Construction Trend Tuesday (#18)

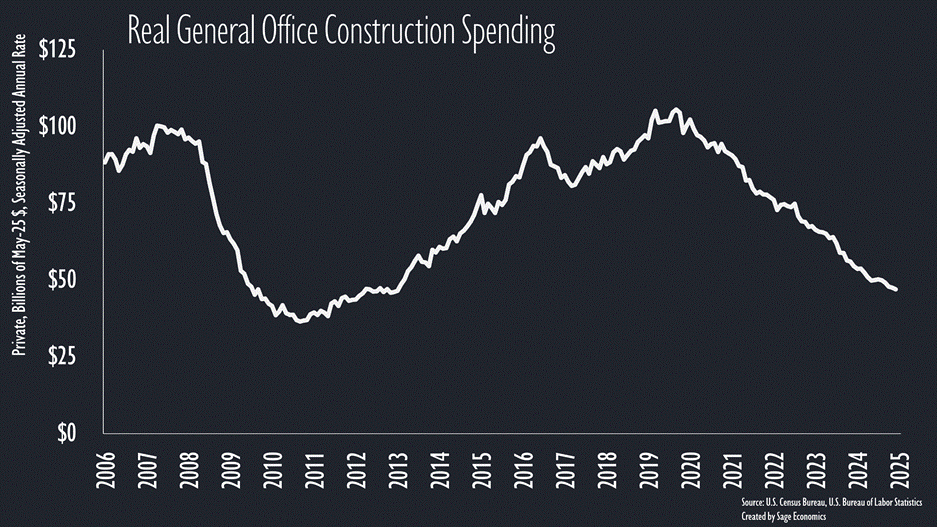

Office construction continues to slide

Construction Trend Tuesday covers one (hopefully) interesting industry trend in a quick, two minute read. You can access the archive of CTT posts here.

Inflation adjusted1 spending on office building construction has plunged about 55% from the February 2020 all-time high and is approaching levels not seen since the Great Recession.

There’s been an even sharper decline in terms of new square footage being built, with just 22 million sq. ft. under construction in Q1 2025, according to CBRE. That’s down about 80% from early 2020 levels.

Some of this slowdown reflects broad-based headwinds (high rates, uncertainty, etc.), but the bigger issue is remote work. Over half of employees with a bachelor’s degree (or more) worked from home in 2023. While that share has likely fallen over the past 1.5 years, it’s not going back to 2019 levels.

Which is to say, an imminent rebound in office construction activity appears unlikely.

What’s Next

This week has already delivered several new developments on the tariff front, and we’ll also get updates on small business confidence, consumer credit, and some housing market indicators. We’ll cover that and a whole lot more in Week in Review, our every-Friday post that briefs you on all the economic news and data in a breezy, five minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.

This is adjusted by the Producer Price Index for New Office Building Construction (rather than general CPI or PCE Price Index) to better reflect how much office space is actually being built per dollar spent.

A. I. is also likely to be a factor in future new office construction as more jobs are automated and people are laid off.