Tariffs and Uncertainty

The White House slapped 25% tariffs on Canada and Mexico on Tuesday morning. Since then, Secretary of Commerce Howard Lutnick:

Said that Trump might remove the tariffs today (Wednesday).

Then he called Doug Ford, the premier of Ontario to make a deal.

And now he says Trump will make an announcement on tariffs this afternoon, during which he might cut tariffs in some sectors.

So the situation is fluid, and we’re not going to dive into the details. Not when they’re likely to change within minutes of us hitting “send.”

This uncertainty is mildly frustrating for an economic newsletter writer. It must be rage inducing for anyone who has to source inputs from international sellers.

Consider a manager at a fertilizer factory. The U.S. gets about 95% of its potash, a key ingredient for fertilizers, from Canada.1 If potash accounts for between a quarter and a third of fertilizer by price, the tariffs would raise that factories input costs by about 6-8% (on top of any tariffs paid on other inputs).

The manager could look to buy potash from another country, but that would probably have to be Russia or Belarus. Setting aside the many problems with that idea, is it even worth exploring new sourcing options? There’s another White House announcement on tariffs coming this afternoon.

And what if that announcement is that the tariffs will stay in place on potash, but they’ll be reconsidered in another month? Another two months?

My guess is that the manager raises prices and passes as much of the cost increase on to farmers as they can (the farmers will in turn pass the costs on to food manufacturers and consumers).

While the dust is settling—if the dust settles—that manager is unlikely to make any hiring decisions, not until they know how the tariffs will affect their margins and sales. They certainly aren’t committing to any large capital investments.

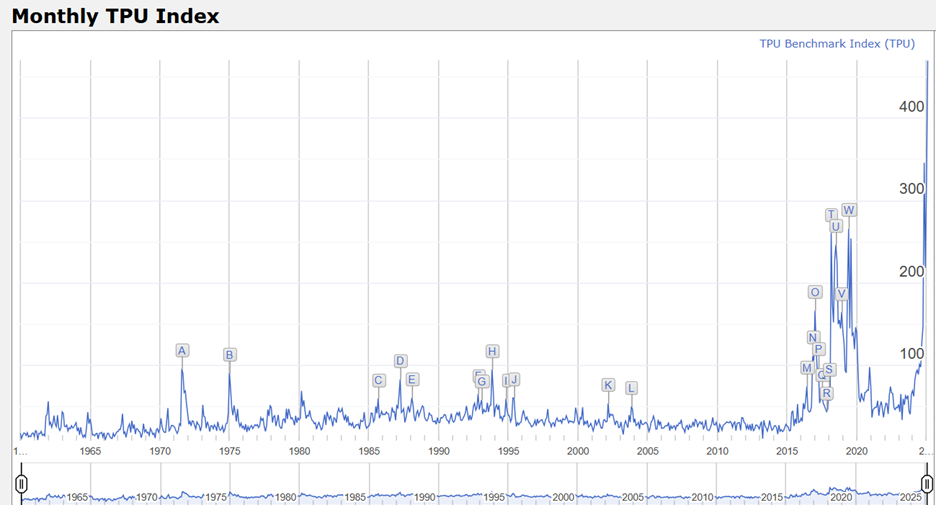

Uncertainty is crippling for U.S. businesses, and we’ve never seen this level of trade uncertainty—at least not over the past 65 years. The monthly Trade Policy Uncertainty index spiked to the highest level ever recorded in February, surpassing the previous peak set during the early months of the pandemic.

Final Thoughts

I think David Kelly, JPMorgan’s Chief Global Strategist, summed it up nicely:

The trouble with tariffs, to be succinct, is that they raise prices, slow economic growth, cut profits, increase unemployment, worsen inequality, diminish productivity and increase global tensions. Other than that, they’re fine.

For what it’s worth, markets seem to agree. The S&P 500 is now lower than it was the day after the election. Yes, ten year treasury yields are down, suggesting interest rates might fall sooner than previously expected, but that’s due to fears of slower growth.

What’s Next

We’ve had a few straight weeks of underwhelming economic data, and that makes this week’s jobs report a critically important one. We’ll cover that and a whole lot more in our every Friday Week in Review post. That’s just for paying subscribers. If that’s not you and you want it to be, just click the button below.

I am in no way an expert on potash or fertilizer, so take this example seriously, not literally.