Week in Review: March 7-11

The good news: baseball is back!

The bad news: virtually everything else. The big story remains Russia’s invasion of Ukraine and the resulting impacts on commodity prices and financial markets.

The Dow is down big, but not too big (where else are you going to put your money?). On January 4, when we only had pandemic to worry about, the Dow was sitting at almost precisely 36,800. As of 12:41pm on March 11th, the Dow was down to 33,183, a dip approaching 10%. The S&P 500 and Dow are both down nearly 3% over the 2 weeks since this ridiculousness started, but prices were of course dipping as the assault approached. Gas prices are rising so fast you can actually save money by filling up in the morning instead of the afternoon (take it from a Mustang owner), and February’s inflation data, which do not account for the impacts of Russia invading Ukraine, embodied the fastest rate of price increases in more than 40 years.

Monday

No big releases on Monday. Phew. Enough bad news without incoming data.

Tuesday

U.S. Goods and Services Trade Balance

The U.S. goods and services deficit (exports minus imports) was $89.7 billion in January 2022, up from $82 billion in December. Exports declined $3.9 billion from December, while imports increased $3.8 billion. Imports of goods increased by $4.8 billion, led by a $1.6 billion increase in cars and car parts, while imports of services declined $1 billion.

What’s the upshot? Americans continue to buy goods at a frankly outrageous pace, leading to a tsunami of imports. No wonder our ports have been overwhelmed. If you want to help combat inflation, spend exclusively on services (and food, I suppose, if you absolutely need to) for the foreseeable future. If you want to help America, buy American.

Wednesday

JOLTS (Job openings and Labor Turnover Survey)

There were 11.3 million available, unfilled jobs in January, about 185,000 fewer than in upwardly revised December 2021 and 4.3 million more than in February 2020. Despite payroll employment increasing 6.6 million over the past year, 7% of all jobs remain unfilled. What does this mean? It means that job growth will only go as far as the labor supply can take it. Recent labor force news has been broadly encouraging, but the ratio of unemployed persons to job openings remains at an all-time low of 0.6. This will sound strange, but we could use some more unemployment. In regions like Atlanta and Minneapolis, unemployment is well below 3%. How are they going to grow?

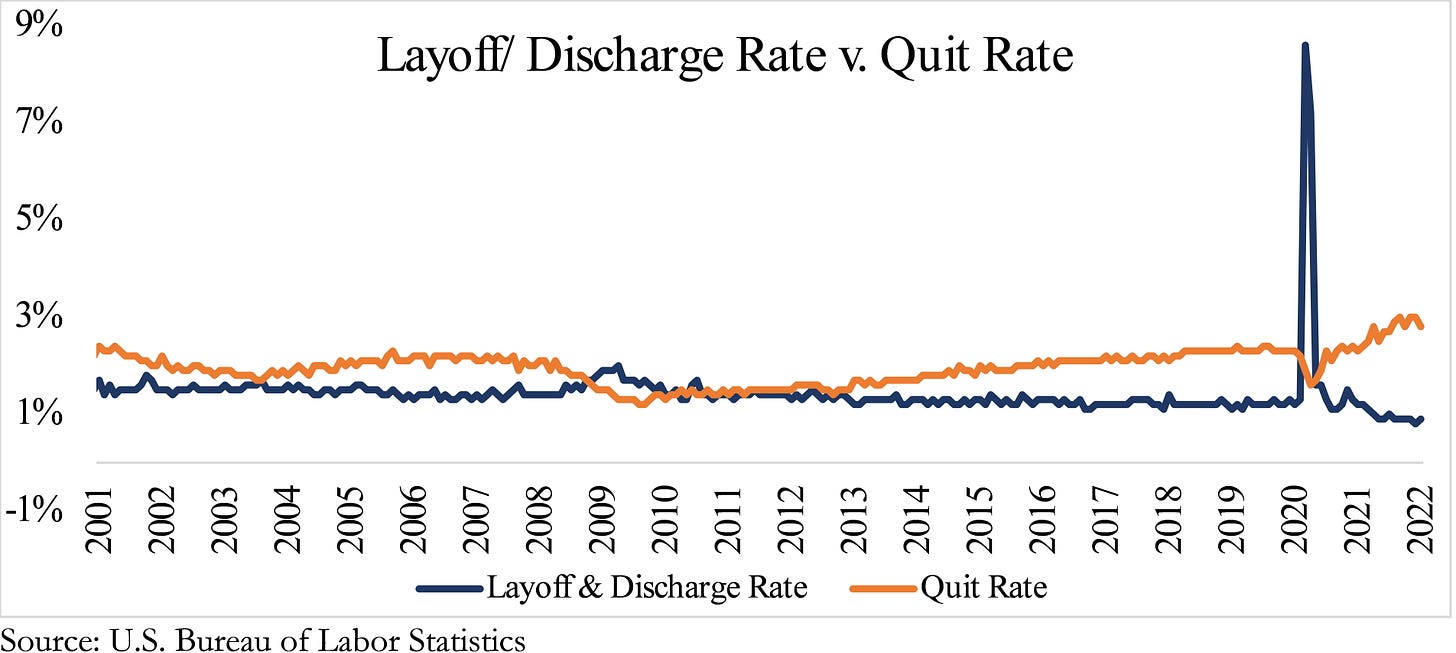

The quits rate is still much higher than the layoff rate, meaning that employers are still clinging to workers and those workers have retained their formidable bargaining power (that’s inflationary, parenthetically, he said, in parenthesis). Last month I pointed out that the right side of the chart below looks like the gaping jaws of a monster with an insatiable appetite for employer profit margins. At least through January, the beast is still hungry.