2025's Last Week in Review

Fast GDP growth, cheap gas, & more

Because it’s a Christmas-shortened week and our last of the year, today’s review—which covers GDP, jobless claims, consumer confidence, and more—is free for all subscribers.

If you missed our 2026 Economic Outlook, be sure to check it out.

Monday

TSA Checkpoint Travel Numbers

882 million people have gone through a TSA checkpoint through the first 356 days of 2025. That’s 3.9 million more than during the same period of 2024 (+0.4%).

This is a fairly good sign, and one that fits with the idea that the economy is solid for higher income households and bad for those on the margins.

Oil Stuff

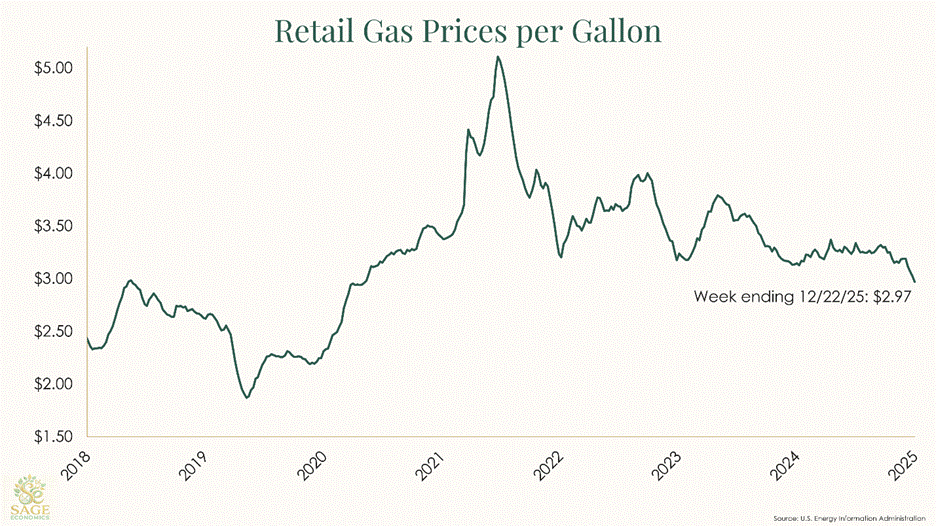

Gas prices fell to an average of $2.97 per gallon during the week ending 12/22 and are below $3.00/gallon for the first time since 2021.

The roughly $0.20/gallon plunge since late November ends a remarkable streak of price stability; the average cost of a gallon hovered between $3.15 and $3.37 for about 16 months.

Why the decline? Demand is lower this time of year, there haven’t been any weather-related supply disruptions, and we’re still producing a ton of oil.

Diesel prices also fell also fell this week and, at $3.54, are down nearly $0.30/gallon from one month ago.

Tuesday

GDP

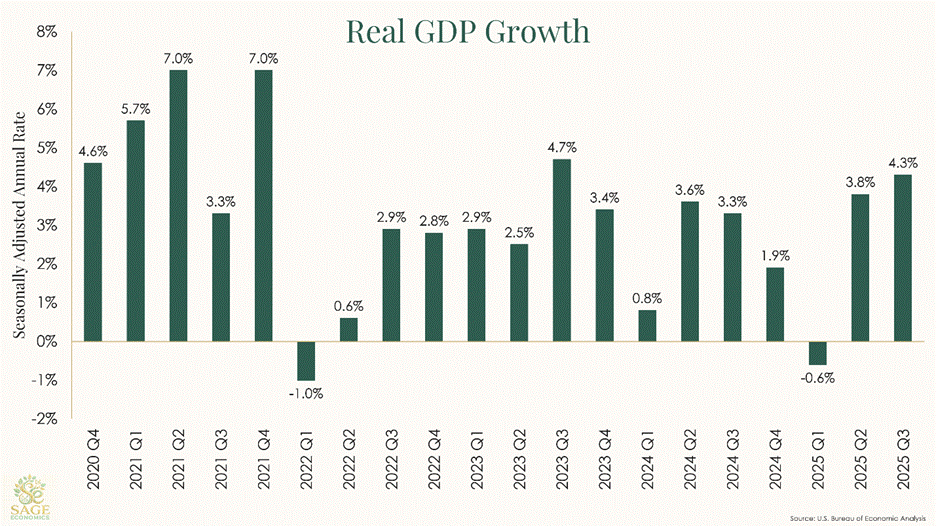

GDP expanded at a 4.3% annualized rate in the third quarter, according to the BEA’s first estimate.

