Bad Policy, Inflation, & More

Week in Review: Aug. 28- Sep. 1

I have been predicting that the economy would start pumping the brakes after Labor Day, and this week supplied ample evidence that growth is starting to slow. The question remains: will the economy keep chugging along, glide to a gentle stop, or go flying through the windshield? I’m still going with gentle stop, though a possible UAW strike has the potential to stop us short.

Monday

County Employment and Wages

325 of the country’s 360 largest counties added jobs over the past year. Midland County, TX, home to a large cluster of oil and gas production, experienced the biggest increase (+8.5%). Elkhart County, IN, which touts itself as “The RV capital of the world,” experienced the biggest decrease (-4.6%).

What should we take from this? With oil production near a record high, it’s a good time to be in the oil and gas industry. With interest rates at the highest level in decades, it’s a bad time to be manufacturing RVs.

Former POTUS has a Bad Idea

A certain former POTUS announced a plan to, if reelected, enact a 10% tariff on all imports. According to the Tax Foundation, this would directly amount to a greater than $300b tax on American consumers, shrink the U.S. economy by 0.7%, and destroy 505,000 full-time equivalent jobs.

[Before you cancel your subscription because I’m criticizing former POTUS, current POTUS has also been bad about tariffs from the perspective of those who still think something approaching free trade (fair trade is a must, too) is optimal. An area in which the last two presidents have been effective is in looking busy. As noted by the great George Costanza, “When you look annoyed all the time, people think you’re busy.” Well done you two!!!]

If the rest of the world retaliated with their own 10% tariffs on imports from America, the economy would shrink 1.1% and destroy an estimated 825,000 jobs according to the Tax Foundation.

This would be especially difficult for the construction industry. Input prices are nearly 40% higher than at the start of 2020, and a 10% across the board tariff would push the cost of delivering construction services even higher.

Gas Prices

Gas prices declined after rising in each of previous seven weeks and are now as low as they’ve been since the end of July.

Diesel Prices

Diesel prices increased for a sixth consecutive week, up another $0.09. They are at their highest level since early February.

TSA Checkpoint Travel Numbers

Some parts of the economy are slowing down, but the travel industry isn’t one of them. The number of people passing through TSA security during the week ending August 29th remained about 2.5% higher than during the same week in 2019.

Tuesday

Job Opening and Labor Turnover Survey (JOLTS)

The number of open, unfilled jobs declined to 8.8 million in July as demand for labor continues to slow. That’s the fewest job openings since March 2021, but is still about 1.8 million more than at the start of the pandemic.

As you can see below, the share of jobs that are unfilled has steadily declined but, at 5.3%, remains half a percentage point above the highest pre-pandemic level.

The quit rate returned to the prevailing pre-pandemic level of 2.3% in July, perhaps the strongest indication that labor market dynamics are normalizing. Employers, however, remain reluctant to fire employees. Just 1% of workers were laid off or discharged for the month, lower than during any month from the start of the data series in 2000 to the start of 2021.

Conference Board Consumer Confidence Index

Jerry Seinfeld once said, “I’m in the unfortunate position of having to consider other people’s feelings.” That’s true for us economists as well. Consumer sentiment plunged in August, wiping out gains from earlier summer months. The forward-looking component of this measure is well below its lowest points of 2020 and 2021. Yes, there are some economic problems right now, but come on people; the outlook isn’t worse than during the early months of the pandemic. It’s as if there are elections next year.

Home Price Measures

The S&P Corelogic Case-Shiller Home Price Index increased for the fifth straight month in June, up another 0.7%, bringing home prices to just below the all-time high established in June 2022. There’s lots of regional data in the release if you’re interested in what’s going on with your own specific market.

The FHFA Home Price Index showed similar dynamics, with prices up 0.3% for the month and 3.1% over the past year. That’s remarkable given the level of interest rates, which continue to hover above 7%. There are a lot of people with cash in America.

