Jobs, Other Job Stuff, & More

Week in Review: Sep. 2-6

It’s good that I’m not graded on this stuff. Trying to predict economic outcomes is always tricky, but it’s difficult to simply characterize what’s going on right now. Massive revisions to data do not help, but neither does the fact that the data fail to tell a consistent tale.

This week was all about labor market indicators, which is fitting for the week of Labor Day. You can read Zack’s detailed overview of today’s BLS jobs report here (free for all subscribers).

Monday

Labor Day

Check out our brief Labor Day post.

Tuesday

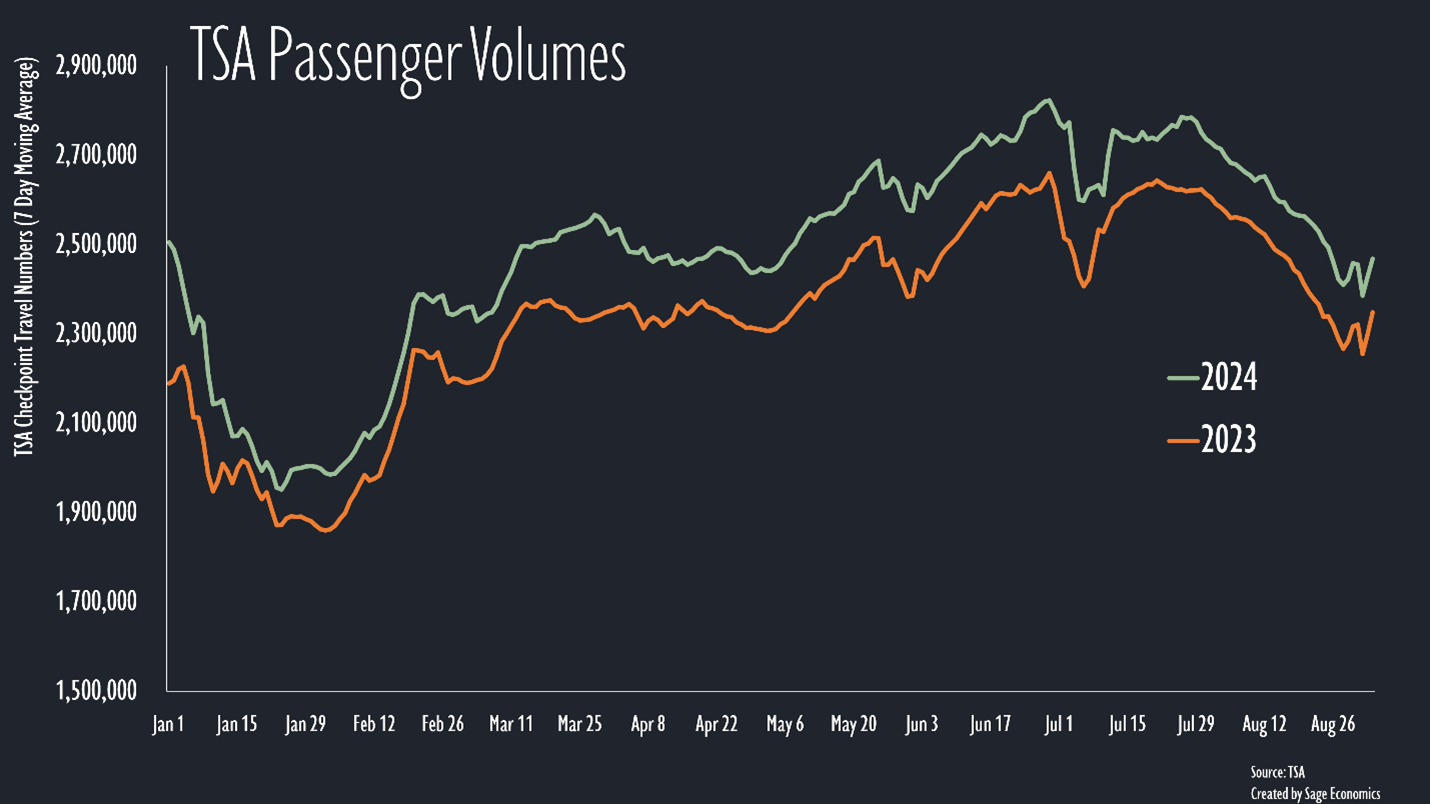

TSA Checkpoint Travel Numbers

Travel volumes rebounded for Labor Day, according to TSA data, and are trending about 5% above 2023 levels. That’s impressive, because 2023 was an excellent year for travel.

ISM Manufacturing PMI

The manufacturing sector contracted for a fifth consecutive month in August, albeit at a slower rate than in July, according to this survey of industry managers. This was still a disappointing release, and markets fell as a result.

Construction Spending

Construction spending fell in July, with residential down 0.4% and nonresidential down 0.2%. Housing construction is in the process of a pretty big slowdown (from 17-year highs earlier this summer), so residential spending should continue to trend lower.

Private nonresidential spending fell 0.4% while public nonresidential increased 0.2%. It’s very possible that Hurricane Beryl reduced spending for the month, but there’s also some weakness here as high interest rates weigh on activity, including in the form of diminished project starts.

Gas Prices & Diesel Prices

Gas prices fell to an average of $3.41/gallon, the lowest price since February. Diesel prices fell again and, at $3.62/gallon, are at the lowest level in nearly three years. That is great news for consumers and will help fuel (see what I did there?) spending on other items.