Witch Burning Week in Review

Housing stats, Fed notes, & more

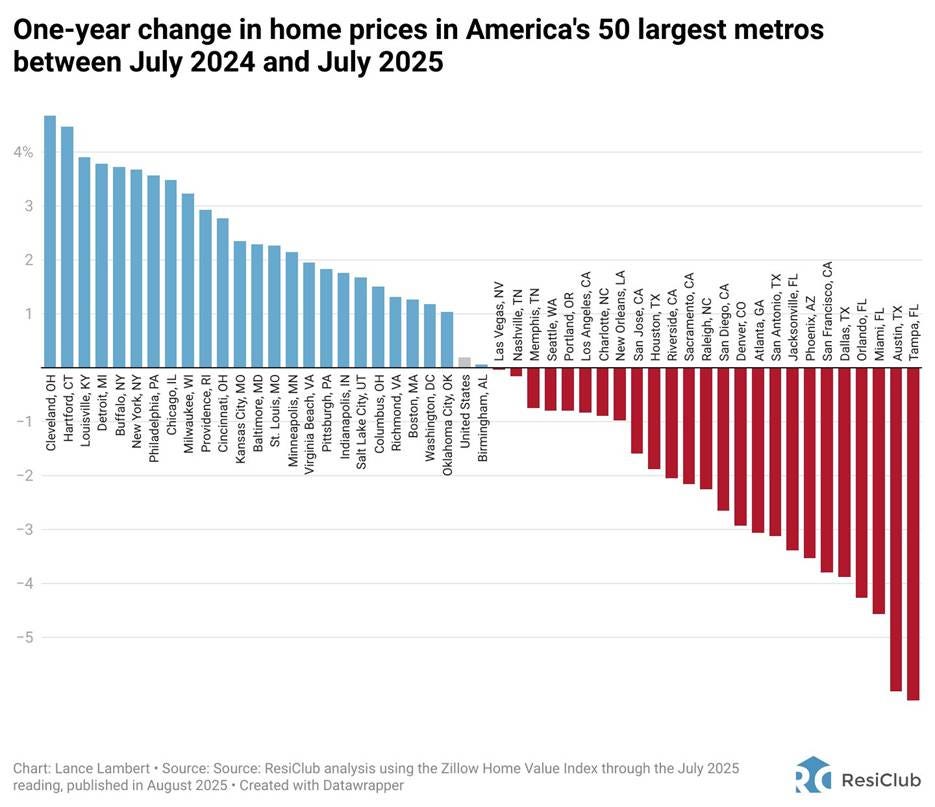

This week brought us a lot of housing market data, none of which was particularly upbeat. Of course, these data series are (mostly) national, and it’s important to remember that geographic variance can be both significant and surprising.

Really. If you traveled back in time to 2022 and told someone that Cleveland and Hartford would have hotter housing markets than the major cities in Texas and Florida, they’d probably burn you for being a witch.

Beyond the housing market data, we got some comments from the Fed, a mildly concerning update on unemployment insurance claims, and more.

Monday

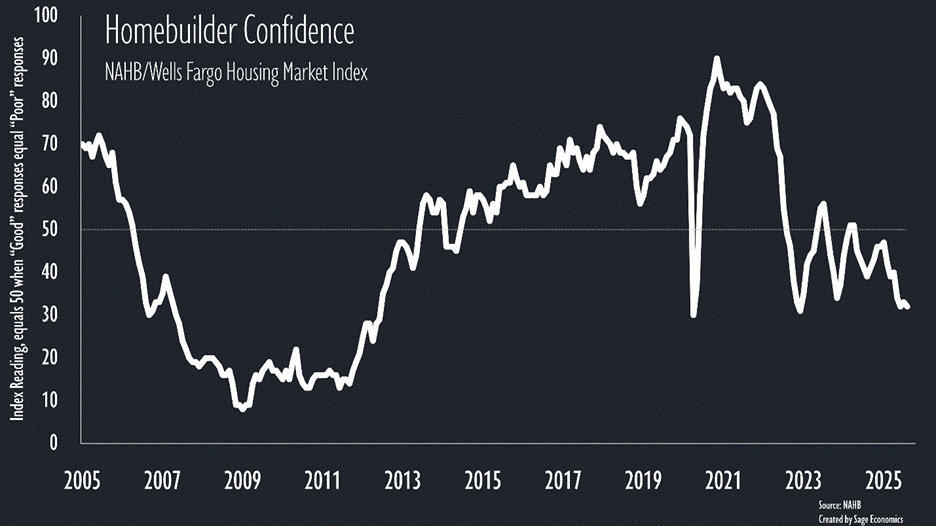

NAHB Housing Market Index

This measure of homebuilder confidence inched down again in August and is once again near the lowest level since 2012.

Of the three components to this index, homebuilders are the most pessimistic about the traffic of prospective buyers, and they continue to feel slightly better (though by no means good) about sales over the next six months than they do about the present.