Wednesday

ADP Employment Report

According to payroll processing firm ADP, private-sector employment increased by 177,000 jobs in August, which is less than expected but still a healthy level of growth. Job gains were very much concentrated in the education and health services, trade and transportation, and leisure and hospitality sectors. The only segment that didn’t add jobs was financial activities.

ADP’s Pay Insights report shows that annual pay increases slowed in August, with pay up 5.9% for job stayers and 9.5% for job changers, though wage inflation remains way faster than before the pandemic.

U.S. Crude Oil Production

U.S. oil production remained at 12.8 million barrels per day during the week ending August 25th. That’s just below the highest level on record (13.1 million/day in February 2020), and it’s quite possible we break that record over the next few weeks, though Hurricane Idalia may have put a dent in those expectations.

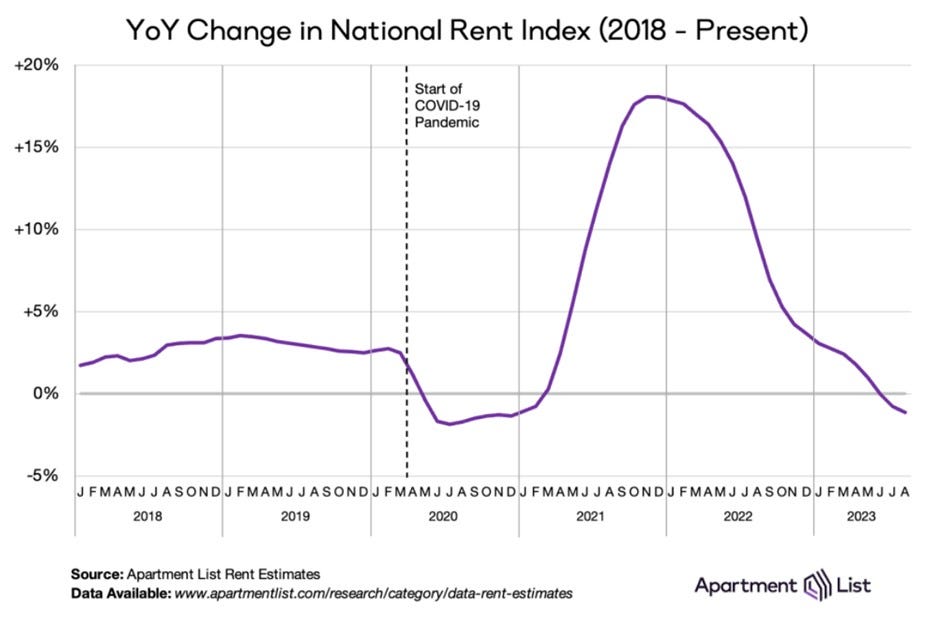

Apartment List National Rent Index

This measure of how much it costs to rent an apartment indicates that rents inched lower in August and were down 1.2% compared to August 2022. That’s pretty remarkable considering that the index peaked at +17.8% year over year in late 2021.

The apartment vacancy rate also inched up to 6.4% in August. That’s still below the 6.8% cyclical peak in mid-2020 but well above the cyclical low point of 3.9% in October 2021. With vacancy rates rising and a record number of multifamily units under construction, rents should remain well-behaved in coming months from a renter perspective.

This bodes well for inflation. The shelter component of the Consumer Price Index, which tends to lag actual changes in housing costs for technical reasons, was up 7.7% year-over-year in July. Because shelter is about 35% of the basket of goods considered by CPI, moderating rents could go a long way toward bringing down inflation.

Pending Home Sales

Pending home sales, which is predictive of actual home sales a few weeks down the road, surprised to the upside in July, rising 0.9% for the month. Despite the uptick, pending sales are down 14% year over year and remain low by historical standards.

Mortgage Applications

After falling to its lowest level in nearly 30 years last week, mortgage applications rebounded, up a modest 2.3% this week. Interest rates are still high, and homebuying activity remains suppressed. The lack of inventory available for sale, however, helps keep sales prices pushing higher.