On a scale of one to really fast, 4.3% annualized growth is really fast. There’s reason to think growth was actually a little bit slower than that, but even with downward revisions this should remain in the 3%+ range (3% would be fast, if not really fast).

This is good news!

This also clashes with a lot of other economic data. It’s hard to square 4.3% economic expansion with virtually nonexistent job growth and rising unemployment. A few possible explanations, all of which are speculative:

First: the economy is great for people with jobs and higher incomes, and they—boosted by really high stock prices—are powering growth. The consumer spending portion of GDP increased at a strong 3.5% annualized rate in Q3.

Second: there’s measurement error in GDP and/or labor market data, especially given the government shutdown (may explain some but surely not all or even most of the gap).

Third: productivity—output per hour worked—is rising. It’s really hard to measure productivity in the short term, but this is possible. Some people are claiming it’s AI-related productivity gains, but if I had to guess, I might point to slower labor force churn; new employees are less productive and make existing employees, who have to train them, less productive too.

Again, this is all speculative, and we won’t know anything certain about Q3 growth for a while. For now, the upshot is that the economy grew quickly in the third quarter.

Conference Board Consumer Confidence Index

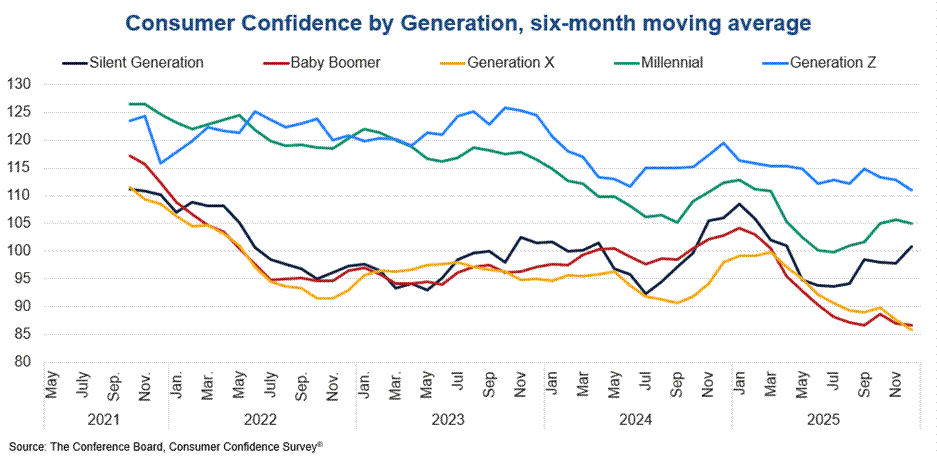

This measure of consumer sentiment fell again in December, and the drop was caused by a sharp decline in how consumers assess the current state of the economy (future expectations were unchanged). The most interesting part of this release is consumer confidence by generation.

Durable Goods Orders

New orders of durable goods—things that typically last at least 3 years—fell 2.2% in October, but I actually think this is a pretty okay release. Excluding transportation equipment (airplane sales are expensive and volatile), orders were up 0.2% for the month and 2.4% on a year-ago basis through the first 10 months of 2025. If we include transportation equipment, orders are up a strong 7.1% compared to the first ten months of 2024.

Not bad, especially given how manufacturing has struggled this year.

Wednesday

Mortgage Rates

Mortgage rates inched down to an average of 6.18% for a 30-year fixed. This is low compared to the rest of 2025, but here’s hoping for sub-6% rates in 2026.

Mortgage Applications

Mortgage applications fell 5.0% during the week ending December 19. I wouldn’t read too much into this because 1) seasonal adjustments are tough around the holidays and 2) mortgage apps are still way too low.

Jobless Claims

Initial jobless claims fell back to 214,000 this week, and continued claims for unemployment insurance remain relatively low.

Nothing to worry about here.

Thursday

Christmas

This was my first Christmas with a toddler. Kids make the holiday really special, but also really exhausting, so maybe I’ll get around to writing something about the economics of Christmas next year.

Friday

Nothing

Links of the Week

Feeding America is getting harder next year (Slow Boring)

How Accurate Are Learning Curves? (Construction Physics)

How to Track Santa (Statecraft)

Final Thoughts

After this week, my outlook for the economy is: Better

Strong GDP growth and no sign of rising layoff activity. What’s not to like?

Looking Ahead

Next week brings us updates on some housing stats, construction spending, and more.

GDP will be 5% in the first quarter. The economy is going to sizzle. Manufacturing is buying equipment preparing for a boom

Couldn't agree more; the sentence about the economy being solid for higher income households and bad for those on the margins, despite the positive travel numbers, is such a sharp analysis and really makes me think about the longer-term implications of that divison.