When good (& bad) news are actually bad news

Week in Review: Feb. 13-17

This week brought us several more instances of good news actually being bad news, except for the new inflation data, wherein bad news was actually bad news.

Reminder: we put out a request for questions for our February 2023 Q&A this week, and you still have a few more days to submit questions.

Monday

Gas Prices

Gas prices inched lower again, down to $3.502 per gallon. After five straight weekly increases during January, gas prices have now fallen in each of the first two weeks of February.

TSA Checkpoint Travel Numbers

Travel numbers for the week ending 2/14/2023 have slipped back below 2019 levels, but only slightly. This may have something to do with the fact that airline fares are up 25.6% over the past year. Keep that middle seat empty, please!!

Tuesday

NFIB Small Business Optimism Index

Small business optimism increased in January but remains below the 49-year average. About a quarter of small business owners report inflation as their biggest issue. Another quarter claimed “quality of labor” was their most important problem.

There is a little bit of good news in here: the share of small business owners who made a capital expenditure in the past six months increased to 59%, the highest level since May 2021.

Consumer Price Index

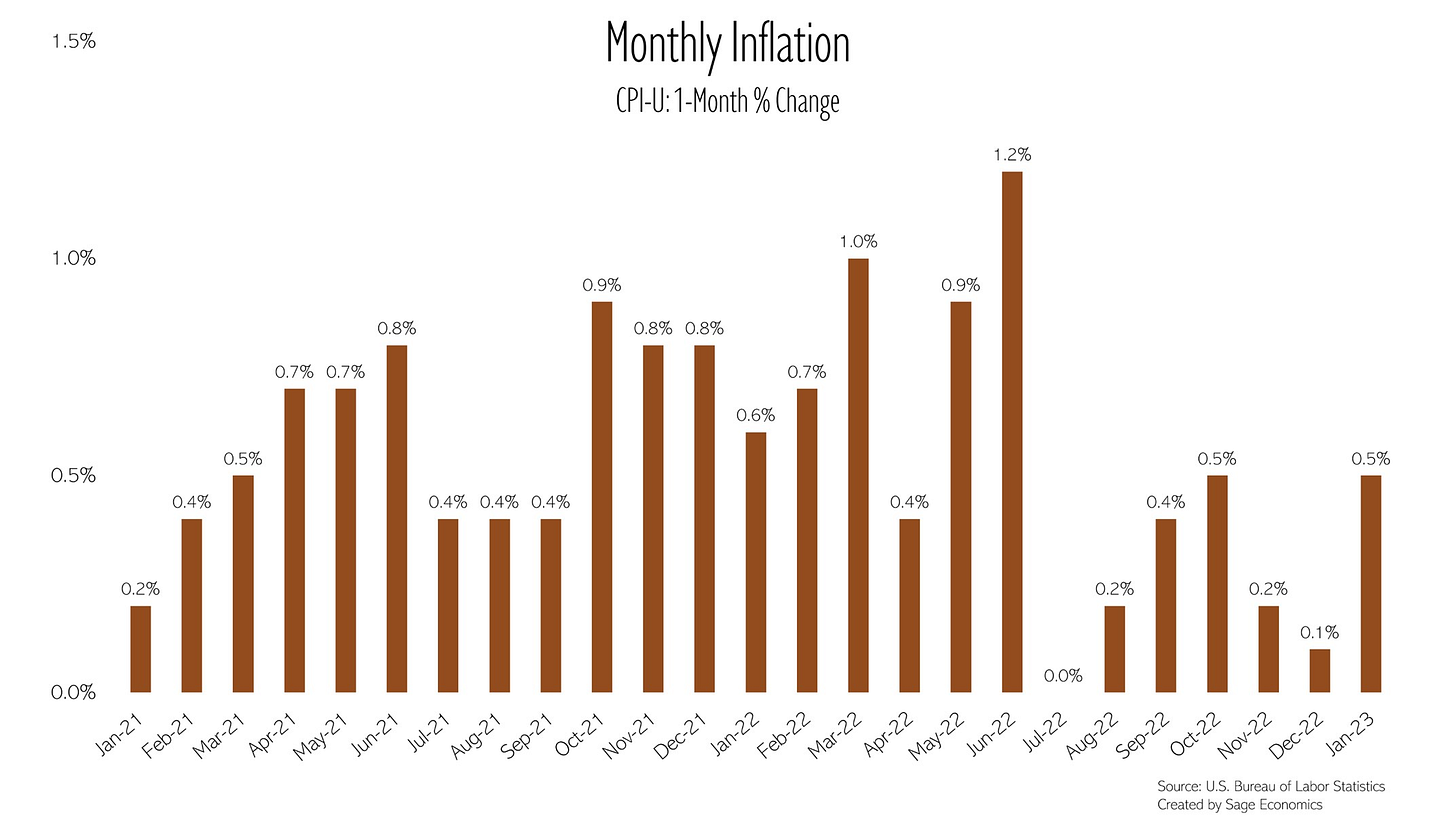

Inflation, which looked to be decelerating at the end of 2022, picked back up in January. Prices increased 0.5% for the month. The annual increase in prices was the lowest since the second quarter of 2021; the pace of inflation fell from 6.445% in December to 6.347% in January. At that rate of decrease, it’ll take 44 months to get back to the Fed’s 2% target rate of inflation. The Orioles will have won a World Series by then.

