Mini Week in Review

Putting a bow on the last week of 2025

We sent out 115 posts totaling approximately 80,000 words in 2025. That’s a novel’s worth of economics coverage. Thanks for sticking with us, and more to come in a hopefully-calmer 2026.

2025 ended with a mercifully quiet week on the economic data front. Because this Review is so short, we’re making it free for all subscribers.

Monday

Pending Home Sales

November was the best month of 2025 (when seasonally adjusted) for pending home sales, which hint at what actual home sales will look like a month or two down the road. Like we said in our 2026 outlook: homebuying conditions will be much improved this year.

TSA Checkpoint Travel Numbers

About 921 million people went through a TSA checkpoint in 2025, 0.5% more than in 2024. All things considered, not bad.

Oil Stuff

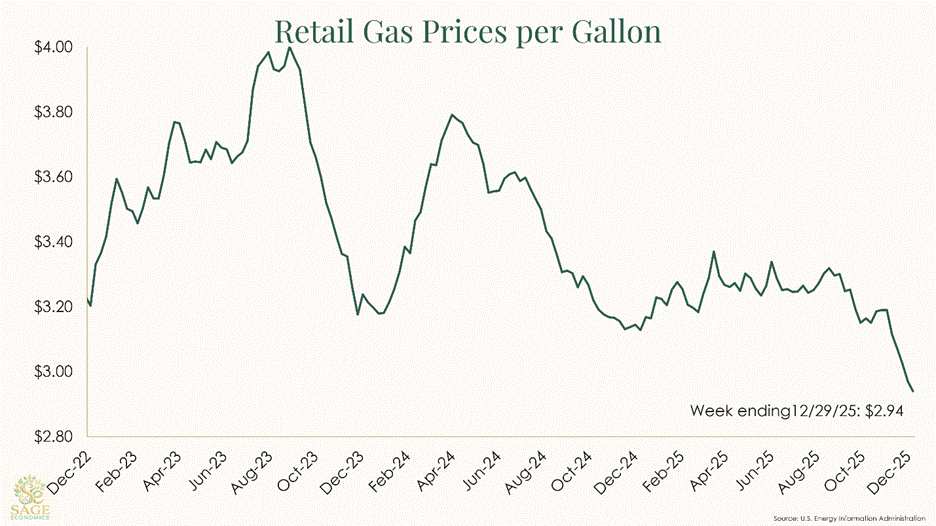

Gas prices fell to an average of $2.94/gallon during the last week of the year. This is cheap and should give consumers a little boost heading into the new year.

Diesel prices also fell this week and despite trending lower over the past several weeks are exactly the same as one year ago.

Tuesday

S&P Case-Shiller Home Price Index

Home prices rose just 1.36% from October 2024 to October 2025. That’s the smallest year-over-year increase in more than two years. With inventory levels at their highest since 2019 and rising, housing price growth should remain tame over the next few quarters. Many regions have experienced recent declines in home sales prices.

FOMC Minutes

The Fed’s members are deeply split on the timing of future cuts, according to minutes from their December meeting. This isn’t terribly surprising, especially given the state of economic data—delayed and caveated—coming out of the federal government shutdown. The upshot is that there’s a lot of uncertainty surrounding interest rate. Zack expects 3-4 cuts in 2026, while Anirban is sticking with the bond market (2 cuts).

Wednesday

Mortgage Rates

Mortgage rates fell during the last week of the year, with the average 30-year fixed down to 6.15%. That’s the lowest level since October 2024. There’s reason to think that 6% is a psychological threshold, below which would-be buyers become actual buyers.

Jobless Claims

Initial jobless claims fell to an extremely low 199,000 during the week ending 12/27. Continuing claims for unemployment insurance also remain low. While this series can be wonky during holiday weeks, one thing is clear—layoff activity remains low heading into the new year.

Thursday

New Year’s Day

No data releases today. If you need something to read during college football commercials, there’s always our 2026 Outlook.

Links of the Week

The 51 biggest American political moments of the 21st century (Silver Bulletin)

Autism Hasn’t Increased (Marginal Revolution)

Ten things that are going right in America (Noahpinion)

Final Thoughts

After this week, Anirban’s outlook for the economy is: Meh

This year should be another year of growth, particularly in certain corporate segments. Artificial intelligence will continue to dominate the headlines, but instead of focusing on NVIDIA and data center developers, more attention will be paid to companies that are successfully generating productivity gains and expanded profitability by exploiting available use cases. Consumer behavior could meaningfully deteriorate as tariffs and immigration policy put upward pressure on costs and the labor market continues to generate very soft job growth.

After this week, Zack’s outlook for the economy is: Better

There are a lot of reasons to worry about the economy in 2026 (some listed above), but layoffs are low, there are small signs of life from the housing market, and we’ll get a nice boost from larger tax refunds during the first few months of the year. What can I say? I’m an optimist.

Looking Ahead

Next week brings us a critically important jobs report, among several other data releases.

I’d say things are looking up!

The Progessives’ “affordability” story appears to be unraveling:

1. Home sales will be ticking up

2. Mortgage rates are ticking down

3. Employment is ticking up

4. Energy costs ticking down

5. GDP surging up

6. Inflation down

2026 is going to be a great year!