Yikes! A bad July Jobs Report

Weak job growth and big downward revisions spell trouble

This post is sponsored by KODIAK – Proven Workforce Solutions. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I trust and 2) addressing critical issues like skilled labor shortages in construction. KODIAK, which recently merged with Pivot, checks both those boxes. Their mission is to help construction companies find experienced talent, including engineers and project managers for Direct Hire, as well as skilled craft professionals like welders and electricians for contingent staffing. With over three decades of experience, I encourage contractors struggling to find workers to consider KODIAK.

Today’s jobs report was, in a word, bad.

U.S. employers added just 73,000 jobs in July, and May and June’s estimates were revised down by a combined 258,000 jobs. We’ve added just 35,300 jobs per month since May. Growth that weak has, historically speaking, only happened during recessions.

The unemployment rate inched up to a still low 4.2% in July. While that’s not bad, the underlying details are. The labor force has now declined in three consecutive months and is down 0.5% over that span.

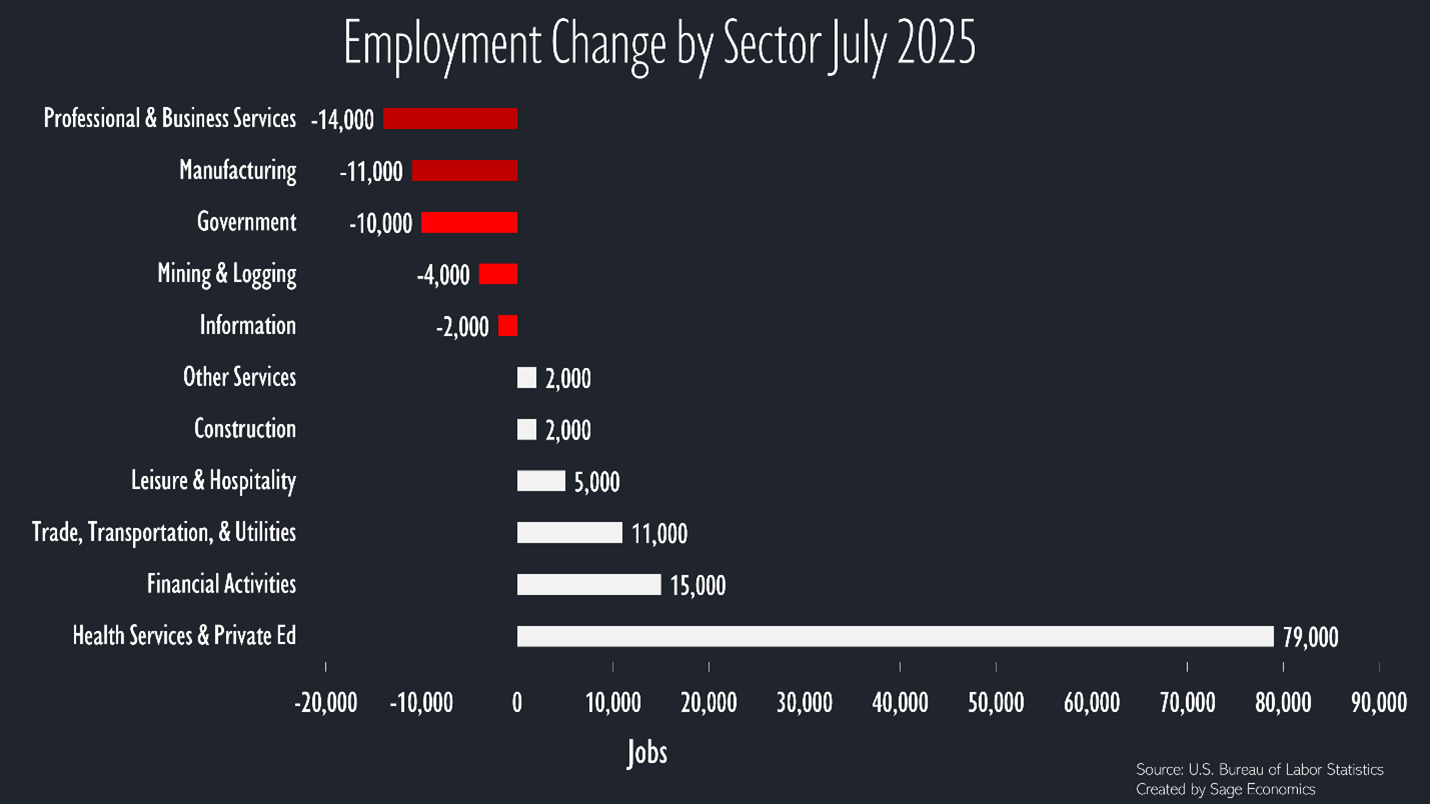

The employment situation would be even worse if the healthcare industry (which is not really affected by broader economic conditions) wasn’t adding jobs at a rapid pace.

Five segments lost jobs in July, led by the professional and business services category. While that sounds like white collar positions, most of the losses were in administrative services categories like staffing firms, landscaping, travel agencies, etc.

Manufacturing lost another 11,000 jobs for the month, and the anticipated effects of tariffs are starting to surface in the subindustry data. Metal manufacturing has added 1,000 jobs since April (what you would expect with higher taxes on steel, aluminum, and copper imports) while the rest of the manufacturing sector has lost 38,000 jobs over that span.

Today’s report is especially concerning, but it doesn’t look all that different from the first seven months of the year. Which is to say, these appear to be trends, not blips. At least there’s healthcare, right?

Maybe it’s not as bad as it seems?

Maybe! Labor supply growth is really slow. That is, obviously, not great, but it does mean that the number of jobs needed to keep the unemployment rate stable is significantly lower than what we’ve come to expect.

Viewed through that lens, you could see today’s report as weak rather than awful.

How about a silver lining?

This is a great report for anyone eagerly awaiting lower interest rates. Ten year yields have plunged about 15 basis points this morning and are down to levels not seen since June.

The upshot

The economy is in trouble, and not just because job growth has slowed. This week also gave us consumer spending data (weak), inflation data (hot), and a lot more.

Anirban will cover all that and more in Week in Review, our every-Friday post that covers everything you need to know about the economy in a breezy, five minute read. That’s just for paying subscribers. If that’s not you and you want it to be, just click the button below: