data are released every Thursday (from Freddie Mac), and while I won’t cover it every week, this one seemed noteworthy. The average 30-year fixed rate mortgage was at 3.22% for the week ending 1/6/2022, the highest rate since May 2020 and well above the pandemic low of 2.65% achieved in January 2021. With housing inventory historically low and prices historically high, higher borrowing costs could have a cooling effect on demand for residential real estate, especially given the prevailing view that this is a seller’s market and that buyers “are having to pay too much as it is.” And yes, I just quoted myself.

Friday

Payroll Employment

I wrote about this at length (with many Sir Mix-a-Lot references) in a separate post. Long story short, there’s something odd (but explainable) going on with the payroll jobs survey, but the household data show an economy with sky-high demand for workers and falling unemployment.

The Best Things I Read This Week

There were a lot of data releases this week, which meant less time to peruse the internet. Sorry Facebook friends. Future weeks should have more links here.

This Twitter thread of Matt Notowidigdo’s ten favorite economic papers of 2021.

An assessment of how each state responded to the pandemic and the impact on employment & work (haven’t read all 510 pages, have some questions about the methodology, but interesting nonetheless).

An interview with Adam Ozimek (chief economist at Upwork) regarding the future of remote work.

Final Thoughts

After this week, my outlook for the economy is: unchanged

Oh, I know about omicron, but that doesn’t change my 2022 forecast of 2.5%-4% growth and my expectation that inflation will come in north of 3%.

Feedback, Please

This is the first Week in Review column and I want your feedback. Requests? Suggestions? Demands or ultimatums? Shoot me an email or let me know in the comments. The format of this will undoubtedly change over time, and I’d like to iterate toward a final version with your help.

For those of you who are currently free subscribers but would like to keep receiving these Week in Review posts, hit the subscribe button below!

How does the change in construction spending relate to units or sf produced? In other words, just how much of the change is due to inflation?

Anirban, This is my favorite thing this week! Look forward to more.