Three Thoughts on Tariffs

Graphs, China, & Tantrums

The Most Important Tariff Graph

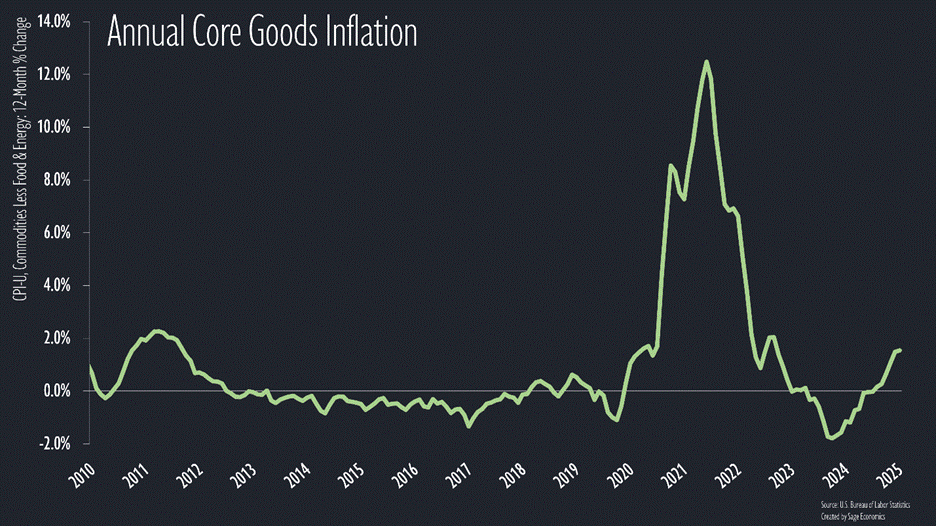

There’s no shortage of fascinating and/or terrifying tariff-related graphs. This is the one I’m most interested in right now.

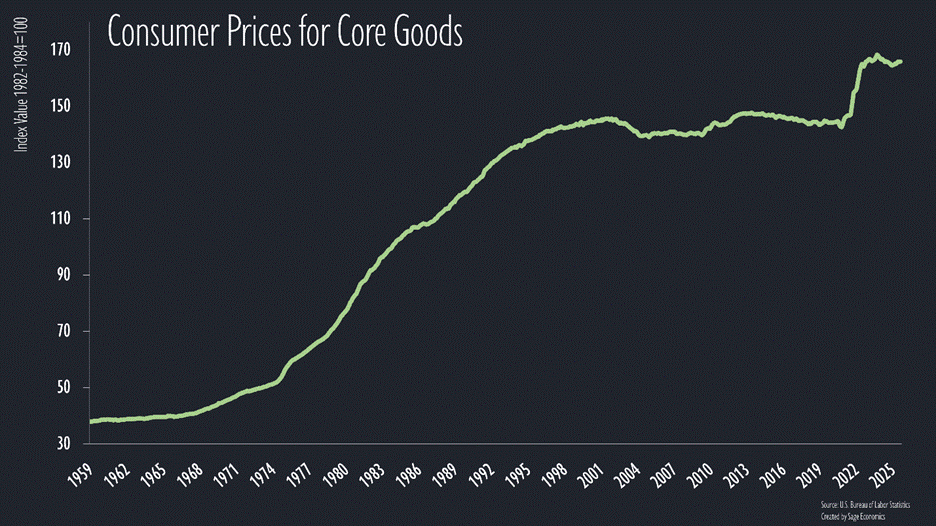

Consumer prices for core goods (things other than food and energy) are up 1.5% over the past year. Yes, that’s a tiny blip compared to what we saw in 2022 when supply chain problems sent goods prices soaring.

It’s also an unusually large increase by post-2000 standards; core goods prices were essentially unchanged from 2001 to 2021.

The worrying part: the pace of increase has accelerated since Liberation Day, with core goods prices rising at a 2.7% annualized rate since May.

If that picks up—pretty likely given the timing of tariffs—consumers will be faced with rising goods prices for the second time in a four year span. After a few decades of stable or falling goods prices, that won’t sit well.

China-U.S. Trade War Deescalates (Again)

The recent flare up in China-U.S. trade tensions appears to be resolved after we reached a framework for a trade deal with Beijing on Monday. This could still go belly up (and probably will again at some point), but for now the threatened 100% additional tariffs on Chinese imports appear to be off the table. As Reuters notes, we’ve been right here several times before.

Bolstering our supply chains for key commodities like rare earths is one of the better justifications for tariffs, but the China saga will likelier than not end—if it ends—with them just agreeing to buy our soy beans again.

Reagan Ad Leads to Higher Tariffs

The Republican president of the United States just slapped 10% additional tariffs on Canadian imports because Ontario ran a commercial quoting Ronald Reagan on tariffs.

Three points on this:

If you had a time machine and went back to virtually any point from 1990-2015, it would be impossible to convince anyone that this actually happened.

This undermines the argument that the tariffs are meant to address the trade deficit, or fentanyl, or any of the other alleged national emergencies used to justify them. I imagine it will come up at the looming Supreme Court hearing on that exact subject.

These tariffs (if they remain in place) amount to a roughly $40 billion tax on Americans, implemented because of a commercial. What are we doing here?

What’s Next

With the government still shut down, this week will be all about housing stats, another Fed regional manufacturing survey, and probably some additional developments on the tariff front. We’ll give you everything you need to know in Week in Review, our every-Friday post that covers all the economic news and data in a breezy, five minute read.

Week in Review is only for paying subscribers. If that’s not you and you want it to be, just click the subscribe button.

Many of us are with you in asking that question, "What are we doing here?"