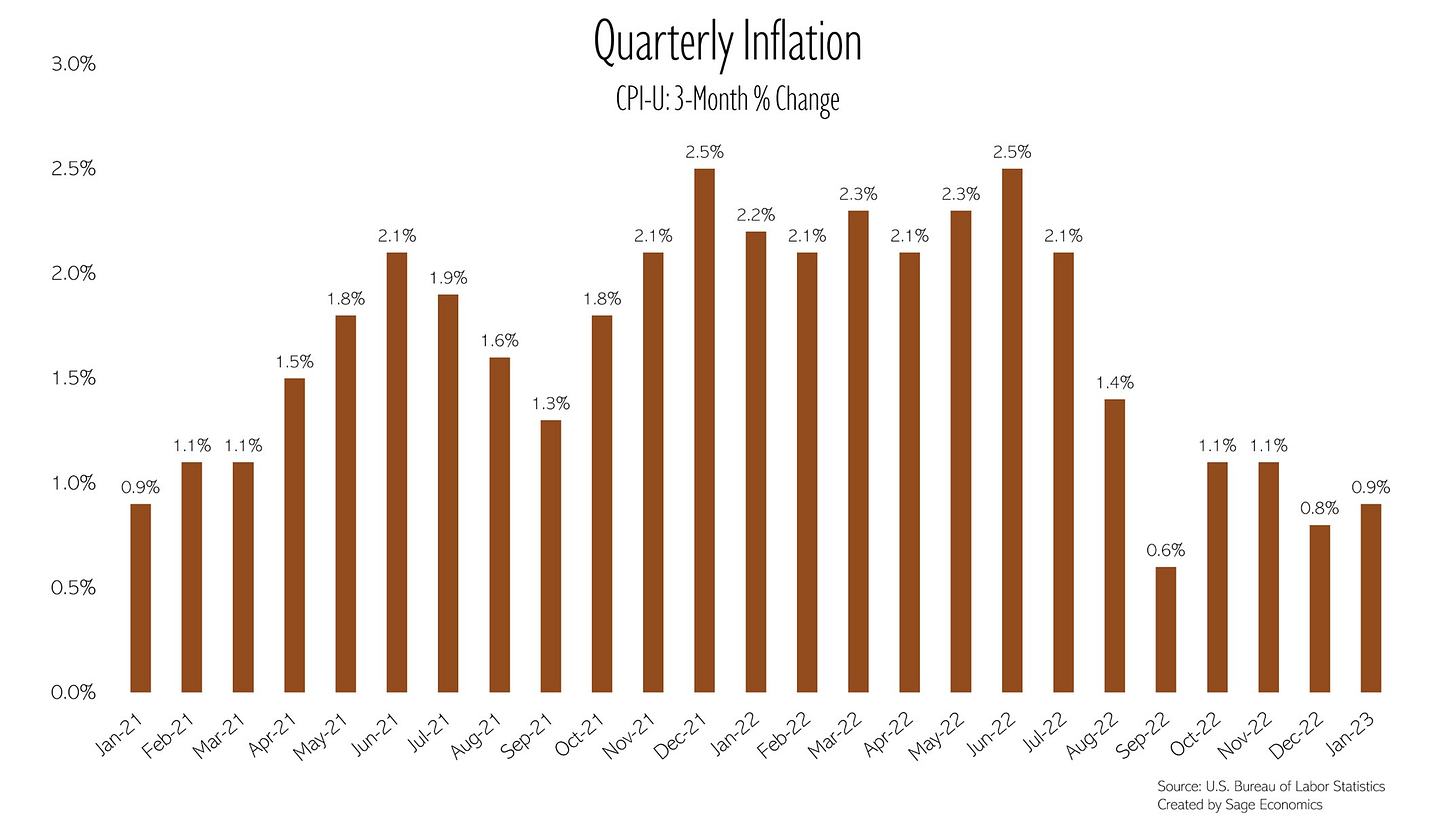

I don’t think it’ll take us that long to get back to 2%, but this isn’t an encouraging report. This, combined with hotter than expected hiring and retail sales data, suggest that higher interest rates: 1) aren’t impacting the demand side of the economy nearly as much as predicted; and 2) will have to be raised higher than previously expected and stay higher for longer.

Big picture, this report was a disappointment (though it met our expectations – we’ve been waiting for hot inflation reports and we got two this week). As you can see in the following three charts (which show 1-, 3-, and 12-month rates of inflation), inflation is decelerating, but not as fast as the Federal Reserve, and equity and bond markets, would like.

Digging into the data, we can see why consumers are so downbeat about the economy. Prices for food at home are 11.3% higher than they were one year ago. Energy is 8.7% more expensive. These two categories account for more than 15% of the average consumers expenditures (lower share for me because I buy so much Ravens’ merch). Even excluding these two categories (CPI minus food and energy prices is called core inflation), prices increased 0.4% for the month and are up 5.6% year over year.