Healthcare construction's weakening vital signs

Construction Trend Tuesday (#24)

Construction Trend Tuesday covers one (hopefully) interesting industry trend in a quick, two minute read. You can access the archive of CTT posts here.

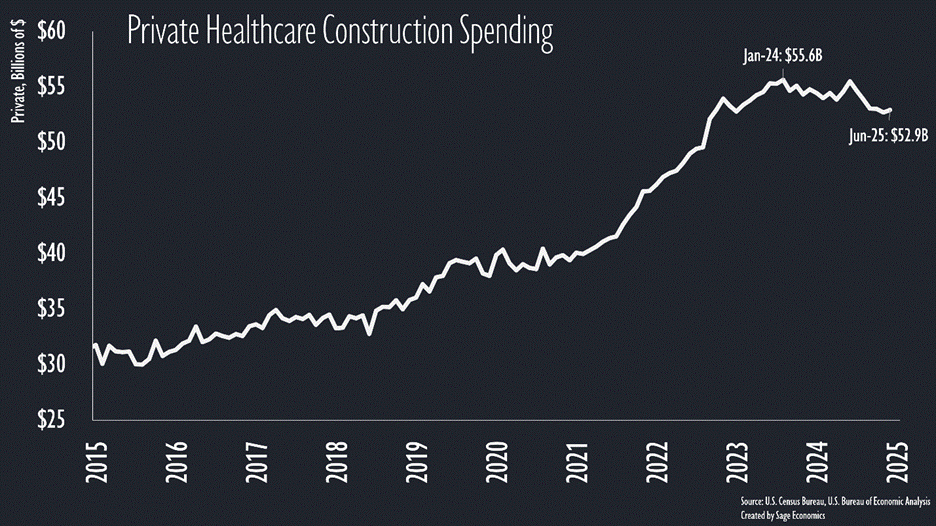

Healthcare construction spending, which had been a leading source of contractor opportunity, has stagnated since the start of 2024, falling by about 5% over the past 18 months.

This is a little surprising, though not because of broader industrywide momentum (aside from data center projects, there isn't much industrywide momentum). Rather, sinking healthcare construction activity is surprising because healthcare hiring is quite literally keeping the labor market afloat.

Really. The economy would be in critical condition if not for the healthcare segment. Over the past 2.5 years, healthcare employment has expanded more than 9%, severely outpacing all other segments. Put another way, healthcare has accounted for one third of all job growth since the start of 2023.

What gives? Healthcare construction boomed in 2023 and 2024, and that was due to a few factors:

Pandemic stimulus.

Projects that were delayed during the worst of the pandemic.

Demographic trends (an aging population).

While the demographic drivers remain in place, the pandemic-related ones are gone. That, plus the rising cost of delivering healthcare services, has left less capital for healthcare infrastructure investment.

Looking at it by segment, medical building (doctor and dentist offices, outpatient clinics, etc.) construction surged starting around 2020 and, despite a slight pullback over the past few years, has grown from about 22% of healthcare construction in 2015 to 38% as of June 2025.

While hospital construction has come to represent a smaller share of the segment’s overall activity, it has posted steady growth over the past two years even as medical building construction slows.

Chalk this up to the fact that hospitals are less cyclical than other segments (i.e., people are going to use hospitals regardless of macroeconomic conditions). Your local dentist office, on the other hand, might wait for lower rates to expand.

What’s Next

This week is all about housing data. We’ll dive into that and more in Week in Review, our every-Friday post that covers all the economic news and data in a breezy, five minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.