Week in Review: Dec. 2-6

Job stuff, construction spending, & more

This week was loaded with economic data releases, including on construction spending, the services and manufacturing sides of the economy, jobs openings, consumer confidence, employment growth (our earlier post on that, free for all subscribers), and more.

In other news, the Microsoft Excel World Championships were this week (video here). I’m not sure what’s better, the Excel-specific lyrics of the theme song or the announcers’ excitement during the last 30 seconds (skip to 6:41:40 in the video).

Monday

Construction Spending

Construction spending increased pretty sharply in October, but that was all due to a large rise in residential renovation and repair work. I think it’s fair to chalk that up to the effects of hurricanes Helene and Milton. Those storms also stalled a lot of nonresidential projects. Nonresidential spending fell in October and is up just 3.9% over the past year. That’s the smallest annual increase since December 2021.

If storms are actually behind this month’s spending dynamics, expect a rebound in nonresidential activity in November’s data.

ISM Manufacturing PMI

Manufacturing activity shrank for the eighth straight month in November, according to this survey of industry managers. The good news is that it shrank at a slower rate than in October. The other good news is that new orders increased for the month and the rate of price increases slowed. The bad news (other than the whole shrinking activity thing) is that electrical components were in short supply for the 50th (!!) straight month.

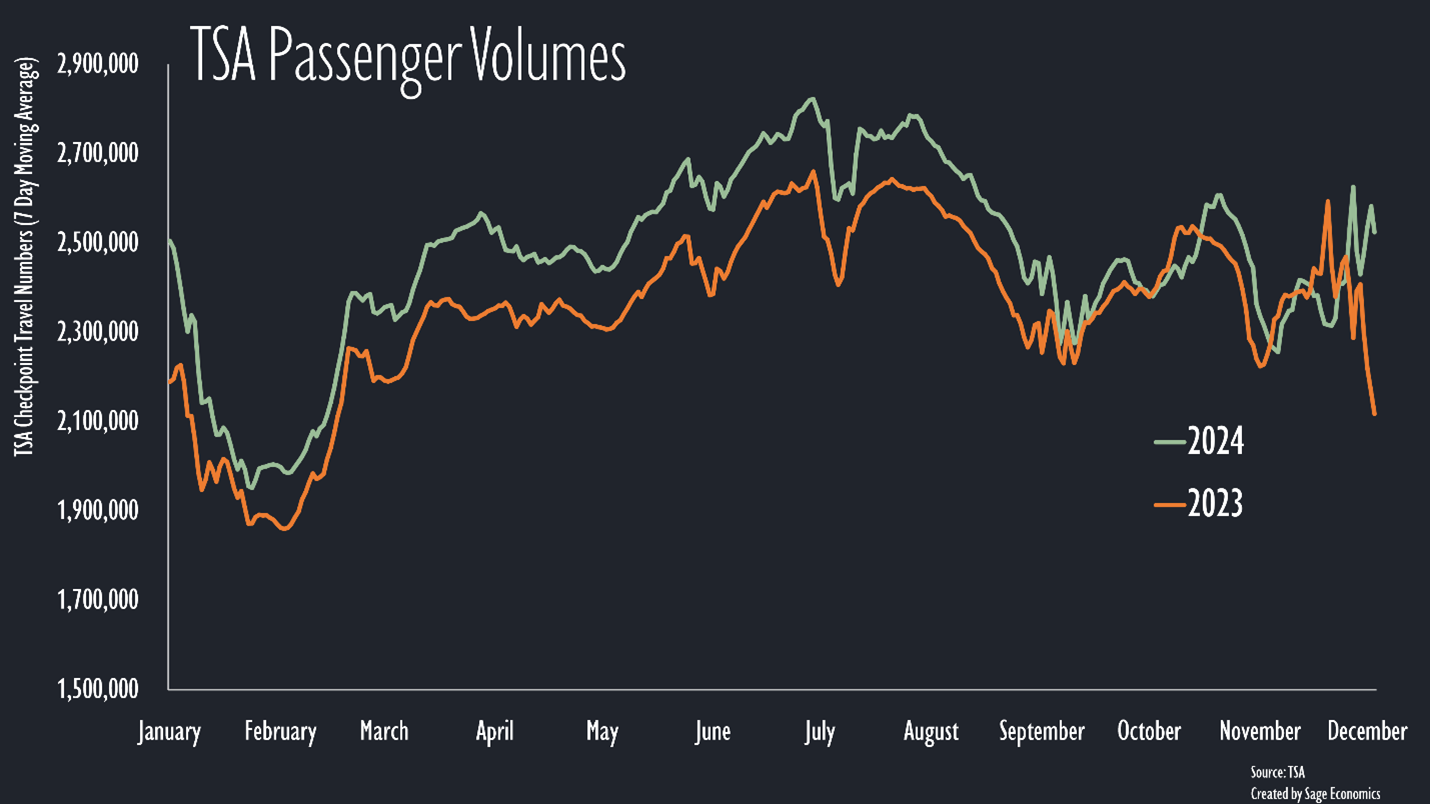

TSA Checkpoint Travel Numbers

It’s been a great week or two for air travel, according to TSA data. That brief period where 2024 dipped below 2023 levels is firmly in the rearview mirror (or however planes look backward?), and airlines are currently seeing record traveler volumes for this time of year.

Tuesday

Job Opening & Labor Turnover Survey

The Great Stay continued in October. Employers aren’t hiring much, but they’re also not laying workers off. Employees also seem content (or at least reluctant to change jobs), with the quit rate still well below 2019-2023 levels. While the number of job openings increased slightly for the month, the percentage of all jobs that are unfilled is the exact same as it was five years ago in November 2019.

To me, this seems indicative of an economy in wait-and-see mode. That checks out; this is October data, right on the eve of the presidential election. I expect labor market churn to pick up over the next few months.

Gas Prices & Diesel Prices

Gas prices fell to $3.16/gallon this week. That’s the lowest price since the middle of 2021. Diesel prices were unchanged at $3.54/gallon.