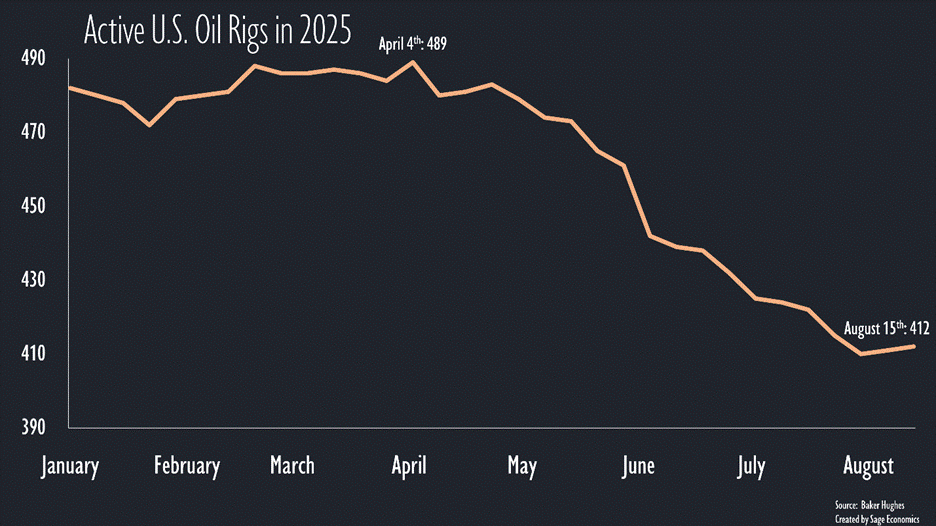

Oil Stuff (Baker Hughes Rig Count, Gas & Diesel Prices)

After 17 consecutive weekly declines, the number of active U.S. oil rigs has now increased in each of the past two weeks. Yes, it’s only increased by 1 rig per week, but let’s take the wins where we can get them.

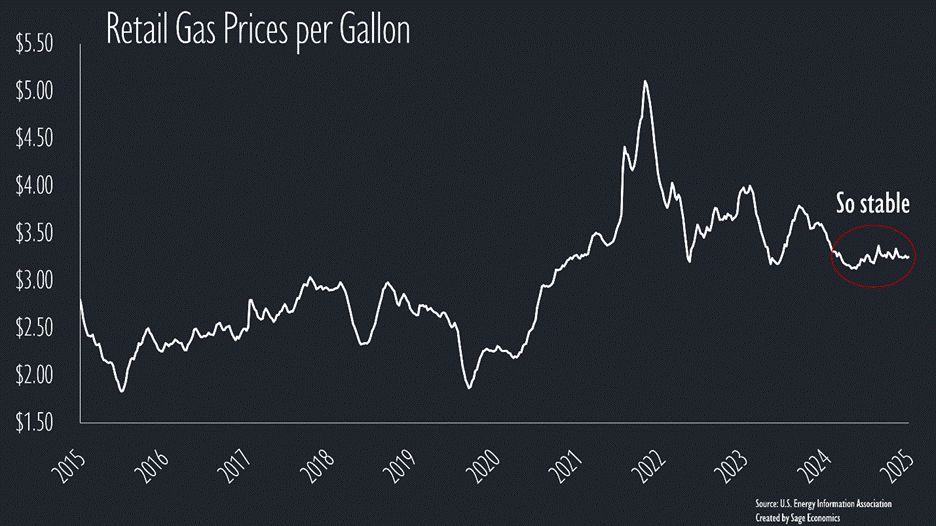

Gas prices crept up to a still low $3.25/gallon this week. One of the most remarkable aspects of the current economy is the stability of gas prices. Since September 2024, gas prices have been between $3.12 and $3.37 per gallon.

Diesel prices fell and are about $0.03/gallon higher than one year ago.

TSA Checkpoint Travel Numbers

The number of people flying remained just slightly ahead of year-ago levels, according to TSA data. As long as we don’t fall behind year-ago levels, there’s not much to see here.

Tuesday

New Residential Construction

We issued fewer permits to build new houses in July than we did in June, and permitting is down about 6% over the past year. The decline is almost exactly the same for single-family and multi-family units—it’s just not a good time to build housing right now, regardless of the type.

While permitting slowed, the number of new housing units started picked up in July, rising to the highest level since February. Despite the uptick, starts are still down considerably from the end of 2024.

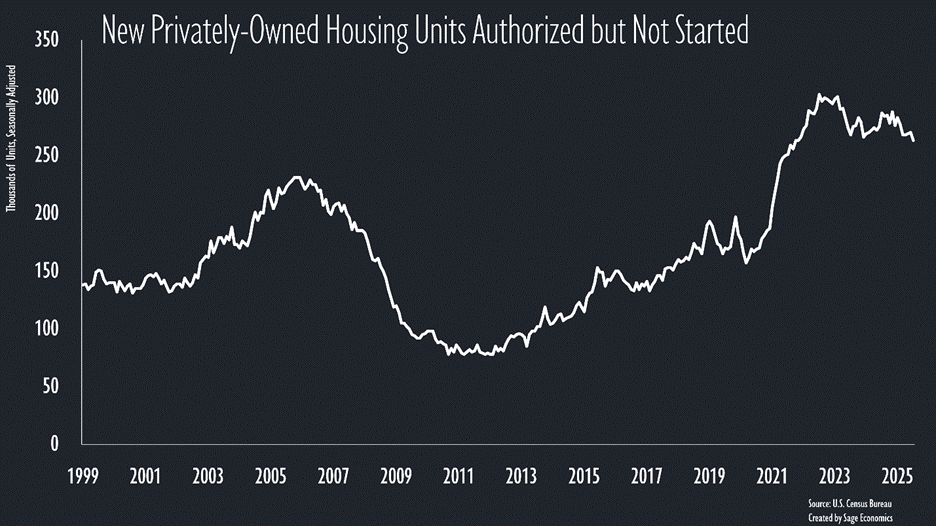

There are still a lot of housing units that have been approved (i.e., permit issued) but not yet started—about 100,000 more than there were right before the pandemic started. Notably, most (but not all) permits expire after 6-12 months, so this probably doesn’t reflect a glut of permits that were issued in 2022-23 but will never be built.