A Perfectly Fine Jobs Report

Employers add 177k jobs, unemployment rate flat at 4.2%

This post is sponsored by KODIAK – Proven Workforce Solutions. I wouldn’t accept a sponsor for this newsletter unless they were 1) a company I trust and 2) addressing critical issues like skilled labor shortages in construction. KODIAK, which recently merged with Pivot, checks both those boxes. Their mission is to help construction companies find experienced talent, including engineers and project managers for Direct Hire, as well as skilled craft professionals like welders and electricians for contingent staffing. With over three decades of experience, I encourage contractors struggling to find workers to consider KODIAK.

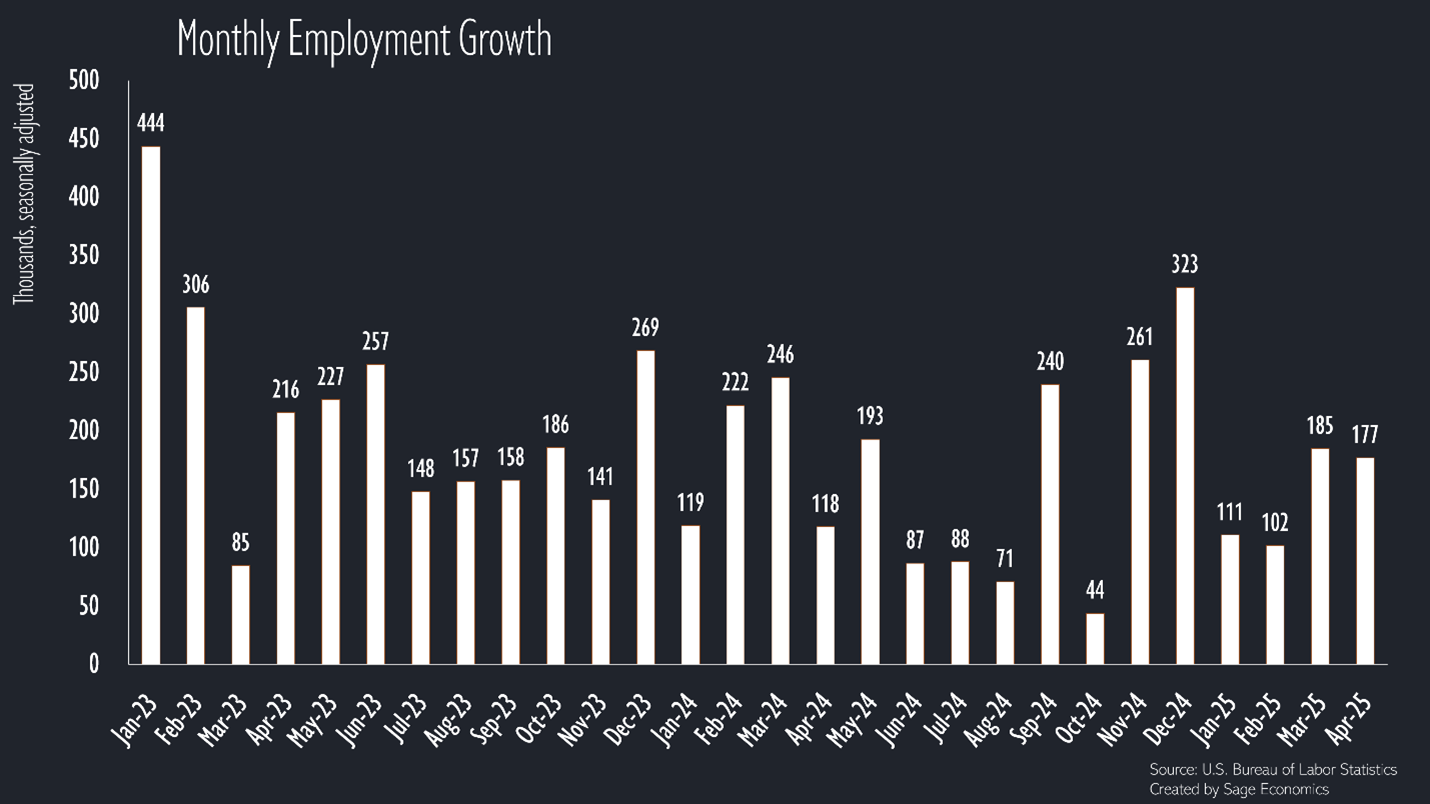

Today’s jobs report was perfectly fine, with U.S. employers adding a healthy 177,000 jobs in April—about 50,000 more than expected. While February and March’s employment estimates were revised lower by a combined 58,000 jobs, there’s not much to dislike in this report.

Digging just slightly into the details:

The unemployment rate remained unchanged at 4.2%.

The labor force grew, and the labor force participation rate rose to the highest level since January.

Wage growth slowed, and average hourly earnings are up just 3.8% over the past year (still faster than the pre-pandemic level but slower than over the past few years).

No real surprises by sector. Healthcare, a segment generally unaffected by broader economic trends, continues to add jobs at a rapid clip. Trade, transportation, and utilities (more on that below) and leisure and hospitality also posted strong job growth for the month.

While government employment grew by 10,000 jobs in April, that was entirely due to state and local government hiring. Federal employment fell by 9,000 and has now declined by 26,000 over the past three months.

But What About Tariffs?

We won’t really see tariff-related labor market effects until May’s jobs report, but there were a few early signs in April.

Transportation and warehousing employment surged by 29,000 jobs in April, and hours worked by transportation and warehousing employees spiked, as companies stocked up on imports ahead of the tariffs. Given the pretty dire reports from those inside the freight industry, this is a temporary bump.

Manufacturing lost 1,000 jobs in April. It’s fair to at least partially blame that on tariffs. Car manufacturing lost almost 5,000 jobs for the month, while fabricated metal manufacturing—a segment that likely benefits from tariffs—gained about 3,000 jobs.

The Upshot

The labor market was still healthy in April, but forecasters are pretty nervous about the next couple months as the effects of tariffs start to surface (check out our Consumer Tariff Strategy Guide if you missed it). With ports starting to look empty and container shipments from China down sharply, job growth is broadly expected to slow in the coming months.

What’s Next?

Anirban is currently working on Week in Review, our every Friday post that covers everything you need to know about the economy in a breezy five-minute read.

Week in Review is just for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.

How much “lag” is there in this data? It seems pretty amazing that on May 4th we can accurately get a read on jobs added from April 1st to April 30th when all other national economic data is 3-12 months behind