Thursday

PCE Price Index

The PCE Price Index, the Fed’s preferred measure of inflation, increased 0.2% in July and is up 3.3% year over year. Over the past three months, headline inflation has increased at a 2.1% annualized rate. If that keeps up (a big “if”), the Fed won’t raise rates again during this cycle. That likely helps explain why bond yields have been diving lately.

Core prices (excludes food and energy because they’re volatile and susceptible to non-economic forces like Vladimir Putin) also increased 0.2% for the month and are up 4.2% since July 2022. The Federal Reserve pays more attention to core prices, but given the shelter discussion above, there is reason to believe that core inflation will also be well behaved going forward.

On the other hand, wage pressures remain, impacting service cost delivery in particular. The monthly increase in prices was entirely due to rising services prices (up 0.4%). Goods prices, down 0.3% in July, have now fallen during each of the past three months. I continue to believe that inflation will remain sticky given wage dynamics. Watch out for that possible UAW strike, which will begin to dominate the business news during the days ahead.

Personal Income, Expenditures, & Saving

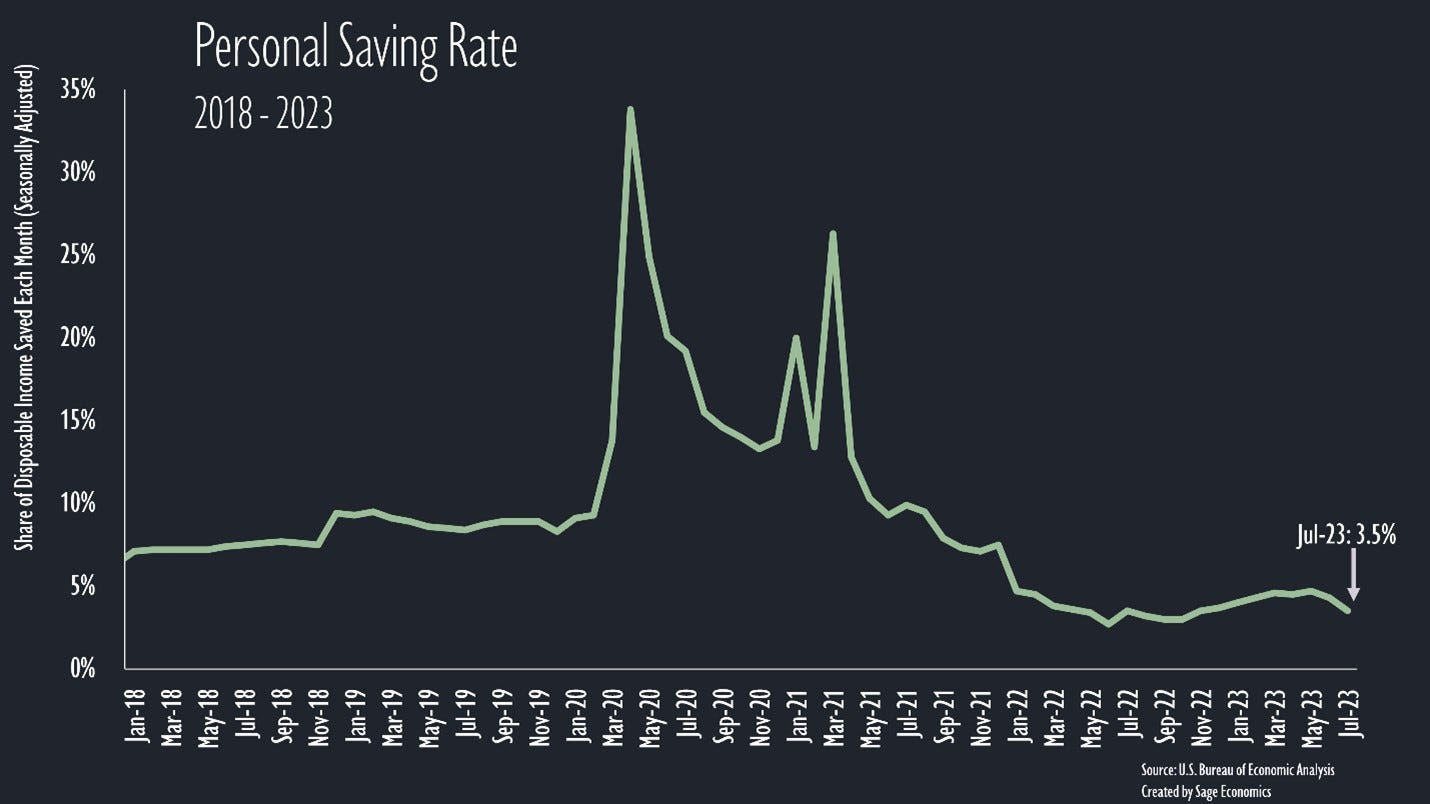

Personal income increased 0.2% in July, which is about what was expected. Personal spending increased 0.8% in July, which is faster than expected. Disposable income was unchanged for the month in nominal terms, but down 0.2% after adjusting for inflation. Consumers are having a great summer, but that increasingly looks like it will lend itself to an autumn hangover. They simply don’t have the wherewithal to keep spending this way.

When spending rises faster than income, savings decline. That’s exactly what happened in July, when Americans saved just 3.5% of their disposable income. That’s the lowest savings rate since November and lower than in any month from 2009 to 2021.

Mortgage Rates

Average mortgage rates fell, ending a streak of five straight weekly increases. At 7.18% for a 30-year fixed, rates are still elevated, just below last week’s multi-decade high.

Jobless Claims

Initial jobless claims fell again, down to 228,000 for the week ending August 26. So the demand for labor is clearly falling, but it has yet to cause a visible uptick in unemployment. Continued claims for unemployment insurance ticked higher, but remain below both the Q2 peak earlier this year and the pre-pandemic level.

Friday

Jobs Report

U.S. payroll employment increased by 187,000 in August, about 15,000 more than expected. The unemployment rate jumped to 3.8%, still extremely low by historical standards, but also the highest rate since February 2022. You can read our full coverage of this in Zack’s post from earlier today.

Construction Spending

Construction spending increased 0.7% in July and is up 5.5% year over year. That annual increase has everything to do with nonresidential activity. Residential construction spending is actually down about 5% over the past year. Single-family construction has plummeted (-15% past year) while multifamily activity has surged (+25%).

Nonresidential construction spending continues to be powered by a surge in manufacturing-related activity. In July, spending in that category reached an annual rate of $200 billion, which is quite frankly difficult to even contemplate after decades of offshoring. I like it.

Spending declined in quite a few publicly financed categories for the month, which is surprising given the recent infrastructure package and other public investment acts. Expect public-related spending to rebound in coming months.

ISM Manufacturing PMI

This measure of manufacturing activity indicates that the industry contracted for a tenth consecutive month in August. Given the recent trend of soft demand for goods but elevated demand for services, this checks out. It’s part of that rolling recession story people talk about, with certain segments of the economy suffering from their own idiosyncratic downturns.

Links of the Week

Nicholas Bloom predicts a working-from-home Nike swoosh (The Economist)

BRICS is fake (Noahpinion)

“Invisible Killer”: Seasonal Allergies and Accidents (NBER Working Paper)

Final Thoughts

After this week, my outlook for the economy is: Unchanged

I’m still predicting recession (a soft one) to begin within the next 6-8 months. A lengthy UAW strike would result in recession sooner rather than later. Hiring is slowing, bank credit is tightening, consumers have been overspending, student loan payback is recommencing, the global economy is weakening, and the Federal Reserve is not ready to begin reducing rates.

Looking Ahead

Next week is all about having a great Labor Day, but also a few measures of activity in the service sector.